Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Investment

Biotech sees large back-to-back funding rounds

Funds for ReNAgade Therapeutics and ElevateBio arrive despite a cautious market

by Shi En Kim

May 25, 2023

| A version of this story appeared in

Volume 101, Issue 17

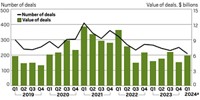

The past week was a fruitful one for outsize investments. On May 23, Massachusetts-based ReNAgade Therapeutics landed $300 million in series A financing to advance RNA therapeutics. The next day, another Massachusetts firm, ElevateBio, closed a series D round of $401 million, the largest capital raised this year.

The two announcements come amid an atmosphere of wariness in the industry and do not necessarily imply an upswing, says Chris Garabedian, a portfolio manager at Perceptive Advisors. “These are unique situations that are not emblematic of what people are looking for in terms of a shift in sentiment,” he says. He adds that beyond the large sizes of both deals, the two firms’ situations don’t have much in common.

ReNAgade is an RNA-focused start-up that was launched under stealth in 2020. The firm claims to distinguish itself from other RNA competitors by going after multiple treatment modalities, such as protein encoding, genome editing, and gene insertion. On top of that, the company develops its own tissue-specific delivery technology using ionizable lipid nanoparticles. “There’s no other company that’s got all of that in-house,” CEO Amit Munshi says. “We call [ourselves] a one-stop shop.”

Garabedian suspects that ReNAgade drew the interest of venture funds because of the start-up’s experienced leadership. In particular, Munshi has a track record of steering biotech start-ups toward profitable exits. Last year, Munshi oversaw Arena Pharmaceuticals’ acquisition by Pfizer for $6.7 billion.

In contrast, ElevateBio is an established gene and cell therapy firm. ElevateBio’s backers include AyurMaya Capital Management and Lee Family Office. They “are not your typical specialty biotech investors,” whose activity would signal the return of a healthy market, Garabedian says.

ElevateBio was expected to go public during the industry boom of the past few years, Garabedian says, yet it is still fundraising privately. The company’s hefty series D does not defy the industry-wide caution—only confirms it.

Other companies will likely face steeper challenges in securing venture capital, Garabedian adds. If these two deals are any indication, there is still an investor appetite for cutting-edge biotechnologies. “There’s hope,” he says, but “it’s still a very discerning market.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter