Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Policy

Last-Minute Push For REACH Rule

Europe's Chemical Industry approaches first registration deadline and readies for more

by Paige Marie Morse

November 29, 2010

| A version of this story appeared in

Volume 88, Issue 48

With the first deadline set for this week, companies have been rushing to complete the registration of chemicals under the European Union regulation for the Registration, Evaluation, Authorization & Restriction of Chemical substances, known as REACH. But as they complete the long and tedious preparation, companies share some concern that their efforts may be diluted by inconsistent enforcement of the regulation and its uncertain utility in other regions.

Weekly statistics captured by the European Chemicals Agency (ECHA), which was established in 2007 to implement REACH, show that registration through its website has ramped up rapidly in recent weeks, with more than 2,300 chemical registrations entered in one mid-November week. ECHA responded to the high demand by making the primary registration tool, known as REACH-IT, available during the weekend for the second half of the month.

“We anticipated this last rush in activity,” reports Geert Dancet, executive director of ECHA, “although I must confess that we are a little behind in publishing data of incoming registrants.” ECHA has worked diligently to prepare guidance documents and information technology tools for registrants, but users report that frequent revisions and updates have created extra challenges in the filing process.

Indeed, it seems that for all parties involved in meeting REACH deadlines, the process has proven to be more complex and costly than they anticipated.

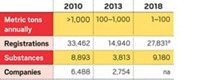

By Nov. 30, companies must complete registrations for all chemicals made in or imported to Europe in quantities of more than 1,000 metric tons per year and for those considered particularly hazardous. As of Nov. 22, companies had submitted registration dossiers for 19,237 chemicals and intermediates, and 13,747 of those registrations were confirmed as complete by ECHA. The deadline is June 2013 for chemicals with sales between 100 and 1,000 metric tons and June 2018 for those between 1 and 100 metric tons.

Most major chemical companies have been focused on the deadline for months. “We are really close to the end,” says Markus Frank, REACH implementation leader at Dow Chemical. “At this time, we are only double-checking to make sure we have not missed anything.”

As is typical for big firms, Dow is the so-called lead registrant for most of the products that it has submitted for registration. The lead registrant is the company that files the data package for a particular chemical; the other companies that produce or import it then follow, linking their submission on manufacturing process and customer end-uses to the primary filing.

In most cases, the major companies have much of the data, so it makes sense that they lead the registration process, Frank says. Dow is the lead registrant for 60 chemicals that exceed the 1,000-metric-ton volume threshold, and more than 100 employees are involved in the data compilation and reporting effort.

The lead registrant has a critical role, consolidating all data on the chemical, including physical properties, toxicology data, and exposure testing results. Additionally, the lead company is charged with facilitating information exchange between registering companies, using an online discussion tool called the Substance Information Exchange Forum (SIEF) to ensure that all available data are considered. Although ECHA provides the software support for the forum, discussions are run entirely by the companies, and it is their responsibility to organize and plan their data collection to prepare the chemical registration.

Managing SIEFs has been a daunting task, according to Michael P. Walls, vice president of regulatory and technical affairs at the American Chemistry Council (ACC), a U.S. trade association. “There are thousands of SIEFs, and there are some SIEFs that have thousands of members. Those members have to understand what data have been developed and then come to some agreement about what should be reflected in the registration dossier,” he says.

The German giant Bayer has taken the lead for about 60% of the chemicals it has registered, reports Andrea Paetz, the company’s director of regulatory policy. Company representatives do use the SIEF tool, she says, but in some cases they have found that e-mail is more efficient. “We have moved to direct e-mail discussion in cases where industry association consortia already exist and we know the people involved and can share the workload,” Paetz adds, citing isocyanate derivatives as an example.

Registration is tougher for smaller companies, particularly those in newer European Union member states, observes Erwin Annys, director of REACH and chemicals policy at the European Chemical Industry Council (CEFIC). “The 12 newest states in the EU do not have the 40 years of history of chemical legislation in Europe.” He adds that language differences are also more of a problem in these countries because fewer employees know English and only a portion of REACH documentation is available in local languages.

To address filing challenges, ECHA has offered stakeholder meetings on how to use the filing tools and holds a periodic dialogue with industry associations through the Directors’ Contact Group, of which Annys is a member. The group has worked through a list of user problems, offering practical solutions for exceptional cases, such as when the lead registrant exits the market at a late stage or data will not be available by a filing deadline.

Complementing the tools from ECHA, CEFIC provides REACH compliance resources, including legal guidance on sharing product information with competitors and sample agreements for SIEF discussions. All of CEFIC’s tools are available to members and nonmembers alike. “We decided two-and-a-half years ago that documents on REACH would have more benefit if not limited to CEFIC membership,” Annys notes. “This is an industry service because it helps our member companies if everyone in the supply chain is well informed on REACH.”

One important target audience of the CEFIC and ECHA support documents is downstream chemical users. This group is less familiar with the regulation and has been concerned about what it could mean for the supply of key raw materials. “End users are really panicking at this point,” ECHA’s Dancet acknowledges. “We have been providing them with weekly updates on what chemicals have been registered, but that has not eased their concern.” Dancet adds that most requests for deadline extensions, none of which have been granted, have come from worried end-user groups.

End users need to be engaged in the process because REACH specifies that every end use be included in a chemical registration. Full disclosure on the use of a chemical is not typical between producers and customers, so registration is forcing a new level of dialogue, Bayer’s Paetz says. Additionally, some companies report that the time needed to gather the information from customers has delayed registrations.

Luckily for companies, REACH does offer a grace period if an end use is missed. Joanne Lloyd, director of the U.K.-based consulting firm REACHReady, explains that if end users learn that a use was not listed, they have six months to report their application and a year to complete the safety assessment. “The timing is triggered once you hear from your supplier that your use was not registered, which would be sometime next year probably,” she says.

Many of REACHReady’s clients are smaller companies that don’t have the in-house resources to support the registration process. This group is often overwhelmed by the volume of information that must be reviewed and the online ECHA tools that must be mastered to complete the registration process. “A lot of problems that we are seeing stem from the lack of confidence in the process and the tools, rather than the technical content of the registration,” Lloyd says.

Smaller U.S. companies are another large user of REACHReady services, particularly for training. “U.S. exporters have had difficulty understanding the obligations they have and how to best support their customers in the EU,” Lloyd observes.

A dominant issue for all companies is the high cost associated with registration. ECHA assesses a registration fee, although it is modest compared with the cost of compiling the documentation. Data-sharing costs can be in the range of $40,000 for each SIEF participant. Moreover, additional charges can result if more testing is needed to complete a chemical registration (C&EN, Aug. 31, 2009, page 7).

“There is no rule-of-thumb cost because there are so many variables,” CEFIC’s Annys acknowledges, citing overall costs per chemical that can range from $2 million to $14 million. “After the deadline, we will try to get a better estimate of the real costs for a registration dossier.”

These up-front costs have forced some companies to reevaluate their position in the market. “Many are deciding not to register,” Lloyd says, “because when they look at the fees and the profit margins on that product over the next couple of years, it is not viable.” Lloyd and others expect that the smaller volume thresholds of future REACH deadlines will drive even more suppliers from the market.

Certainly, REACH costs at major companies are high. Lanxess, for example, estimates it has spent $40 million and expects to need an additional $60 million through 2018. Annual costs of REACH implementation at Wacker Chemie are about $4 million. At a recent industry meeting, CEFIC Director General Hubert Mandery, a former BASF executive, estimated one member company’s overall cost at more than $1 billion (C&EN, Oct. 25, page 29).

And considering the significant investment, companies are eager to ensure that their efforts do not damage their competitive position in the global chemicals market. Early in the process, many European chemical producers were fearful that REACH implementation would hinder regional growth, although that view has softened some in recent months. Companies remain concerned about costs and continue to press for reduced bureaucracy in the filing process, but they seem resigned to the requirements.

A few managers even see a silver lining. Bayer’s Paetz suggests that the REACH requirements may boost business by encouraging European companies to buy from each other instead of from importers that may choose to exit the region.

“We have seen many manufacturers and importers rationalize their product portfolio, which is probably something they should have done anyway for business reasons, not just health and safety reasons,” REACHReady’s Lloyd says.

One substantial issue that remains unresolved on the eve of the registration deadline is enforcement of the new regulation. At this point, REACH enforcement remains with member states and their national legal structures. Budget constraints in some countries may reduce the number of inspections and, therefore, infractions captured.

“We must be sure that REACH will be enforced uniformly,” Dow’s Frank warns, “and not only for manufacturers but also traders, importers, and representatives of products.”

ECHA is facilitating a discussion on harmonizing member-country enforcement, but the group has not reached a resolution. “This could become an issue,” Paetz cautions, “because countries such as Germany, the Netherlands, and France have very strict regulations, and we are not sure it will be that way in every country.”

As Europe works through REACH implementation, other regions are assessing its utility. The most obvious output of REACH is a huge database of chemical information that can be shared globally. Beyond that, the implementation tools may have limited applicability outside Europe.

“REACH will result in a tidal wave of information,” ACC’s Walls notes. ACC has been engaged in REACH discussions for several years to provide input and track implementation for U.S. exporters. “Because of the relative size of the European chemical industry, it was clear that what they would do had the potential to set a precedent for how the U.S. revised its own laws,” he says.

But Walls argues that REACH is not a good fit for the U.S. “There is information available under the REACH program that is relevant to our industry interaction with our own Environmental Protection Agency, but I don’t believe that REACH is a model for Toxic Substances Control Act modifications.” Walls cites legal structure, risk assessment, and handling of confidential information as key issues that do not translate well from REACH.

Dancet says ECHA is willing to work with U.S. agencies on chemical regulation reform, but he cautions that the process is not quick. “It takes a long time to implement a new legislation,” he states. “We prepared for three years for REACH implementation in Europe. If the U.S. is clever, maybe they can save half that time.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter