Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Economy

Trade group predicts trouble ahead for US chemical industry

Industry is expected to contract as country heads into mild recession

by Alexander H. Tullo

December 8, 2022

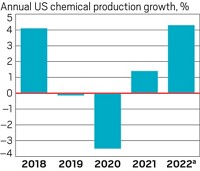

The US economy will experience a “shallow recession” early next year, contributing to a slump for the nation’s chemical sector, according to a forecast from the American Chemistry Council (ACC), an industry trade group.

Forecast

3.9%

Increase in US chemical production in 2022

-1.2%

Expected decrease in US chemical production in 2023

Source: American Chemistry Council

US chemical production rebounded strongly in 2022 from the depths of the pandemic, expanding by 3.9%. “Following several years of really weak growth, we’ve actually had one of the better years of the past decade,” Martha Gilchrist Moore, the ACC’s chief economist, told reporters on a Dec. 7 conference call.

Consumer spending, Moore said, was strong as people spent some of the savings they had squirreled away during the pandemic. And supply chain disruptions eased after weighing on the industry in 2021.

Chemical trade was also strong. US exports are on track to rise 20.4% to $184 billion this year. Because of relatively inexpensive natural gas, the US remains a globally competitive venue for making chemicals. And, Moore noted, exports got a lift from shipments of natural gas-intensive chemicals, such as fertilizers, to Europe in particular. That region is facing an energy crisis stemming from Russia’s invasion of Ukraine, and many European chemical makers had to cut production.

But the ACC says the US chemical boom will subside in 2023, when it expects production to decrease by 1.2%.

“We’re seeing recessionary conditions start to take hold,” Moore said. “Decades-high inflation is really underlying all of this.” It has eroded household purchasing power and has prompted interest rate hikes by the Federal Reserve that will dampen economic growth.

Higher interest rates on mortgages are increasing the cost of borrowing to buy homes. “So we’re going to see a continuation of the downturn in housing,” Moore said. The ACC expects that US housing starts, a big outlet for chemical products, will decline from 1.6 million in 2022 to 1.3 million in 2023.

And the broader global economy is accumulating problems, the ACC says. Europe faces a potential recession. Draconian COVID-19 lockdowns and a crisis in the property sector have weighed down the Chinese economy.

The outlook isn’t all bad, however. With shortages of semiconductors abating, automotive production, another big user of chemicals, is picking up steam. After declining to 13.8 million units in 2022, their lowest level in more than a decade, US vehicle sales will rise to 14.9 million in 2023, the ACC expects.

“There’s some pent up demand,” Moore said. “But that’s going to be tempered by higher interest rates in the housing market.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter