Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Stocks Mixed in First Quarter

Chemical stock index grew in period, while drug and biotech shares were hit with bad news

by WILLIAM J. STORCK, C&EN WASHINGTON

April 18, 2005

| A version of this story appeared in

Volume 83, Issue 16

Chemical stocks increased moderately on average in the first quarter, with C&EN's chemical stock index beating the Dow Jones industrial average. Drug and biotechnology shares were not so fortunate.

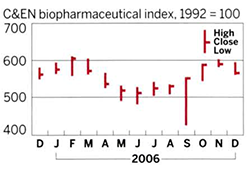

C&EN's index of 25 chemical stocks rose 2.1% from the end of the fourth quarter of 2004 to 207.8 (all C&EN indexes are calculated with a base year of 1992 = 100). C&EN's index for nine pharmaceutical stocks fell 1.5% to 353.1, while its index of 15 biopharmaceutical and drug discovery companies dropped 13.9%.

Meanwhile, the Dow Jones industrial average and the Standard & Poor's 500 index both declined 2.6%, and the NASDAQ fell by 8.1%.

Thus, the chemical index was the star in the first quarter--if a 2.1% increase qualifies it as a star. Although 14 of the companies making up the index had higher stock prices at the end of the first quarter than at the end of 2004, just three showed double-digit increases. Monsanto's stock was up 16.1% to $64.50 per share, its high during the three-month period. The increase came after Monsanto raised its earnings forecast for 2005.

Great Lakes Chemical's stock price increased 12.7% to close the quarter at $32.12 per share. The improvement came after Crompton Corp. said it would acquire Great Lakes. And FMC's stock rose 10.7% to $53.45 per share, largely on the strength of improvement in the company's agricultural chemicals business.

The two largest companies in the index, Dow Chemical and DuPont, posted gains for the quarter. DuPont's stock price increased 4.5% to $51.24 per share, while the stock price for industry leader Dow was up only 0.7% to $49.85 per share.

Of the 25 companies that make up the chemical index, 11, or fewer than half, saw their stock prices decline during the period, but there were some significant drops. Cambrex had the greatest fall, with its price per share declining 21.4% from its 2004 close. The company had warned that it expected first-quarter earnings to be "disproportionately low due to lower volumes, the timing of projects, and an unusually high tax rate resulting from the geographic mix of income."

There were other double-digit declines. Ferro's stock price fell 18.8% to $18.82 per share, Cabot's was down 13.6% to $33.43 per share, and Terra Industries' share price declined 12.6% to $7.76.

STOCKS AT major pharmaceutical companies suffered during the quarter as clinical trials and regulators continued to uncover safety problems in drugs that are already on the market. In fact, worry among investors over what problems might come next seems to be playing a major role in how investors look at the entire industry. A full seven of the nine companies that make up the index had lower stock prices than at the end of the previous quarter.

For instance, Eli Lilly & Co.'s stock price fell 8.2% to $52.10 per share during the quarter after the company said that trials of Xigris, its sepsis drug, showed higher death rates in patients who have single-organ dysfunction and who have recently had surgery.

Pfizer, which faces questions on the safety of its COX-2 inhibitor drugs--and which on April 7 withdrew one of them, Bextra--continued to see its stock price decline. Pfizer stock finished the quarter at $26.27 per share, off 2.3% from the end of 2004. This follows a 12.1% quarter-to-quarter decline in the last three months of 2004, when the problems with the drugs surfaced.

Merck, whose Vioxx kicked off the COX-2 scrutiny last year, seems finally to have put the problem behind it, at least in terms of its stock price. Its stock showed a slight increase of 0.7% to $32.37 per share at the end of the first quarter this year.

The largest decline in the quarter among the nine pharmaceutical companies was at troubled Schering-Plough, where the stock fell 13.1% to $18.15 per share. Johnson & Johnson performed best among the pharmaceutical companies in the C&EN index, with its stock increasing 5.9% to $67.16 per share.

But it was the biotechnology index that suffered most in the quarter. G. Steven Burrill, chief executive officer of Burrill & Co., a San Francisco-based life sciences merchant bank, put it best: "After posting several excellent quarters of positive stock market results, biotech came down to earth with a solid bump in the first quarter of 2005. A string of product disappointments, lower earnings projections, and heightened concerns over drug safety compounded biotech's woes."

Of the 15 companies making up the C&EN biotech index, only three had price growth in the quarter. Chiron's stock was up 5.2% to $35.06 per share, stock at Genentech increased 4.0% to $56.61 per share, and Gilead Sciences' share price increased 2.3% to $35.80.

DRUG COMPANIES were not alone in seeing stock prices fall on safety concerns. Hardest hit in terms of dollars per share was Biogen Idec, which had safety problems of its own. At the end of the first quarter, the company's stock price was $34.51 per share, down $32.10, or 48.2%, from the end of 2004.

The stock was hit when two patients who were taking Biogen's multiple sclerosis drug Tysabri died as a result of a rare but often fatal disease, progressive multifocal leukoencephalopathy (PML), forcing the firm to pull the drug from the market. To compound the problem, just when analysts and others were speculating that Biogen might be able to get the drug reapproved, another patient was diagnosed with PML.

Another company with regulatory issues was Cytogen, which saw its stock price fall 49.7% to close the quarter at $5.79 per share, thanks to a Food & Drug Administration advisory committee that would not recommend approving an investigational functional molecular imaging agent for which the company had exclusive U.S. marketing rights. The agent, Combidex, was developed by Applied Magnetics of Cambridge, Mass.

Of the 12 biotech companies that had declines in their stock prices in the quarter, nine were in the double digits.

In the first seven trading days for the second quarter, the pharmaceutical and biotech indexes outperformed the chemical index and the broader measures. The pharmaceutical index was up 2.5% from the end of the first quarter to 361.8, while the biotech index rose 2.4% to 412.8.

The chemical index fell 1.8% to 203.5 as the Dow Jones industrial average declined 0.5% and the NASDAQ was down 0.4%.

MORE ON THIS STORY

- TABLE 1 - CHEMICAL STOCKS

Chemical company index outperformed Dow Jones industrials in first quarter - TABLE 2 - DRUG AND BIOTECH STOCKS

Drug stocks fell slightly, but biotech share prices fell more

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter