Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Consolidation In Brazil

National oil company Petrobras is buying midsized petrochemical maker Suzano

by Alexander H. Tullo

August 7, 2007

Brazilian state oil company Petrobras is making another big consolidation move in that country's petrochemical sector through the purchase of Suzano Petroquímica. The deal will be worth roughly $1.4 billion when completed.

Petrobras is offering $684 million for Suzano's common shares and another $425 million for its preferred shares. These stakes account for the 76% interest in Suzano held by Suzano Holding, the entity that controls Suzano. A subsequent tender offering for the remaining shares will cost Petrobras another $300 million.

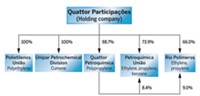

Suzano earned $107 million before taxes on about $1.3 billion in sales in 2006. The company, with 685 million tons of annual capacity, is the largest polypropylene producer in Latin America. Its polypropylene business had been the PoliBrasil joint venture with global leader Basell until Suzano bought out its partner's interest in 2005.

Suzano also owns a 33% interest in Rio Pol??meros, which started up a 540 million-ton ethylene and polyethylene complex in the state of Rio de Janeiro in 2005. Petrobras already held a 17% interest in that facility. Suzano owns a 7% stake in Petroqu??mica Uni??o (PQU), which operates a petrochemical complex in the state of S??o Paulo. Petrobras' existing stake in PQU is 17%. Suzano also owns a 20% interest in synthetic rubber maker Petroflex.

Petrobras says the acquisition will help consolidate the Brazilian petrochemical industry and help pave the way for an $8.3 billion petrochemical complex planned by Petrobras and local industrial group Ultrapar for Rio de Janeiro. Earlier this year, Petrobras, Ultrapar, and Braskem announced the joint purchase of petrochemical maker and refiner Ipiranga for $4 billion.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter