Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Makers Feel The Pinch

High oil prices crimp earnings, but sun shines on agriculture

by Melody Voith

July 28, 2008

| A version of this story appeared in

Volume 86, Issue 30

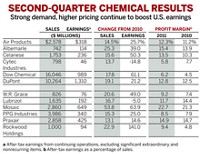

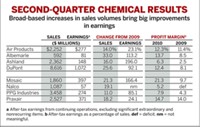

Second-quarter financial results show that much of the chemical industry continues to struggle with rising energy costs and weak U.S. demand. Agriculture and industrial gas firms, however, had another quarter of strong earnings.

In a report to investors, Dow Chemical CEO Andrew N. Liveris tried to explain his company's 26.7% earnings decrease compared with the second quarter of 2007. "The surge in oil prices from first to second quarter added another $1 billion of cost sequentially, and we reacted quickly," he said. Liveris outlined steps that Dow is taking to catch up, including two price increases, plant shutdowns, and other cost-cutting measures.

The news was very different for companies in the agriculture sector: Both seeds and chemicals brought in big money this quarter. DuPont and Terra Industries benefited from strong prices for corn and soybeans. At Dow, agricultural sciences was the one bright spot; pretax earnings increased by 61%.

In a conference call with investors, DuPont Chief Financial Officer Jeffrey L. Keefer said the 23% sales growth in the company's agriculture and nutrition segment was "underpinned by strong global agriculture markets, price gains in crop protection products, and seed corn share in North America."

Terra Industries, a leading producer of nitrogen fertilizer products, saw sales increase by 21.6% and earnings almost double versus the second quarter of 2007, thanks mostly to higher selling prices. Shipments were flat because of a cool late planting season and the flooding in much of the Midwest Corn Belt.

But there was hope in the air, even for nonagriculture companies. Celanese increased earnings by 36.5%, compared with last year's second quarter. Volume and price increases for acetyl intermediates were major factors in the earnings boost, and growth in Asia and price hedging on raw materials also helped.

Industrial gas maker Praxair had a strong quarter, posting double-digit sales growth in all segments and a 19.9% increase in earnings compared with the second quarter of 2007. Praxair was also one of many firms that benefited from currency exchange rates. The money it earned in euros added 7% to revenues. The average for the industry this quarter was just under 6%.

For companies serving the construction markets, overseas selling made a big difference this quarter. While H.B. Fuller continues to suffer from the sluggish North American economy, Hercules saw sales increase by 17% in developing regions. High materials costs still hurt, though, and brought down earnings at both firms.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter