Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Environment

Getting to 'Clean Coal'

U.S. faces a rocky path to clean up coal-fired electric power plants in an era of shrinking federal dollars and fewer regulations

by Jeff Johnson

February 23, 2004

| A version of this story appeared in

Volume 82, Issue 8

President George W. Bush has a new plan for coal. He wants to develop a zero-emissions coal-fired power plant that creates hydrogen and electricity and captures and injects carbon dioxide deep into the earth. And he wants to do it within 10 years.

But even if such a lofty plan is successful, for it to matter the President had better think of a way to get electric utilities to try it. That may prove to be the hardest part of his plan.

Coal-fired electric utilities are powerful and conservative, and they have a good thing going. Change for them is expensive and risky.

But the U.S., like the rest of the world, has a coal problem: There is a lot of it and it is cheap, but it is dirty.

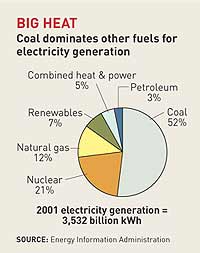

The U.S. gets 52% of its electricity from coal, and coal-fired utilities pull in some $350 billion in annual revenues. More than 75,000 miners dig 1 billion tons of coal out of the earth each year in the U.S.

| BAD AIR DAYS: Coal Pollution Leads To Town Buyout |

Yet these miners barely tap the U.S.'s coal supply. Geologists say the nation has enough coal to last at least another 250 years. And U.S. coal is so cheap that even the poor efficiency of the nation's aging power plants doesn't make much difference.

But along with the jobs, electricity, and economic advantages of coal come huge piles of waste, destroyed landscapes, lakes of waste sludge, and water and air pollution.

Coal-fired power plants are responsible for 60% of U.S. sulfur dioxide emissions, 33% of U.S. mercury emissions, 25% of nitrogen oxide emissions, and more than 33% of the nation's carbon dioxide air emissions.

But even those who don't like coal can't get along without it. In fact, because coal is easy to find, easy to burn, and available nearly everywhere, any plan to address the future of energy in the U.S. or the world has to begin with coal.

Bush is a big backer of coal. He is not alone. Chemical companies that depend on natural gas for fuel and feedstock hope increased coal consumption by electric utilities will ease demand for natural gas and help counter the skyrocketing gas prices that have plagued them in recent years.

"The future is bright for coal," National Mining Association (NMA) President Jack N. Gerard says. The association predicts that 2004 will be a record year in coal production, up 3.5% to 1.156 billion tons. Nearly all of that will go to produce electricity, NMA says, noting that electric utilities will increase their use of coal by about 2%.

THE INCREASE IN use comes with a significant cost to human health. A 2001 study by the Harvard School of Public Health looked at nine coal plants around Chicago and attributed 400 deaths per year to the plants' emissions of particulates of sulfur dioxide and nitrogen oxides. The study estimates that the deaths could be cut to 100 with the installation of modern pollution control equipment. Other Harvard studies found similar impacts from coal-fired power plants in Massachusetts, Georgia, and Washington, D.C., says Jonathan Levy, one of the authors of the reports.

Another health study by EPA-contractor Abt Associates estimates that if all coal-fired power plants reduced their emissions by 75%, a technically achievable goal that most old coal power plants have dodged, about 20,000 premature deaths could be avoided each year.

But these air pollution cuts are not likely to happen for a while. The Bush Administration last year ended enforcement of the Clean Air Act's new source review (NSR) provisions, which require that plants install new pollution control equipment when making equipment changes and upgrades that increase pollution.

Utilities argued that the NSR restrictions were expensive and blocked them from adding new equipment to make their operations more efficient. NSR regulations were part of the 1977 Clean Air Act and offered utilities a break by letting them put off installing pollution control equipment until they made other plant changes. Utilities did not do so.

Instead, they slowly upped production and made small changes, and states and EPA did not enforce NSR. That situation changed in the late 1990s, when the Clinton Administration and several New England states began to file NSR suits. The utilities cried foul, and the Bush Administration backed off, offering up its Clear Skies Initiative to cut SOx, NOx, and mercury emissions as an alternative.

The Bush initiative requires 70% reductions from plants that lack pollution control equipment and sets an emissions cap, but it has gone nowhere in Congress. EPA has recently proposed the initiative as a regulation. But as a proposal, it could take years to be enacted. Even if made a regulation today, the initiative doesn't call for full compliance with its air pollution reductions until 2018. It also does not address global warming by requiring any reductions in carbon dioxide emissions.

Rather, Bush has rejuvenated a federal R&D program for clean coal and coupled clean coal with his push for a hydrogen economy.

OVER THE PAST 20-plus years, the federal government has spent some $5 billion for clean-coal technology R&D programs, split between air pollution control technologies and power systems.

In his 2005 budget, Bush is proposing to boost clean-coal funding and shift most of it to his clean-coal-power initiative and the "FutureGen" program. Clean-coal R&D spending would receive $470 million for 2005 under the Administration's proposal. This works out to a 4% increase in overall clean-coal R&D from last year's level and a huge jump from Clinton-era spending for coal R&D.

FutureGen would get at least $287 million plus a cost share from industry. The plan is to build a demonstration project that will make hydrogen and electricity from coal while capturing carbon dioxide and sequestering it underground.

The project is estimated to take 10 years and cost $1 billion. It would create the world's first zero-emissions coal-fired power plant, Energy Secretary Spencer Abraham boasted when describing the 2005 budget proposal. A consortium of nine coal companies and electric utilities has shown an interest in the project and would be responsible for 25% of the costs.

The FutureGen program is based on integrated gasification combined-cycle technology (IGCC). Officials representing organizations as diverse as American Electric Power, the U.S.'s biggest coal-based electric utility, and the Natural Resources Defense Council, an environmental group, like IGCC and think it can work. No one, however, believes utilities will easily adopt it.

An IGCC power plant is more like a chemical plant than a coal-fired power plant, and that is part of the problem it faces.

DOE estimates that more than 400 commercial gasifiers are running in the world at some 160 commercial operations, generating chemicals for production and electricity. Most use refinery residues as a feedstock for the synthetic gas.

IN IGCC'S GASIFIER, carbon-based raw material reacts with steam and oxygen at high temperature and pressure. Mostly hydrogen is produced in the gasifier, along with carbon monoxide, methane, and carbon dioxide. The gasifier's high temperature vitrifies inorganic materials into a course, sandlike material, or slag.

The synthetic fuel leaves the gasifier and is further cleaned of impurities. It is used in the system to run primary and secondary gas and steam turbines, similar to a natural gas combined-cycle generating system.

The primary environmental benefit is increased efficiency and nearly zero air pollution. Most pollutants are removed before combustion and are not created when the fuel is burned. Or, in the case of sulfur, it is collected in a form that can be used. This is a big change for coal plants, where even clean ones produce a lake-sized impoundment of sulfuric slurry by pulling sulfur compounds from the stack flue gas.

DOE HAS HAD two IGCC plants in operation for several years: a 250-MW unit in Florida at Tampa Electric Power's facility and a refurbished 300-MW unit at Cinergy's Wabash River coal-fired power plant in Indiana. The Wabash plant is a rebuilt 50-year-old facility that now reports an 82% reduction in NOx emissions and 97% fewer sulfur dioxide emissions. DOE also has two other plants in the works, according to department officials.

However, Bush plans to do more--he wants to create pure hydrogen for use in combustion and in fuel cells, and he wants to capture and sequester CO2. It is an ambitious goal, but why would any utility chief executive officer adopt it?

George Rudins, DOE deputy assistant secretary for coal, has 30 years' experience in the federal coal program. IGCC is the most revolutionary advance ever in the clean-coal technology program, he says. "It is a huge leap to zero emissions." The driver, he says, will be a combination of high natural gas prices and concerns about global warming.

IGCC is more efficient, Rudins notes, creating more electricity per unit of coal and less CO2. "Efficiency will be increased from about 33% from a traditional coal-fired plant to 38% at a plant like Tampa to 50 to 60% with FutureGen," he says. But the biggest climate-change benefit will be from reductions in the release of carbon dioxide.

It works like this, he says: At conventional pulverized-coal plants, CO2 makes up about 10% of the flue gases. But with IGCC, the CO2 concentration will be 90%, making it easier and 10 times cheaper to collect. The plan would be to then inject it and hold it forever deep underground.

FutureGen would test technology for the separation of hydrogen and CO2 as well as CO2 sequestration. Conventional IGCC is already more costly than conventional coal units, and it is unclear what FutureGen units would cost.

Construction costs for IGCC are expected to be about $1,200 to $1,400 per kW, compared with $1,000 per kW to build a conventional plant, Rudins estimates. However, a highly efficient natural gas combined-cycle plant can be as inexpensive as $500 per kW. But Rudins points out that coal is much cheaper than gas and is much more plentiful in the U.S.

However, no utility has built an IGCC plant, Rudins acknowledges. He says technological uncertainties have really hurt, and they lead to higher financing costs, longer construction times, and other problems.

"Right now, there is not a single company producing a turnkey IGCC power plant, so you have components sold by different companies, and that increases the challenge," he says. "If you could somehow wrap up IGCC in a single component, it would be a no-brainer to get it into the marketplace."

WHAT RUDINS WANTS is a tax incentive to help construction for the first half-dozen or so IGCC commercial plants. The energy bill had these provisions, he notes, but it became stuck in the Senate, partly as a result of opposition from the Administration and members of Congress because of some $30 billion in tax breaks for a host of energy providers, including coal.

Advertisement

Rudins puts his faith in financial breaks as the way to spur acceptance and downplays the importance of regulatory drivers to lead to adoption of a new IGCC technology. Still, he believes that utilities see some sort of mandated carbon emissions cap or tax coming in the future, and using IGCC technology will allow them to be positioned to take advantage of its carbon-collecting potential down the line.

Neville Holt, a technical fellow with the Electric Power Research Institute, echoes Rudins' description of the benefits of IGCC and notes that EPRI, the R&D arm for electric utilities, has a half-dozen related R&D studies going on.

"The bottom line, however, is there is no incentive for any utility--regulated or unregulated--to do anything new," he says. "There is no reward for risk.

"If you are an independent power producer, you want the lowest capital cost to reduce your financial exposure, and that, of course, is natural gas combined-cycle, where capital cost is maybe 40% of a new traditional pulverized coal-fired plant, let alone an IGCC," Holt continues.

The concept of IGCC is attractive, he stresses, pointing to its ability to produce hydrogen and potentially capture CO2 while using a plentiful domestic resource. But the main complaint of utilities, after cost, is that the plants are different.

" 'These are chemical plants,' they say. We hear the same kind of complaints that we heard about SO2 scrubbers a decade ago, only with IGCC they come in spades," Holt says.

The plants are complicated, he notes. "You've got a cryogenic oxygen plant, a pressurized gasifier, gas cleanup equipment, shift reactors, and a new power system. It is a whole cultural difference.

"We take utility engineers to Florida and Wabash and show them the plants. They see 250 MW in operation, and they say the economic size needs to be double that. We can't point to a plant that is exactly like they want."

Holt comes back to utilities' reluctance to make a change. He notes that most of the coal-fired power plants operating today were built 30 to 50 years ago and are completely paid off.

"We've got 320 gigawatts of coal-fired plants running, and air emissions of only 100 GW are scrubbed. [The utilities'] costs to generate electricity are about $20 a MW-hour, and they will keep going as long as possible. It is a tremendous advantage.

"A new pulverized-coal plant will produce electricity for $40 to $50 a MW-hour depending on coal and location, and there has been almost none built in the last 20 years," Holt points out.

"If you take a close look at coal figures, you see coal-generated gigawatts going up along with coal use. You see about 200 million more tons of coal used each decade. Utilities are running the old plants more and more, and they have every incentive to do it," he adds.

ONE OF THE strongest supporters for IGCC in the power industry is Dale Heydlauff, senior vice president for governmental and environmental affairs at American Electric Power. AEP is the nation's largest utility and biggest coal burner, and it depends on coal to generate about 70% of its electricity.

AEP is a member of DOE's FutureGen alliance and plans to pony up at least $20 million for its share of the project. Heydlauff hopes that the program will make coal a safe bet for the future.

However, he says, when AEP engineers do the math, IGCC doesn't work. The cost difference is significant, about $500 more per kW, he says, when compared with a pulverized-coal plant with modern pollution control equipment, which comes in at $1,100 per kW to build.

"When you compare it to a natural gas combined-cycle plant at $500 per kW," Heydlauff says, "you understand why just about the only new capacity built in the last 10 years is gas fired."

For AEP to try IGCC will take a federal subsidy, Heydlauff says, laying out a plan similar to Rudins'. "Our belief is that over time, if we build commercial-scale plants and replicate the technology, we will engineer cost savings, but it will take a half-dozen installations at commercial scale to get there.

"Without it," he says, "AEP will build gas units in the near term, even with the $5.00-per-million-Btu natural gas prices. We have surplus power now, but it will dwindle, and if there are only purely economic drivers, we will turn to gas and maybe some wind energy."

Heydlauff is disappointed with how DOE is funding the FutureGen hydrogen and sequestration R&D program--by drawing funds from the base gasification R&D budget.

"I am deeply troubled by that," he explains, "because we need more research to develop IGCC technologies. I know we are staring at a $500 billion deficit, but if we care about energy security and air-quality issues as well as beginning a down payment on technologies that allow us to get serious about stabilizing greenhouse gases, we do desperately need FutureGen, but we also need the base IGCC R&D program to get there."

He also fears that Congress will take FutureGen program funds to support other pet projects.

Heydlauff notes that so far, only one utility has tried IGCC commercially, and that is We Energies in Wisconsin. It proposed building three new coal-fired units, one of which was to be an IGCC plant. However, the plan was turned down last November by its own public utility commission.

The commission's rejection was to protect ratepayers and was due primarily to cost and the uncertainty of the technology, says Kris McKinney, manager of environmental policy at We Energies. He adds that the utility might try it again in the future.

We Energies estimates that the 550-MW IGCC unit would cost $1,580 per kW to build versus $1,435 per kW for a conventional unit. When financing, timing, and uncertainties in the new technology are factored in, total costs would reach $250 million more for the IGCC plant, according to We Energies officials.

IF WE ENERGIES tries it again, the Natural Resources Defense Council has a plan to help. NRDC is attempting to get IGCC defined by New Mexico and Illinois as a "best available control technology," or BACT, under the Clean Air Act. The environmental group tried that strategy in Wisconsin but failed, says Antonia Herzog, a physicist and staff scientist with the environmental group. It plans to try again, she adds.

A BACT designation would require that new coal-fired units use IGCC. "We are taking a pragmatic approach," Herzog says. "We support energy efficiency and renewable energy, but in the near to medium term, coal is not likely to disappear in the U.S. or the world."

Support for the technology by NRDC is due to the potential for large reductions in emissions of conventional pollutants as well as CO2 reductions gained through efficiency and carbon removal. The group wants more R&D on CO2 sequestration to see if it can be safe and effective.

To spur the technology to commercialization, NRDC wants the government to require a carbon cap. But meanwhile, IGCC, if defined as a best technology, will lead to the development and use of new technologies that will allow easier capture of carbon when or if regulations come in the future.

"Remember, when a utility builds these units, they can operate for 40 or 50 years," she adds.

The question of incentives is one that environmental economists like to examine, and Dallas Burtraw, senior fellow at Resources for the Future, has looked long and hard at coal. Asked to choose between pushing the industry with regulatory-forcing regulations or pulling it along with tax credits, Burtraw goes with the push.

He points to research from University of California, Berkeley, engineering assistant professor Margaret Taylor and others that show that it was the 1990 Clean Air Act Amendments that forced utilities to finally make SO2 reductions, despite decades of incentives and study. Economists had hoped that newly developed SO2 reduction technologies would enter the marketplace on their own, drive out inefficiencies, and lead to reduced sulfur emissions, all by themselves.

"Only when the Clean Air Act mandated a 50% SO2 reduction did anything happen," Burtraw says.

"With a mix of the carrot and stick, the stick turns out to be a very important instrument," he says. "We are placing a lot of hope in clean-coal technologies because we are likely to live in a carbon-constrained economy in the not-too-distant future. Clean-coal technology gains would seem to be an incentive to achieve carbon reductions in the near term, but the Administration's unwillingness to use carbon-reduction-forcing measures in the short term is allowing industry to miss a lot of low-hanging fruit.

"Forcing regulations don't need to be big, but they must start soon," he continues. "They begin a process to influence investments and change industry expectations. They can lead to more public- and private-sector research and many small improvements on the margin that matter."

Advertisement

Burtraw says right now the Administration is doing nothing to encourage carbon reductions, other than R&D spending for new technologies.

Without reaching out through regulations or subsidies, the Administration is having the unintended affect of encouraging utilities to burn more natural gas for new capacity, which the Administration says it opposes.

"Uncertainties can kill you," says Paul S. Fischbeck, a Carnegie Mellon University professor and director of the Center for the Study & Improvement of Regulations. Fischbeck and his colleagues have developed models that utilities can use to overcome regulatory uncertainties and deal with unknown risks.

"We run seminars with utility executives" he says, "and ask them to raise their hands if they don't expect carbon regulations in 20 years, and in a room of 200 we get about two or three hands.

"They expect something, but they don't have any idea what shape or form it will take or when it might be enacted. The cost of uncertainty makes people afraid to act. It is too risky.

"If there was a somewhat certain future, utilities would lock in, and decisions would be a lot different," Fischbeck says. "Instead, they will go with the gas turbines, which are cheap and fast."

MORE ON THIS STORY

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter