Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

C&EN’s top 50 US chemical producers for 2024

Data from the survey show that the chemical industry has faltered in difficult times

by Alexander H. Tullo

May 3, 2024

| A version of this story appeared in

Volume 102, Issue 14

US TOP 50 INTERACTIVE TABLE

US top 50 interactive table

Click through an interactive look at the US Top 50 going back to 2004. Be sure to also check out our Global Top 50 information presented in the same interactive format.

Downloads

JPG of C&EN’s US Top 50 chemical companies for 2024

Previous coverage

C&EN’s Global Top 50 chemical firms for 2023

The global economy has fallen on difficult times. Europe has been teetering on the brink of recession since Russia’s invasion of Ukraine in February 2022. US economic growth is relatively strong but not without obstacles such as high inflation and a weak housing market. China is only slowly recovering from the extended lockdowns due to the COVID-19 pandemic.

In addition to a tough macroeconomic environment, unique troubles have plagued chemical producers. Most experienced a harrowing inventory correction last year as customers depleted their own stocks of materials instead of buying new. And even as demand has faltered, supplies have been growing. The sector built up too much capacity, too quickly, particularly in the US and China. Some important segments, such as polyethylene and polypropylene, won’t fully recover for several years.

The slump is plainly apparent in this year’s survey of the top 50 US chemical producers. Revenues declined for 38 of the firms. As a group, the 50 chemical makers posted sales of $321.7 billion for 2023, the year of record for the survey. This is a 14.5% decline from what the same companies posted for 2022.

Operating profits, reported by 43 of the firms, dropped even more dramatically, falling 43.2% to $31.3 billion. Thirty-four of the chemical companies posted a decline in profits. Three lost money: titanium dioxide and fluorochemical maker Chemours; styrenic polymer maker Trinseo; and Kronos Worldwide, also a producer of the white pigment TiO2.

Petrochemical producers were hit particularly hard. Dow posted a 63% profit drop. ExxonMobil Chemical and LyondellBasell Industries also saw substantive declines. Westlake, which also has a large chlorovinyl business, posted a 98% decrease in chemical profits.

Because of tumbling prices, fortunes also turned for fertilizer makers, which until last year had been enjoying staggering profits. Mosaic, which makes potassium and phosphorus fertilizers, saw profits drop by 68%. Nitrogen fertilizer makers CF Industries Holdings and LSB Industries posted 60% and 83% declines, respectively.

Some companies managed to do well in 2023. Profits were up for industrial gas maker Air Products and Chemicals, water treatment chemical supplier Ecolab, adhesive maker H.B. Fuller, fuel additive specialist NewMarket, oil field chemical supplier ChampionX, carbon black firm Orion Engineered Carbons, electronic material supplier Entegris, lithium chemical maker Arcadium Lithium, and nutritional ingredient maker Balchem.

What do they have in common? They are specialty purveyors in recession-resistant sectors that are able to forge ahead independent of the chemical business cycle.

Despite the overall lackluster results, chemical companies are hopeful about their future prospects. The combined capital spending of the 42 companies reporting such figures was $22.9 billion, a 13.4% increase. Spending on R&D was essentially flat for the 26 firms reporting those figures, at $3.3 billion.

Two firms left the ranking this year. Specialty chemical maker Hexion was acquired by the private equity firm American Securities and no longer discloses its financial results. Sisecam Resources, which had been an independently traded public US company, was taken over by its Turkish parent company.

Two additions to the ranking are Minerals Technologies, a maker of inorganic materials, and Sensient Technologies, which supplies food colorants. They debut at numbers 48 and 49, respectively.

The C&EN ranking includes only companies that publicly disclose chemical sales. Koch Industries and TPC Group are examples of privately owned companies that would likely make the cut if they reported sales figures to the public.

Similarly, a few large public firms would likely make the ranking, but they don’t break out chemical sales from their nonchemical operations. For example, the energy firm Enterprise Products has become a sizable chemical maker, primarily through propane dehydrogenation, but its chemical operation is included in a business segment that also runs barges.

Below C&EN profiles recent developments at the first 25 of the Top 50 firms.

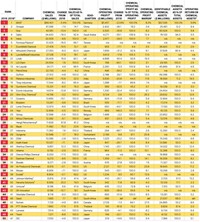

Top 50 US chemical firms

Top 50 US chemical firms

Sales at most US chemical companies declined sharply in 2023.

| RANK | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2023 | 2022a | COMPANY | CHEMICAL SALES ($ MILLIONS) | CHANGE FROM 2022 | CHEMICAL SALES AS % OF TOTAL SALES | SECTOR | CHEMICAL OPERATING PROFITb ($ MILLIONS) | CHANGE FROM 2022 | OPERATING PROFIT MARGINc | HEADQUARTERS | IDENTIFIABLE CHEMICAL ASSETS ($ MILLIONS) | OPERATING RETURN ON CHEMICAL ASSETSd | |

| 1 | 1 | Dow | $44,622 | -21.6% | 100.0% | Diversified | $2,100 | -63.2% | 4.7% | Midland, Michigan | $57,967 | 3.6% | |

| 2 | 2 | ExxonMobil | 40,672 | -14.4 | 12.2 | Petrochemicals | 5,598 | -23.9 | 13.8 | Spring, Texas | 45,674 | 12.3 | |

| 3 | 3 | LyondellBasell Industries | 31,928 | -19.1 | 77.7 | Petrochemicals | 2,810 | -32.6 | 8.8 | Houston | n/a | n/a | |

| 4 | 4 | Mosaic | 13,696 | -28.4 | 100.0 | Fertilizers | 1,710 | -67.5 | 12.5 | Tampa, Florida | 23,033 | 7.4 | |

| 5 | 7 | Air Products and Chemicalse | 12,600 | -0.8 | 100.0 | Industrial gases | 2,704 | 14.8 | 21.5 | Allentown, Pennsylvania | 32,003 | 8.5 | |

| 6 | 6 | DuPont | 12,068 | -7.3 | 100.0 | Diversified | 1,717 | -15.1 | 14.2 | Wilmington, Delaware | 38,552 | 4.5 | |

| 7 | 5 | Chevron Phillips Chemical | 11,560 | -18.5 | 100.0 | Petrochemicals | n/a | n/a | n/a | The Woodlands, Texas | 19,709 | n/a | |

| 8 | 11 | Celanese | 10,940 | 13.1 | 100.0 | Diversified | 1,218 | -11.9 | 11.1 | Irving, Texas | 26,597 | 4.6 | |

| 9 | 15 | Albemarle | 9,617 | 31.4 | 100.0 | Specialties | 181 | -92.7 | 1.9 | Charlotte, North Carolina | 18,271 | 1.0 | |

| 10 | 10 | Eastman Chemical | 9,210 | -12.9 | 100.0 | Diversified | 1,095 | -4.5 | 11.9 | Kingsport, Tennessee | 14,633 | 7.5 | |

| 11 | 9 | Westlake | 8,336 | -24.3 | 66.4 | Petrochemicals | 59 | -97.6 | 0.7 | Houston | 13,538 | 0.4 | |

| 12 | 12 | Corteva Agriscience | 7,754 | -8.5 | 45.0 | Agrochemicals | 977 | -24.8 | 12.6 | Indianapolis | 15,004 | 6.5 | |

| 13 | 16 | Ecolabf | 7,193 | 3.6 | 47.0 | Process services | 1,081 | 10.6 | 15.0 | Saint Paul, Minnesota | n/a | n/a | |

| 14 | 8 | CF Industries Holdings | 6,631 | -40.7 | 100.0 | Fertilizers | 2,256 | -59.5 | 34.0 | Northbrook, Illinois | 14,376 | 15.7 | |

| 15 | 19 | Lubrizol | 6,400 | -4.5 | 100.0 | Specialties | n/a | n/a | n/a | Wickliffe, Ohio | n/a | n/a | |

| 16 | 20 | Honeywell International | 6,239 | 4.1 | 17.0 | Fluorochemicals | n/a | n/a | n/a | Charlotte, North Carolina | n/a | n/a | |

| 17 | 17 | Chemours | 6,027 | -11.3 | 100.0 | Diversified | -92 | def. | def. | Wilmington, Delaware | 8,251 | def. | |

| 18 | 13 | Huntsman | 5,985 | -23.2 | 100.0 | Diversified | 102 | -85.6 | 1.7 | The Woodlands, Texas | 7,248 | 1.4 | |

| 19 | 14 | Olin | 5,324 | -31.5 | 77.9 | Chlorine chemistry | 633 | -59.7 | 11.9 | Clayton, Missouri | 6,630 | 9.6 | |

| 20 | 18 | Occidental Petroleum | 5,321 | -21.3 | 18.8 | Chlorine chemistry | 1,531 | -39.0 | 28.8 | Houston | 4,682 | 32.7 | |

| 21 | 21 | FMC | 4,487 | -22.7 | 100.0 | Agrochemicals | 768 | -37.9 | 17.1 | Philadelphia | 11,926 | 6.4 | |

| 22 | 23 | Cabote | 3,931 | -9.0 | 100.0 | Specialties | 529 | -7.5 | 13.5 | Boston | 3,604 | 14.7 | |

| 23 | 22 | Trinseo | 3,675 | -26.0 | 100.0 | Polymers | -168 | def. | def. | Wayne, Pennsylvania | 3,029 | def. | |

| 24 | 24 | H.B. Fullerf,g | 3,511 | -6.4 | 100.0 | Specialties | 355 | 10.0 | 10.1 | Saint Paul, Minnesota | 4,724 | 7.5 | |

| 25 | 26 | Avientf | 3,143 | -7.5 | 100.0 | Pigments | 197 | -19.1 | 6.3 | Avon Lake, Ohio | 5,969 | 3.3 | |

| 26 | 25 | Tronox | 2,850 | -17.5 | 100.0 | Pigments | 186 | -65.7 | 6.5 | Stamford, Connecticut | 6,134 | 3.0 | |

| 27 | 30 | NewMarket | 2,698 | -2.4 | 100.0 | Fuel additives | 483 | 36.0 | 17.9 | Richmond, Virginia | 2,309 | 20.9 | |

| 28 | 28 | Avantor | 2,538 | -12.4 | 36.4 | Laboratory chemicals | n/a | n/a | n/a | Radnor, Pennsylvania | n/a | n/a | |

| 29 | 31 | ChampionXf | 2,501 | 0.3 | 66.5 | Oil field chemicals | 361 | 141.0 | 14.4 | The Woodlands, Texas | n/a | n/a | |

| 30 | 27 | Ascend Performance Materials | 2,400 | -20.0 | 100.0 | Polymers | n/a | n/a | n/a | Houston | n/a | n/a | |

| 31 | 29 | Stepan | 2,326 | -16.1 | 100.0 | Detergents | 77 | -61.3 | 3.3 | Northbrook, Illinois | 2,363 | 3.3 | |

| 32 | 32 | Ashlande | 2,191 | -8.4 | 100.0 | Specialties | 159 | -44.8 | 7.3 | Wilmington, Delaware | 5,939 | 2.7 | |

| 33 | 33 | International Flavors & Fragrances | 2,081 | -11.0 | 18.1 | Food additives | 214 | -21.0 | 10.3 | New York City | 10,666 | 2.0 | |

| 34 | 37 | Innospec | 1,949 | -0.8 | 100.0 | Fuel additives | 162 | -13.7 | 8.3 | Englewood, Colorado | 1,707 | 9.5 | |

| 35 | 35 | Orion Engineered Carbons | 1,894 | -6.7 | 100.0 | Inorganics | 205 | 2.3 | 10.8 | Spring, Texas | 1,833 | 11.2 | |

| 36 | 42 | Genesis Energy | 1,743 | 38.6 | 54.9 | Inorganics | 282 | -8.1 | 16.2 | Houston | 2,705 | 10.4 | |

| 37 | 34 | Americas Styrenics | 1,722 | -16.4 | 100.0 | Polymers | 134 | -37.0 | 7.8 | The Woodlands, Texas | n/a | n/a | |

| 38 | 40 | Ingevity | 1,692 | 1.4 | 100.0 | Pine chemicals | 256 | -24.8 | 15.2 | North Charleston, South Carolina | 2,623 | 9.8 | |

| 39 | 41 | Entegrisf | 1,690 | 22.4 | 47.9 | Electronic materials | 296 | 35.2 | 17.5 | Billerica, Massachusetts | 6,406 | 4.6 | |

| 40 | 39 | Kronos Worldwide | 1,667 | -13.7 | 100.0 | Pigments | -46 | def. | def. | Dallas | 1,838 | def. | |

| 41 | 38 | AdvanSix | 1,534 | -21.2 | 100.0 | Polymers | 70 | -69.3 | 4.5 | Parsippany, New Jersey | 1,496 | 4.7 | |

| 42 | 44 | Koppers | 1,256 | 5.4 | 58.3 | Coal tar chemicals | 140 | -0.5 | 11.1 | Pittsburgh | 1,060 | 13.2 | |

| 43 | 43 | 3M | 1,167 | -3.2 | 3.6 | Fluorochemicals | n/a | n/a | n/a | Saint Paul, Minnesota | n/a | n/a | |

| 44 | 48 | Arcadium Lithium | 883 | 8.5 | 100.0 | Specialties | 400 | 18.9 | 45.4 | Philadelphia | 3,230 | 12.4 | |

| 45 | 49 | Balchem | 789 | 0.0 | 85.5 | Nutritional ingredients | 130 | 10.0 | 16.5 | Montvale, New Jersey | 1,348 | 9.6 | |

| 46 | 47 | Ecovyst | 691 | -15.7 | 100.0 | Inorganics | 119 | -14.7 | 17.2 | Malvern, Pennsylvania | 1,838 | 6.5 | |

| 47 | 46 | CVR Partners | 682 | -18.4 | 100.0 | Fertilizers | 201 | -37.0 | 29.6 | Sugar Land, Texas | 975 | 20.7 | |

| 48 | — | Minerals Technologies | 643 | -0.9 | 29.6 | Inorganics | n/a | n/a | n/a | New York City | n/a | n/a | |

| 49 | — | Sensient Technologiesf | 608 | 0.7 | 40.7 | Food colorants | 105 | -8.0 | 17.3 | Milwaukee, Wisconsin | 847 | 12.4 | |

| 50 | 45 | LSB Industries | 594 | -34.2 | 100.0 | Fertilizers | 52 | -83.2 | 8.7 | Oklahoma City | 1,298 | 4.0 | |

Sources: Company documents, C&EN analysis.

Note: n/a means not available.

a Prior-year results have been restated to accommodate changes in the reporting of

chemical sales at Avient.

b Chemical sales less administrative expenses and cost of sales.

c Chemical operating profit as a percentage of chemical sales.

d Chemical operating profit as a percentage of identifiable chemical assets.

e Fiscal year ended Sept. 30, 2023.

f Chemical sales include a significant amount from nonchemical products.

g Fiscal year ended Dec. 2, 2023.

1

Dow

2023 chemical sales: $44.6 billion

CEO Jim Fitterling says achieving Dow’s goal of carbon neutrality by 2050 is an obligation, one that the firm has to start working on here and now. “We’re not going to be able to build another cracker and derivatives complex without it being zero emissions,” he said at a petrochemical conference in Houston in March. Fitterling had made the final investment decision on such a project—at Dow’s Fort Saskatchewan, Alberta, complex—last November. The $6.5 billion ethylene cracker will run on hydrogen made in an autothermal reformer from plant off-gases while capturing and sequestering carbon dioxide emissions. The project is an industry first. Another first from Dow will be using a nuclear reactor to generate electricity and steam for a chemical complex, as it is planning for its Seadrift, Texas, site. The modular reactor could help the company avoid 440,000 metric tons of CO2 emissions per year.

2

ExxonMobil

2023 chemical sales: $40.7 billion

Even ExxonMobil, which prides itself on integration and efficiency, hasn’t been immune to Europe’s deep downturn in petrochemicals. The company will close its ethylene cracker complex in Port-Jérôme-sur-Seine, France, by the end of this year. ExxonMobil says the facility has lost more than $530 million since 2018. Some good news for ExxonMobil is that its 2021 purchase of Materia could yield a major new platform that might generate $1 billion in profits by 2040. Materia’s thermoset polyolefins, based on cyclic C5 monomers, cure faster and are stronger than epoxies, ExxonMobil says. The materials could lend themselves to applications such as windmill blades and automotive parts. The company has already green-lit a commercial-scale plant.

3

LyondellBasell Industries

2023 chemical sales: $31.9 billion

LyondellBasell is purchasing a 35% stake in National Petrochemical Industrial Company (Natpet), a Saudi Arabian polypropylene maker. Natpet, with Lyondell’s backing, will study the construction of a propane dehydrogenation and polypropylene complex. Buying into existing joint ventures has become Lyondell’s go-to strategy. In recent years, it purchased a stake in an integrated ethylene complex in China and bought into polyethylene plants that Sasol, which was struggling financially, had built in Louisiana. Lyondell has also been trimming assets. It sold a small US ethylene oxide business to Ineos Group and has started the process of closing a polypropylene line in Italy.

4

Mosaic

2023 chemical sales: $13.7 billion

Mosaic, which produces phosphate and potash fertilizers, had been posting stratospheric profits in recent years, thanks to high fertilizer prices. But commodity markets can be fickle, and Mosaic’s results have come back down to Earth. The company posted a 28% decline in sales in 2023 and a 68% plunge in profits. Sales volumes for both its phosphate and potash businesses actually increased, but prices cratered. Potash prices were about half of what they were in 2022, while phosphate prices declined by about 30%.

5

Air Products and Chemicals

2023 chemical sales: $12.6 billion

Air Products and Chemicals is getting involved with one of the world’s most ambitious physics experiments. The Deep Underground Neutrino Experiment is setting up massive neutrino detectors in Lead, South Dakota. Air Products was awarded a contract to install a cooling system for the 17,500 metric tons of argon needed to help detect neutrinos. The firm’s device will use liquid nitrogen to condense gaseous argon into a liquid. Otherwise, Air Products continues its strategy of backing massive low-carbon hydrogen projects. Most recently, it signed on to build a carbon capture facility at ExxonMobil’s refinery in the Netherlands. Air Products says the installation will make it the largest producer of blue hydrogen in Europe.

6

DuPont

2023 chemical sales: $12.1 billion

Since its separation from Dow in 2019 to become an independent company once again, DuPont has been selling off traditional chemical businesses and adding electronics and medical materials businesses. Last August, the company bought, for $1.75 billion, the medical component firm Spectrum Plastics Group, which makes devices like catheters and medical balloons. As a follow-up to the $11 billion sale of most of its engineering polymer business to Celanese, DuPont sold 80% of its Delrin polyacetal business to the private equity firm TJC in a transaction that valued the business at $1.8 billion. Celanese couldn’t buy the unit because it is already a major player in acetal polymers. The Delrin business has annual sales of about $550 million.

7

Chevron Phillips Chemical

2023 chemical sales: $11.6 billion

Chevron Phillips Chemical, a joint venture between Chevron and Phillips 66, has appointed a new CEO, Steve Prusak, who had headed up corporate planning and technology for the partnership. Its previous CEO, Bruce Chinn, retired. Prusak will have a lot on his plate. Chevron Phillips recently started construction of a $6 billion ethylene cracker and derivatives complex—itself a joint venture with QatarEnergy—in Ras Laffan, Qatar. Chevron Phillips and QatarEnergy are planning a similar joint venture in Texas.

Spending

Many US chemical companies eased up on capital outlays in 2023.

| CHEMICAL CAPITAL SPENDING | CHEMICAL R&D SPENDING | |||||

|---|---|---|---|---|---|---|

| 2023 ($ MILLIONS) | CHANGE FROM 2022 | % OF CHEMICAL SALES | 2023 ($ MILLIONS) | CHANGE FROM 2022 | % OF CHEMICAL SALES | |

| AdvanSix | $107 | 20.1% | 7.0% | $10 | -21.6% | 0.6% |

| Air Products and Chemicals | 4,626 | 58.1 | 36.7 | 106 | 2.6 | 0.8 |

| Albemarle | 2,149 | 70.4 | 22.3 | 86 | 19.0 | 0.9 |

| Americas Styrenics | 30 | -10.4 | 1.8 | n/a | n/a | n/a |

| Arcadium Lithium | 327 | -2.9 | 37.1 | 6 | 48.7 | 0.7 |

| Ashland | 170 | 50.4 | 7.8 | 51 | -7.3 | 2.3 |

| Avient | 119 | 13.2 | 3.8 | 90 | 6.4 | 2.9 |

| Balchem | 33 | -24.9 | 4.2 | 15 | 23.0 | 1.9 |

| Cabot | 244 | 15.6 | 6.2 | 57 | 3.6 | 1.5 |

| Celanese | 568 | 4.6 | 5.2 | 146 | 30.4 | 1.3 |

| CF Industries Holdings | 499 | 10.2 | 7.5 | n/a | n/a | n/a |

| ChampionX | 50 | 18.4 | 2.0 | n/a | n/a | n/a |

| Chemours | 370 | 20.5 | 6.1 | 108 | -8.5 | 1.8 |

| Corteva Agriscience | 263 | -30.8 | 3.4 | n/a | n/a | n/a |

| CVR Partners | 24 | -45.9 | 3.6 | n/a | n/a | n/a |

| Dow | 2,356 | 29.2 | 5.3 | 829 | -2.6 | 1.9 |

| DuPont | 619 | -16.7 | 5.1 | 508 | -5.2 | 4.2 |

| Eastman Chemical | 828 | 35.5 | 9.0 | 239 | -9.5 | 2.6 |

| Ecovyst | 65 | 10.9 | 9.4 | 8 | 8.3 | 1.1 |

| Entegris | 142 | -6.2 | 8.4 | n/a | n/a | n/a |

| ExxonMobil | 2,826 | -4.4 | 6.9 | n/a | n/a | n/a |

| FMC | 134 | -5.9 | 3.0 | 329 | 4.6 | 7.3 |

| Genesis Energy | 219 | 25.7 | 12.6 | n/a | n/a | n/a |

| H.B. Fuller | 119 | -8.4 | 3.4 | 49 | 8.2 | 1.4 |

| Huntsman | 230 | -15.4 | 3.8 | 115 | -8.0 | 1.9 |

| Ingevity | 110 | -22.9 | 6.5 | 32 | 5.0 | 1.9 |

| Innospec | 62 | 56.8 | 3.2 | 42 | 7.8 | 2.1 |

| International Flavors & Fragrances | 85 | -46.9 | 4.1 | n/a | n/a | n/a |

| Koppers | 66 | 16.9 | 5.2 | n/a | n/a | n/a |

| Kronos Worldwide | 47 | -25.0 | 2.8 | 18 | 20.0 | 1.1 |

| LSB Industries | 68 | 47.6 | 11.4 | n/a | n/a | n/a |

| LyondellBasell Industries | 1,487 | -18.7 | 4.7 | 130 | 4.8 | 0.4 |

| Mosaic | 1,402 | 12.4 | 10.2 | n/a | n/a | n/a |

| NewMarket | 48 | -14.1 | 1.8 | 138 | -1.6 | 5.1 |

| Occidental Petroleum | 551 | 66.5 | 10.4 | n/a | n/a | n/a |

| Olin | 176 | -1.3 | 3.3 | n/a | n/a | n/a |

| Orion Engineered Carbons | 173 | -25.8 | 9.1 | 25 | 12.9 | 1.3 |

| Sensient Technologies | 38 | 24.4 | 6.2 | n/a | n/a | n/a |

| Stepan | 260 | -13.7 | 11.2 | 59 | -11.4 | 2.5 |

| Trinseo | 70 | -53.0 | 1.9 | 58 | 12.1 | 1.6 |

| Tronox | 261 | -39.0 | 9.2 | 12 | 0.0 | 0.4 |

| Westlake | 857 | -6.1 | 10.3 | n/a | n/a | n/a |

Sources: Company documents, C&EN analysis.

Note: Figures are for companies on the top 50 list reporting capital and/or R&D expenditures. n/a means not available.

Top 50 US chemical firms

Many US chemical companies eased up on capital outlays in 2023.

| CHEMICAL CAPITAL SPENDING | CHEMICAL R&D SPENDING | |||||

|---|---|---|---|---|---|---|

| 2023 ($ MILLIONS) | CHANGE FROM 2022 | % OF CHEMICAL SALES | 2023 ($ MILLIONS) | CHANGE FROM 2022 | % OF CHEMICAL SALES | |

| AdvanSix | $107 | 20.1% | 7.0% | $10 | -21.6% | 0.6% |

| Air Products and Chemicals | 4,626 | 58.1 | 36.7 | 106 | 2.6 | 0.8 |

| Albemarle | 2,149 | 70.4 | 22.3 | 86 | 19.0 | 0.9 |

| Americas Styrenics | 30 | -10.4 | 1.8 | n/a | n/a | n/a |

| Arcadium Lithium | 327 | -2.9 | 37.1 | 6 | 48.7 | 0.7 |

| Ashland | 170 | 50.4 | 7.8 | 51 | -7.3 | 2.3 |

| Avient | 119 | 13.2 | 3.8 | 90 | 6.4 | 2.9 |

| Balchem | 33 | -24.9 | 4.2 | 15 | 23.0 | 1.9 |

| Cabot | 244 | 15.6 | 6.2 | 57 | 3.6 | 1.5 |

| Celanese | 568 | 4.6 | 5.2 | 146 | 30.4 | 1.3 |

| CF Industries Holdings | 499 | 10.2 | 7.5 | n/a | n/a | n/a |

| ChampionX | 50 | 18.4 | 2.0 | n/a | n/a | n/a |

| Chemours | 370 | 20.5 | 6.1 | 108 | -8.5 | 1.8 |

| Corteva Agriscience | 263 | -30.8 | 3.4 | n/a | n/a | n/a |

| CVR Partners | 24 | -45.9 | 3.6 | n/a | n/a | n/a |

| Dow | 2,356 | 29.2 | 5.3 | 829 | -2.6 | 1.9 |

| DuPont | 619 | -16.7 | 5.1 | 508 | -5.2 | 4.2 |

| Eastman Chemical | 828 | 35.5 | 9.0 | 239 | -9.5 | 2.6 |

| Ecovyst | 65 | 10.9 | 9.4 | 8 | 8.3 | 1.1 |

| Entegris | 142 | -6.2 | 8.4 | n/a | n/a | n/a |

| ExxonMobil | 2,826 | -4.4 | 6.9 | n/a | n/a | n/a |

| FMC | 134 | -5.9 | 3.0 | 329 | 4.6 | 7.3 |

| Genesis Energy | 219 | 25.7 | 12.6 | n/a | n/a | n/a |

| H.B. Fuller | 119 | -8.4 | 3.4 | 49 | 8.2 | 1.4 |

| Huntsman | 230 | -15.4 | 3.8 | 115 | -8.0 | 1.9 |

| Ingevity | 110 | -22.9 | 6.5 | 32 | 5.0 | 1.9 |

| Innospec | 62 | 56.8 | 3.2 | 42 | 7.8 | 2.1 |

| International Flavors & Fragrances | 85 | -46.9 | 4.1 | n/a | n/a | n/a |

| Koppers | 66 | 16.9 | 5.2 | n/a | n/a | n/a |

| Kronos Worldwide | 47 | -25.0 | 2.8 | 18 | 20.0 | 1.1 |

| LSB Industries | 68 | 47.6 | 11.4 | n/a | n/a | n/a |

| LyondellBasell Industries | 1,487 | -18.7 | 4.7 | 130 | 4.8 | 0.4 |

| Mosaic | 1,402 | 12.4 | 10.2 | n/a | n/a | n/a |

| NewMarket | 48 | -14.1 | 1.8 | 138 | -1.6 | 5.1 |

| Occidental Petroleum | 551 | 66.5 | 10.4 | n/a | n/a | n/a |

| Olin | 176 | -1.3 | 3.3 | n/a | n/a | n/a |

| Orion Engineered Carbons | 173 | -25.8 | 9.1 | 25 | 12.9 | 1.3 |

| Sensient Technologies | 38 | 24.4 | 6.2 | n/a | n/a | n/a |

| Stepan | 260 | -13.7 | 11.2 | 59 | -11.4 | 2.5 |

| Trinseo | 70 | -53.0 | 1.9 | 58 | 12.1 | 1.6 |

| Tronox | 261 | -39.0 | 9.2 | 12 | 0.0 | 0.4 |

| Westlake | 857 | -6.1 | 10.3 | n/a | n/a | n/a |

Sources: Company documents, C&EN analysis.

Note: Figures

are for companies on the top 50 list reporting capital and/or R&D expenditures. n/a means

not available.

8

Celanese

2023 chemical sales: $10.9 billion

Unboxing the $11 billion purchase of DuPont’s engineering polymer business, completed in late 2022, has been a priority for Celanese. The company has already made one strategic decision related to its newly acquired assets: closing a nylon 6,6 and high-performance nylon plant in Uentrop, Germany. Exorbitant energy prices made it Celanese’s highest-cost nylon plant. In other businesses, Celanese’s joint venture with Mitsui & Co., Fairway Methanol, began making methanol from carbon dioxide—in addition to carbon monoxide—at its Clear Lake facility in Pasadena, Texas. The venture reacts CO2 with what it calls “lower carbon intensity” hydrogen furnished by the industrial gas maker Linde. Celanese uses the methanol to make acetic acid. Mitsui also bought a 70% stake in Celanese’s food ingredient business, which is now a joint venture called Nutrinova.

9

Albemarle

2023 chemical sales: $9.6 billion

The price of lithium has declined by more than 75% since January 2023, and as a result, Albemarle, a major producer of the battery material, has cut back capital spending. Such outlays will decline from $2.1 billion in 2023 to less than $1.3 billion this year. The firm is also delaying a $1.8 billion lithium hydroxide facility in South Carolina. Last October, the company withdrew its $4.3 billion bid to purchase the Australian lithium miner Liontown Resources. A competing firm, Hancock Prospecting, had amassed a large stake in Liontown, complicating Albemarle’s proposed deal.

10

Eastman Chemical

2023 chemical sales: $9.2 billion

Eastman Chemical just started up a polyethylene terephthalate recycling plant at its headquarters complex in Kingsport, Tennessee. The plant will use a methanolysis process to break down up to 100,000 metric tons of the polymer into its building blocks, dimethyl terephthalate (DMT) and ethylene glycol. Eastman will use the DMT to make specialty polyester resins. The company says it may earn $75 million in profits from the operation this year. And Eastman is in line to secure $375 million in funding from the US Department of Energy toward its second US recycling plant, planned for Longview, Texas. It will cost up to $1.2 billion, according to the Texas governor’s office. The company is also planning a depolymerization plant in Port-Jérôme-sur-Seine, France.

11

Westlake

2023 chemical sales: $8.3 billion

Known as a commodity producer of chlorovinyls and polyolefins, Westlake has been raising its sustainability profile recently. Last September, it launched Pivotal, a line of polyethylene with up to 45% postconsumer content. The high-end materials are suitable for challenging applications such as multilayer films, the firm says. And by 2030, Westlake intends to reduce scope 1 and scope 2 emissions—those that result from its own operations and energy purchases—by 20% from a 2016 baseline.

12

Corteva Agriscience

2023 chemical sales: $7.8 billion

Looking to tap into ideas from up-and-coming firms, Corteva Agriscience launched Corteva Catalyst in March. The initiative plans to invest in, and form partnerships with, start-ups and other innovators in agriculture. Corteva’s own R&D has also been bearing fruit. Last September the company launched Reklemel active, a new nematicide. The agent controls nematodes, which eat plant roots and cause more than $80 billion in crop damage globally each year. Corteva says it has been working on Reklemel’s development for more than a decade to ensure that it doesn’t disrupt beneficial organisms in the soil.

13

Ecolab

2023 chemical sales: $7.2 billion

Ecolab, which supplies water treatment chemicals, continues to lavish attention on Purolite, a producer of ion exchange resins for separations it bought in 2021 for $3.7 billion. Purolite is building a $190 million facility in Landenberg, Pennsylvania, to make agarose-based chromatography resins for purifying biologic drugs. Separately, Ecolab hit a milestone earlier this year with the start-up of a 30 MW wind farm in Finland it developed with the firm Low Carbon. Now all of the electricity used at Ecolab’s European facilities—including 26 manufacturing plants—is sourced from renewable power.

14

CF Industries Holdings

2023 chemical sales: $6.6 billion

CF Industries Holdings was among the first nitrogen fertilizer companies to plunge into low-carbon ammonia, and over the past few years it made a flurry of project announcements. Now some of those projects are coming to fruition. CF is commissioning green ammonia production at its site in Donaldsonville, Louisiana. The plant is based on a 20 MW electrolyzer furnished by Thyssenkrupp Nucera and will produce enough hydrogen for 20,000 metric tons of green ammonia. CF says the plant is the largest of its kind in North America. Also at Donaldsonville, CF aims to complete the installation of equipment next year that will allow it to capture 2 million metric tons of process CO2 annually, transforming a portion of the conventional ammonia it makes there now into blue ammonia. Later this year, CF intends to complete studies for a $3 billion blue ammonia project with Mitsui & Co. at its Blue Point, Louisiana, complex.

15

Lubrizol

2023 chemical sales: $6.4 billion

Lubrizol is making a major push into India, where it is spending $150 million on expansions. Included in the program is a chlorinated polyvinyl chloride (CPVC) plant in Vilayat, India, that the firm is building with the Aditya Birla Group subsidiary Grasim Industries. The plant, with 100,000 metric tons of annual capacity, will be the largest of its kind in the world when it is completed in 2025, Lubrizol says. CPVC is more temperature resistant than polyvinyl chloride and is used in demanding applications like water conduit for fire sprinkler systems. The Indian market for CPVC is growing at 10–12%, the company says.

16

Honeywell International

2023 chemical sales: $6.2 billion

Energy transition has been a big theme for Honeywell’s UOP technology arm. A UOP process was selected for the world’s inaugural commercial-scale liquid organic hydrogen carrier project, which is being built by the Japanese energy company Eneos. A plant using the technology will hydrogenate toluene into methylcyclohexane (MCH). Eneos hasn’t disclosed the location of the plant, but it could be the US Gulf Coast, where the firm is involved in a low-carbon hydrogen project. The MCH will be shipped to Japan, where it will be converted into toluene again, yielding hydrogen that can be used for energy. Separately, UOP’s Ecofining technology will form the basis for a sustainable aviation fuel and diesel plant that Acelen Renewables is setting up in Brazil. The technology, developed with the Italian energy company Eni, converts fats into hydrocarbon fuels.

17

Chemours

2023 chemical sales: $6.0 billion

Chemours became embroiled in an accounting scandal recently that led to the ouster of its CEO and two other top executives. An internal probe found that Chemours delayed payments to vendors from the fourth quarter of 2023 to the first quarter of this year. At the same time, it pushed up payments of receivables due it from the first quarter to the previous quarter. The executives did this to boost 2023 cash flow numbers, which were linked to bonuses. CEO Mark Newman resigned and was replaced by Chemours and DuPont veteran Denise Dignam. Chemours had more on its plate than just the crisis. Last August, it sold its glycolic acid business to Iron Path Capital for $137 million. The company is also on the hook for more than $700 million in accrued litigation so far related to its production of per- and polyfluoroalkyl substances.

18

Huntsman

2023 chemical sales: $6.0 billion

Huntsman, a producer of polyurethanes and composite materials, has jumped into carbon nanotubes. In 2018, it bought Nanocomp Technologies, which operates a plant in New Hampshire that makes 1 metric ton (t) per year of carbon nanotubes from methane via a catalytic process. The process also yields low-carbon hydrogen, and because both products have value, Huntsman is upping production with a 30 t plant in San Antonio, Texas. But while it is enthusiastic about one new technology, Huntsman has cooled on another. It has shelved plans to expand ethylene carbonate production in Texas. The carbonate is used as a battery solvent, but output in China is swelling and prices for the solvent have been tumbling.

19

Olin

2023 chemical sales: $5.3 billion

Olin saw sales drop by 32% and earnings plummet by 60% in 2023. The company’s cumene and epoxy businesses have struggled, and it has been closing inefficient capacity. Olin has also been experiencing slumping prices in its core chlorine and caustic soda unit. Olin has a new CEO, Kenneth Lane, who replaced Scott Sutton after an executive search. Lane comes to Olin with a wealth of experience. He was vice president of LyondellBasell Industries’ global olefin and polyolefin business, which alone is larger than Olin. He was also LyondellBasell’s interim CEO.

20

Occidental Petroleum

2023 chemical sales: $5.3 billion

These days, when you hear about Occidental Petroleum, it is usually in reference to its 1PointFive direct-air-capture subsidiary, which is setting up projects to extract carbon dioxide from the atmosphere all over the world. Telecom giant AT&T just signed up to buy carbon credits from a plant that 1PointFive is building in Texas. But for decades, Oxy has had a chemical business that specializes in chlorine chemistry. Last year, it began installing membrane technology at its chlor-alkali plant in La Porte, Texas. The plant had been using asbestos diaphragms, which the industry is phasing out. Oxy expects to complete the project in 2026.

21

FMC

2023 chemical sales: $4.5 billion

At the end of last year, FMC launched a growth initiative aimed at increasing annual sales to between $5.5 billion and $6.0 billion by 2026, from about $4.5 billion today. As part of the overhaul, the company, which produces crop protection chemicals, wants to strengthen its relationship with farmers, improve returns, and innovate. FMC also announced that it is considering the sale of its Global Specialty Solutions business, which makes pesticides for golf courses and sport stadiums.

22

Cabot

2023 chemical sales: $3.9 billion

Cabot has a knack for getting involved in chemistry relevant to electric vehicles beyond battery materials. In March, Cabot launched Propel E8, a carbon black meant to address a problem for electric vehicles. Because of the higher torque and heavier weight the vehicles’ wheels must bear, their tires wear out much faster than those on vehicles with internal combustion engines. Propel E8, Cabot says, imparts lower rolling resistance and higher tread durability to the tires, increasing their life-span. Also last year, Cabot launched Entera aerogel particles. These thermal insulation additives for barriers used in electric vehicle batteries are a fraction of the weight of traditional insulation materials.

23

Trinseo

2023 chemical sales: $3.7 billion

Trinseo has been trying to turn into a specialty materials company, making acquisitions in this area, such as its 2021 purchase of Arkema’s acrylic resins business. But Trinseo hasn’t been able to make the transition fast enough and is now weighed by its commodity chemical operations. The company generated an operating loss of nearly $170 million in 2023. It plans to close a polycarbonate plant in Germany and has already closed styrene plants in Germany and the Netherlands. It also wants to sell its share of the Americas Styrenics joint venture with Chevron Phillips Chemical. That venture, number 37 on this list, had sales of $1.7 billion in 2023.

24

H.B. Fuller

2023 chemical sales: $3.5 billion

H.B. Fuller, which bills itself as the world’s largest adhesive specialist, posted a strong showing in 2023. Despite a decline in sales, profits increased by 10%. The company has been growing in recent years through acquisitions, and it made a large international one with the purchase of XChem last July. A specialty adhesive maker based in the United Arab Emirates, XChem primarily serves construction markets.

25

Avient

2023 chemical sales: $3.1 billion

Avient, formerly known as PolyOne, has become more of a chemical company in recent years and has thus been climbing C&EN’s ranking. It sold its plastic distribution business in 2022 to the private equity firm H.I.G. Capital. In 2020, it bought Clariant’s color business, and in 2022 it bought DSM’s Dyneema ultra-high-molecular-weight polyethylene fiber unit. Avient’s $3.1 billion in 2023 sales reflect a full year of incorporation of that business.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter