Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Policy

Facts & Figures for the Chemical Industry

July 5, 2004

| A version of this story appeared in

Volume 82, Issue 27

The chemical industry around the world is hoping that 2003 was the year in which business turned around. In total, however, chemical industry data for the 12 months do not look very different from those of 2002. Production of chemicals, especially in the developed countries, changed little. The chemical industry still cut employees--especially production workers--as it had in the previous year because of the slack demand.

The industry also reduced forward-looking spending such as that for new plants and equipment and for R&D. Most of the companies in the U.S., Europe, and Japan that were surveyed reduced such expenditures in 2003 from the previous year, which itself had been down from 2001.

Prices, however, jumped to keep up with rising raw material costs. In fact, the increase in prices in some countries made it seem as if demand for chemicals, which is measured in currency as opposed to volume, was rising rapidly. But the increase in total value was almost all due to the rising prices.

What does not show up in the annual data, however, is that, in the final quarter of the year in some producing countries, including the U.S., the cost-cutting reorganizations of the previous few years finally began to have an effect on the bottom line. Yes, costs were still increasing, and production was improving only slightly. But coupled with the increased prices, cost cutting--including the employment cuts--produced higher earnings for many producers in the fourth quarter of 2003. This improvement continued and became more widespread in the first quarter of 2004.

C&EN's collection of industry data from the major chemical-producing countries and regions was accomplished by Assistant Managing Editor Michael McCoy, Senior Correspondent Marc S. Reisch, and Associate Editor Alexander H. Tullo (all three in C&EN's Northeast News Bureau); Senior Correspondent Patricia L. Short (London); and Asia-Pacific Bureau Head Jean-François Tremblay (Hong Kong). The work was coordinated by Senior Correspondent William J. Storck (Northeast News Bureau).

Note: The following links are available in Adobe PDF format.

Finances

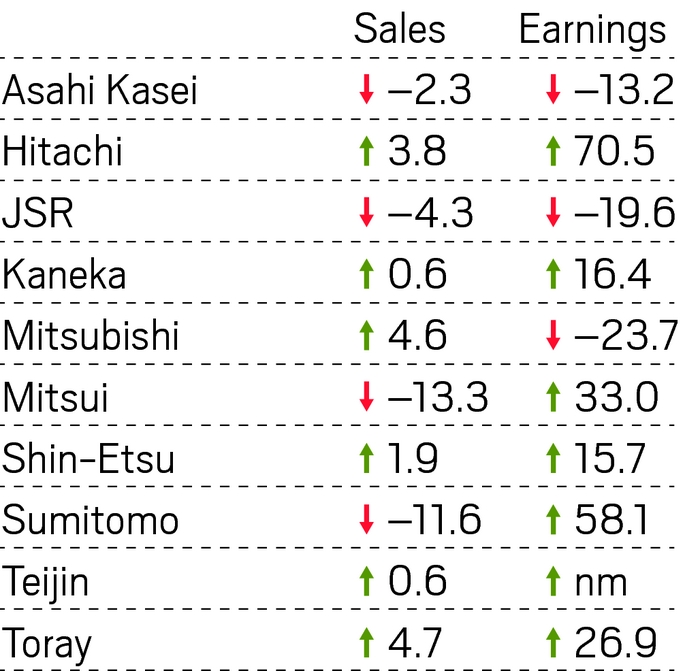

Last year was a mixed bag for chemical company finances. Demand for chemicals improved in many countries, chemical prices were higher--often much higher--but costs were rising, especially the prices that companies were paying for raw materials.

Employment

Chemical companies around the world were still not hiring new employees in 2003; they were continuing to cut jobs in an effort to offset rising raw material costs and boost their bottom lines.

Production

Chemical production in 2003 is hard to pin down. It ranged from no growth in Germany and the Netherlands to as much as 6.3% in Taiwan. In the U.S., which had a growth of just 0.2%, tha range on a sector basis ran from a decline of 1.5% for basic chemicals to an increase of 5.1% for paints and coatings.

Trade

Foreign trade is not just a segment of the chemical industry; it is, in fact, vital to the health of the enterprise. It has been said that the chemical industry is unique in that a company's competitors are also its customers. The same can be said for countries--U.S. customers bought some $6.80 billion in chemicals from Japan last year; U.S. producers sold about $8.01 billion in chemicals back.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter