Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Environment

Venture Funds Turn to Cleantech

Investors see profits in solar power, renewable fuels, and energy storage

by Melody Voith

February 11, 2008

| A version of this story appeared in

Volume 86, Issue 6

Konarka's flexible photovoltaic material has attracted investors.

SOLAR PIONEERS invited the neighbors over to show off their rooftop panels and explain how they convert sunlight to electricity. Thanks to venture capital investors, those who want to convert sunlight more directly into money will soon have many new options. Venture capitalists predict that green start-ups will constitute their highest growth sector in 2008, and some of those companies will become part of tomorrow's stock portfolios.

Already in some stock owners' portfolios are SunPower and First Solar, two of several solar companies that issued initial public offerings (IPOs) in 2005 and 2006. These successful IPOs have helped turn on a sudden flow of money into what is being called the "cleantech" sector.

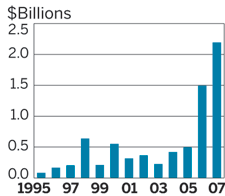

In 2007, U.S. cleantech venture capital investments increased 46%, to almost $2.2 billion, compared with 2006, and the National Venture Capital Association (NVCA) predicts another banner year in 2008. Though solar and other energy technology companies have received the most investment, cleantech encompasses a wide range of industries including energy storage, environmental monitoring, electric cars, and energy-efficient building materials.

"Cleantech is the fastest growing venture asset class," says Ira E. Ehrenpreis, general partner and head of the cleantech practice at Technology Partners, a venture capital firm in Palo Alto, Calif. "Venture capital had been focused on IT"—information technology—"and life sciences, but now there is a new, third pillar."

Ehrenpreis attributes the rise of cleantech to the convergence of several factors. One is the recent history of successful solar company IPOs, which have helped build confidence in cleantech among investors. To venture capitalists, successful IPOs and acquisitions—called "exits" in industry parlance—prove the worthiness of investments that like any business start-up entail a great deal of risk and market uncertainty.

In addition to rising interest in solar power, Ehrenpreis points to megatrends including a change in the political climate, new attitudes toward environmental issues, globalization, increasing demand for energy in India and China, and a strong interest in cleantech by large corporations, both as investors and as acquirers of companies.

As the public hears more evidence of global climate change, investors predict that Republicans and Democrats will follow the voters and focus on environmental issues. The Cleantech Ventures Network, a professional organization with more than 8,000 investors, observes that "opinion polls show rising public concern about global warming and energy security. Investors, sensing the level of public interest in these stories—and therefore an opportunity in the market—are beginning to invest in industries that reduce human impact on the ecosystem."

But these same factors threaten to open the door to an overheated, overhyped market. Josh Wolfe, managing partner of Lux Capital, a venture fund in New York City, cautions that although solar and biofuels have attracted a lot of investment, "there are hundreds of undifferentiated solar companies and dozens of biofuel companies using superbugs." Wolfe predicts that many will fail, saying, "I'd be a nervous partner."

Indeed, NVCA finds that 61% of venture capitalists it surveyed say cleantech will be overvalued in 2008. The good news, according to Wolfe, is that the attractiveness of these industries to investors brings down the cost of capital, allowing for more experiments in technologies and business models.

John S. Taylor, a research and financial affairs executive at NVCA, points out that cleantech investments, although growing, accounted for only 7% of total venture capital spending in 2007. "People are approaching it cautiously," he observes. "There are many inherent risks because the economics are unproven." Risks include a dependence on the high price of oil to make solutions economical, the need for up-front capital, and a reliance on new, possibly unproven science. "The technological risk is, if you build it, will it work? It is very different than software programming," Taylor says.

A survey by the Cleantech Ventures Network identifies energy prices as the major driver of investments in cleantech. High gasoline prices and government requirements for renewable components in fuel have driven investments in biofuels such as ethanol, biodiesel, and butanol. The cost of a gallon of gas, however, doesn't explain the flow of money into solar-derived electricity ventures, at least not until dreams of widespread use of plug-in electric or hybrid cars become reality. Wolfe worries that some venture capitalists rationalize their investments in solar technologies on the basis of the high price of gas and may not understand the differences between markets for fuels and electricity.

Investment in "clean" technology has skyrocketed in the past two years

Government efforts to stave off climate change are another driver. A report by the Cleantech Venture Network predicts that "climate-change policies will play a key role in the growth of cleantech as it becomes increasingly apparent that products and processes that reduce greenhouse gases will see increased demand." At the state level, California's Low-Carbon Fuel Standard is expected to triple the size of the state's renewable fuels market.

Seasoned investors know how to wade through multiple pitches for capital in search of breakthrough technologies that could be scaled up to answer a real need in the marketplace. Lux Capital's Wolfe says companies that develop advances in batteries, such as those used to power hybrid and electric cars, may be less risky choices because their success is not dependent on any single energy source.

The Cleantech Venture Network observes that smaller lightweight batteries that recharge quickly are in high demand by the mobile device industry. Moreover, electric cars will require batteries with similar characteristics before they catch on with consumers. Energy storage start-ups and chemical companies alike are working to develop novel battery components that avoid the problems of lithium-ion batteries, which overheat occasionally—but often enough to make newspaper headlines.

CHEMICAL COMPANIES are also investing in cleantech. For example, BASF, DSM, Unilever, and DuPont have invested with NGEN Partners, a cleantech-focused venture capital firm with a history in materials science. One star in NGEN's portfolio is Konarka Technologies, a Lowell, Mass.-based solar start-up. Konarka has developed a flexible, coatable plastic photovoltaic material that can be used where traditional solar technologies are not practical.

Venture investors are being very selective in the companies they choose, according to NVCA's Taylor. "How do you predict a winner? Everyone wants to find the next Microsoft—and it's out there." But no one area will dominate because it is not clear which solution will provide the core value that will be the basis of clean technologies, Taylor adds. Risk in these industries is lower for investors who understand the energy and materials markets and target a number of solutions. "If all of a sudden you could make renewables 10-15% more efficient, you would have a huge impact," Taylor says.

Historically, there have been tradeoffs in investing in green companies—financial returns were sacrificed for environmental benefits—but Technology Partners' Ehrenpreis sees a change in store for that equation. "We've now seen in the public markets, venture capital, corporations, and government that green for the environment and green for returns are not mutually exclusive," he says. "There is now a belief that by investing in energy and the environment, we'll achieve financial success."

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter