Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Earnings Climb Continues

Prices for some products surge, yielding a stellar first quarter for companies

by WILLIAM J. STORCK, C&EN NORTHEAST NEWS BUREAU

May 23, 2005

| A version of this story appeared in

Volume 83, Issue 21

The U.S. chemical industry chalked up another fine earnings period in the first quarter of 2005 as production of chemicals increased and chemical prices, especially for hydrocarbon-dependent products, skyrocketed.

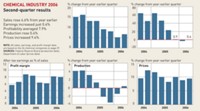

The result was a 55.0% increase in earnings from continuing operations, excluding unusual items, from first-quarter 2004 to a combined $4.00 billion for C&EN's sample companies. Sales increased 12.8% to $39.3 billion. The aggregate profit margin for the group jumped to 10.2% in the 2005 period from 7.4% in the comparable quarter last year. Although 25 companies are listed in the table on page 23, the totals represent 24 firms: Ferro is excluded since it did not report comparable 2004 data.

Much of the sales and earnings increase can be attributed to price increases garnered by the companies. As an indication, the government's producer price index for all chemicals, including pharmaceuticals, rose 11.7% from the year-earlier period. But the average price index for industrial chemicals--the largest sector of the industry--jumped 20.5%. Within this important sector, organic chemicals led the way, with the index for basic organics increasing 23.8% while the index for basic inorganic chemicals rose 10.2%, less than half as much.

Meanwhile, output of chemicals was increasing, but not as fast as prices. The Federal Reserve Board's index of chemical production rose just 4.0% over the same period in 2004. But again, basic chemicals, and especially organic chemicals, pointed the way. The average index for basic chemicals for the first quarter was up 4.0%, driven by a 9.3% rise in basic organic chemicals. The index for basic inorganic chemicals, however, fell 1.6%.

NOTE: All sales, earnings, and profit-margin are based on the chemical companies on page 23. SOURCES: Federal Reserve Board [production data], Deparment of Labor [prices data]

NOTE: All sales, earnings, and profit-margin are based on the chemical companies on page 23. SOURCES: Federal Reserve Board [production data], Deparment of Labor [prices data]

DEMAND FOR U.S. chemicals also increased in the quarter. The value of shipments for all chemicals rose 9.5%, and chemical demand, excluding pharmaceuticals, jumped 12.1%. Overall shipments in the quarter were helped by exports, which rose by 15% over the first three months of 2004.

The quarter was so good that Dow Chemical's chief financial officer, J. Pedro Reinhard, opened a meeting with analysts of chemical securities by saying: "Let me start with a clear message to those of you who have recently been a little nervous about chemical stocks. From Dow's perspective, industry fundamentals remain solid across all operating segments and geographic areas. The long-term uptrend continues."

The improvement was widespread across the companies. Of the 24 companies that reported earnings for both quarters, 18 had double-digit or better increases. Another firm, PolyOne, came out of a $1.6 million deficit in the 2004 period to post $19.1 million in earnings in the 2005 quarter. Only the two smallest companies--Cambrex and Stepan--had earnings declines from the year-earlier period.

Earnings at Cambrex were down 47.4% to $4.1 million on a 2.6% sales decline to $111 million, primarily because of lower volumes in the company's human health and biopharma segments. Chief Executive Officer John R. Leone says: "In order to improve the results of the human health and biopharma segments during the second half of the year, we are aggressively adding new customer opportunities, implementing further cost reductions, and making appropriate changes to management and business processes."

Stepan says its surfactant earnings declined because of higher research expenses, coupled with a weaker sales mix in North America and lower margins in Europe. Polymer earnings rose significantly, the company says, but the benefit was largely offset by lower earnings on specialty products. Stepan saw its earnings decline 20.0% to $3.2 million, despite a 19.4% increase in sales to $264 million.

But the quarter was all about earnings improvement--and there were some big numbers posted by chemical companies. The largest dollar increase came at industry leader Dow, where earnings increased by $884 million, or 188.5%, to $1.35 billion. This improved the company's profit margin to 11.6% from just 5.0% in the first quarter last year. According to Reinhard, "Significant price improvements, supported by solid volumes, enabled further margin recovery across virtually all of Dow's businesses, despite an increase of more than $1 billion, or 30%, in purchased feedstock and energy costs."

Eastman had the largest percentage gain for the quarter, with earnings rising 287.5% as sales increased 10.3% to $1.76 billion. "Improvement in operating performance throughout the company led to the best quarter of earnings and revenue in Eastman's history," CEO J. Brian Ferguson says.

According to Eastman, the significant year-over-year improvement was due principally to higher selling prices throughout the company, higher sales volume from continuing product lines, improved capacity utilization, and cost reduction efforts. Like other companies, Eastman's performance was attained despite increases in raw material and energy costs of about $160 million compared with first-quarter 2004.

FMC Corp. also more than tripled its earnings in the quarter with a 207.9% increase to $42.8 million. Sales at the company improved 9.2% to $552 million. The earnings growth raised the company's profitability to 7.7% in the first quarter from just 2.7% in the same period a year ago.

Like other CEOs, FMC's William G. Walter sees good overall performance at his company. The industrial chemical business "is enjoying significant leverage from one of the best pricing environments since the mid-1990s, particularly in soda ash," he says. "In agricultural chemicals, the benefits of our focused strategy, coupled with increases in planted acreage and strong pest pressures in Brazil, resulted in another outstanding quarter. Our specialty chemicals business generated solid earnings growth driven by higher selling prices and improved productivity in the face of continued high raw material costs."

With six quarters of aggregate double-digit earnings increases now behind the chemical industry, executives are still optimistic about the future. At Dow, Reinhard says the company "continues to expect that global gross domestic product will remain solid at around 3.5%. Although this is slightly lower than we've seen in the recent past, this rate is more sustainable--and will drive continued growth in the chemical industry. For Dow, the second-quarter demand is expected to increase moderately from first-quarter levels, with strong growth in seasonal industries such as building and construction and agricultural products." Dow expects volume growth for the full year of between 2 and 5%.

CRITERIA FOR C&EN EARNINGS ANALYSIS

C&EN's quarterly report on financial performance of the U.S. chemical industry contains data from 25 major U.S. basic chemical companies and from five petroleum companies, each of which has more than $200 million in annual chemical sales.

To be included in the table of basic chemical producers, a company must have at least 50% of its sales in chemicals.

In referring to chemical sales, C&EN means sales of chemicals whose molecular composition has been changed during manufacture. Hence, these include traditional categories of basic petrochemicals and inorganics, organic intermediates and inorganic compounds, polymers such as plastics and fibers, and agricultural chemicals and specialty derivatives.

In listing earnings, the report gives after-tax income for continuing operations, excluding significant nonrecurring and extraordinary items.

At Rohm and Haas, which posted a 39.5% increase in earnings to $159 million in the first quarter on 10.4% sales growth to $2.0 billion, CEO Raj L. Gupta says the company expects modest volume growth for the year, despite an uncertain outlook for overall demand.

Hercules, which has had its share of troubles over the past few years, now sees continued improvement. "We expect improved volumes, lower general and administrative costs, and improved margins going forward in 2005," CEO Craig A. Rogerson says. "We remain committed to our targets of double-digit ongoing earnings-per-share growth and significantly higher cash flows in 2005 compared to 2004."

Rogers warns, though, of further restructuring charges in the second quarter, primarily from severance costs related to improvement and productivity efforts. In the first quarter, Hercules' earnings rose 30.6% to $20.5 million on a 6.4% sales improvement to $505 million.

Eastman's Ferguson sees a future wished for by other chemical company executives. He foresees "second-quarter 2005 earnings per share to be similar to first-quarter 2005 ($1.92) and expect[s] that 2005 will be a great year throughout the company."

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter