Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Is the Chemical Industry Slowing?

Government data show little, if any, growth in some sectors or among downstream users

by William J. Storck

October 3, 2005

| A version of this story appeared in

Volume 83, Issue 40

At first glance, it would seem that things are going pretty well for the U.S. chemical industry.

Sales are up, often with double-digit increases. Earnings are popping, with C&EN's 25 chemical company sample showing seven straight quarters with more than 40% year-over-year growth. Some chemical companies have even seen triple-digit increases. Profitability has increased significantly over the past couple of years.

Since the beginning of 2004 through August of this year, chemical prices and production have grown well. For the total chemical industry, the industrial production index was up a seasonally adjusted 4.5%, and the producer price index increased 12.9%, according to data from the Federal Reserve Board and the Labor Department, respectively.

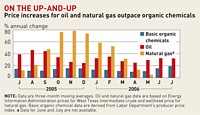

This pattern of large price increases outpacing production growth held in some of the industry's individual sectors. For instance, plastics and resins had a 2.3% increase in production over those 20 months, and the prices that producers got for their output soared 26.2%. Basic chemicals saw production decline 2.2%, while prices still jumped 20.1%. Within basic chemicals, production of inorganics rose just 0.3%, but prices went up 15.2%. The disparity was even greater in organics, where output fell 3.8% as prices rose 21.6%.

So things are good, right? Well, I'm not so sure. The disparity between the increases in the two indexes is a cause for concern. The industry has been able to increase prices, especially in basic chemicals, because of relatively tight supplies. Through these price increases, along with cost cutting, chemical companies have been able to largely offset higher raw material and energy costs. But what happens if demand-and thus capacity utilization-turns down? Will the basic laws of supply and demand prevail?

The data since the spring of this year are sobering. In March and April, chemical production and prices in some of the industry's major sectors peaked and have since retrenched, or at least have been relatively unchanged since then.

For instance, overall chemical output hit a high in March and by August, the last month for which data are available, had fallen 1.2%. Meanwhile, the producer price index for all chemicals has declined 0.5% since April, the highest point for this index. Thus, the nominal value of production-calculated by multiplying the production index by the price index-fell 0.5% since March.

The same holds true for the important basic chemicals sector. Here, however, output actually peaked in December 2004 and by August had fallen 8.0%. Prices kept climbing until March, but have fallen 3.4% since then. Thus, compared with March, the value of production is down 8.5%.

Within that sector, most if not all of the damage was done by organic chemicals, where output was down 11.0% from its 2005 high in January and prices have fallen 4.4% since their March peak. Since March, then, the value of production has declined 12.4%.

In the basic inorganic segment, although output fell 1.5% between its high in April and August, prices have continued to rise, increasing 2.9% since then. This produced a 1.3% increase in the production value.

Major users of chemicals are seeing much the same pattern in output. Paper manufacturing has declined since March, as has production of plastic and rubber products, primary metals, glass, and cars and light-duty trucks, except for a jump in August when companies were offering deals to move vehicles off the lots.

These results all took place before Hurricanes Katrina and Rita hit the Gulf Coast in August and September. These natural disasters caused temporary plant shutdowns, damage to facilities, interruptions in power and feedstock supplies, and disruption of the transportation infrastructure, making a further decline in chemical production in September and beyond almost a certainty. And estimates are that while these factors are causing increases in chemical prices, they may be more than offset by lost production and by much higher feedstock and energy costs.

One effect of the hurricanes, and especially Katrina, has been a lowering of earnings estimates by many chemical companies and Wall Street analysts; at least one industry insider, however, says many companies are including in their estimates the effects of slowing production and pricing power over the past few months. Analysts have lowered their third-quarter and full-year earnings estimates on such chemical firms as Dow Chemical, DuPont, Nova Chemicals, Eastman Chemical, Albemarle, PPG Industries, Rohm and Haas, Georgia Gulf, and others.

Even if the hurricanes are only a short-term factor, which most observers agree that they will be, one has to wonder if the slowdown seen since the spring could have happened at a worse time. Oil and therefore gasoline prices may be causing consumers to curtail spending in other areas, which will only exacerbate the slowing in chemicals. In addition, the Federal Reserve Board continues to raise interest rates. While this is sound fiscal policy designed to slow the economy and inflation, it will have an effect on consumer demand.

What's the upshot? If oil and gas prices remain high, combined with higher interest rates, they may not presage a recession, but they could mean lower consumer demand and manufacturing activity. This could only mean continued contraction in the chemical industry.

Views expressed on this page are those of the author and not necessarily those of ACS.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter