Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

Dow struggles in the second quarter

Sales and earnings were down sharply for the largest US chemical maker as economic woes continue

by Alexander H. Tullo

July 25, 2023

| A version of this story appeared in

Volume 101, Issue 25

27%

Dow’s decline in second-quarter sales

68%

Dow’s decline in second-quarter earnings

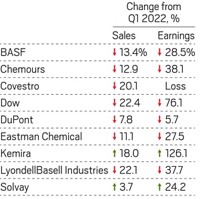

Echoing preliminary results from a handful of European chemical companies, Dow, the largest US chemical producer, has reported declines in both sales and earnings for the second quarter.

“We continued to navigate a challenging macroeconomic environment, with slow global growth in the second quarter,” Dow CEO Jim Fitterling said on a July 25 conference call with stock analysts.

Dow’s sales for the quarter declined 27% from the same period last year, and adjusted earnings dropped 68%.

Sales volumes were weak, slipping 8%. The company’s regional division that includes Europe led the decline with a 14% volume decrease. Product selling prices declined 18% due to soft demand and lower energy costs.

Dow suffered weakness across the board. Its largest business, packaging and specialty plastics, saw sales decline by 28% as ethylene and polyethylene prices dropped and sales volumes for olefins and aromatics decreased.

Dow’s industrial intermediates and infrastructure segment, which houses its polyurethane and construction chemical businesses, saw a 27% drop in sales due to weak demand from consumer durable and construction markets. Its performance chemicals and coatings segment posted a similar decline.

Dow’s results are similar to those coming from the European companies that have released preliminary results for the quarter. BASF, the world’s largest chemical maker, expects second-quarter sales to decline 25% and pretax earnings to fall 57%. Evonik Industries, another German firm, expects a 16% decline in sales and a 40% drop in pretax profits.

The Swiss firm Clariant expects a poor showing for all of 2023 because of economic troubles, particularly the slow pace of recovery in China.

Howard Ungerleider, Dow’s president and chief financial officer, told analysts that he expects the challenges to continue in the third quarter.

“While inflation is beginning to moderate, the lagging effects of tighter monetary policy on consumer demand and a slower-than-expected recovery in China have resulted in a slowdown of industrial economic activity around the world,” he said.

“In Europe,” Ungerleider noted, “recessionary conditions persist and are expected to continue.” In contrast, low unemployment in the US is buoying consumer demand there.

Dow’s results showed a few positive signs. Sales were down only 4% from the first quarter of this year as gains in sales volumes almost offset lower prices. And demand for polyethylene, a key Dow product, has been perking up.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter