Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Earnings Continue To Grow

Most companies that are reporting see higher returns in the first quarter

by William Storck

April 30, 2007

| A version of this story appeared in

Volume 85, Issue 18

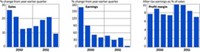

It's early in the earnings season, but most chemical companies that have disclosed their first-quarter results are showing growth in both sales and earnings.

Of the 12 major U.S. chemical companies that have published their results, only three had lower earnings in the first quarter compared with the same period last year. Earnings are from continuing operations, excluding significant extraordinary and nonrecurring items.

Albemarle had the greatest percentage gain in earnings—68.9% to $58.1 million—despite the 3.0% decline in sales to $589.2 million. CEO Mark C. Rohr credits fine chemicals, where income rose 132%, for most of the increase.

The industrial gases business did well for both Air Products & Chemicals and Praxair. Air Products' earnings increased 11.6% to $227.6 million as sales improved 10.9% to $2.47 billion. And Praxair saw earnings rise 17.8% to $265.0 million on a 7.4% sales increase to $2.18 billion.

Air Products CEO John P. Jones III says the company delivered strong volume performance, led by merchant gases, tonnage gases, and electronics and performance materials businesses. At Praxair, CEO Stephen F. Angel notes continued strength in the company's global markets, solid manufacturing fundamentals, and strong demand for energy and environmental applications.

Industry leader Dow Chemical was one of the three firms reporting lower earnings. The company's earnings fell 19.9% to $973.0 million. Sales at the company, however, were up 3.4% to $12.4 billion. The earnings decline was principally due to a drop in licensing revenues from high levels a year ago, the company says.

Number two DuPont saw earnings rise 15.0% to $997.0 million, more than double the 6.1% increase in sales to $7.85 billion. The company says strong seed sales and growth outside the U.S. more than offset lower volumes in the U.S. housing and automotive markets.

Besides Dow, the two other companies with lower earnings were PPG Industries and Rohm and Haas. PPG's earnings fell 6.6% to $199.0 million despite a healthy 10.6% increase in sales to $2.92 billion. CEO Charles E. Bunch says the commodity chemicals segment was down from the same quarter last year.

Earnings at Rohm and Haas fell 8.2% to $190.0 million as sales improved 5.0% to $2.16 billion. The company says its salt, electronic materials, and performance materials businesses performed well, but its specialty materials segment was negatively impacted by weak demand in the U.S. and a decline, as expected, in monomer pricing.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter