Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Profits Rebound In Japan

Fiscal First Half: Demand is strong for all materials

by Jean-François Tremblay

November 8, 2010

| A version of this story appeared in

Volume 88, Issue 45

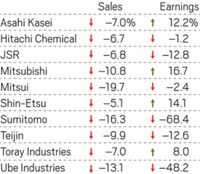

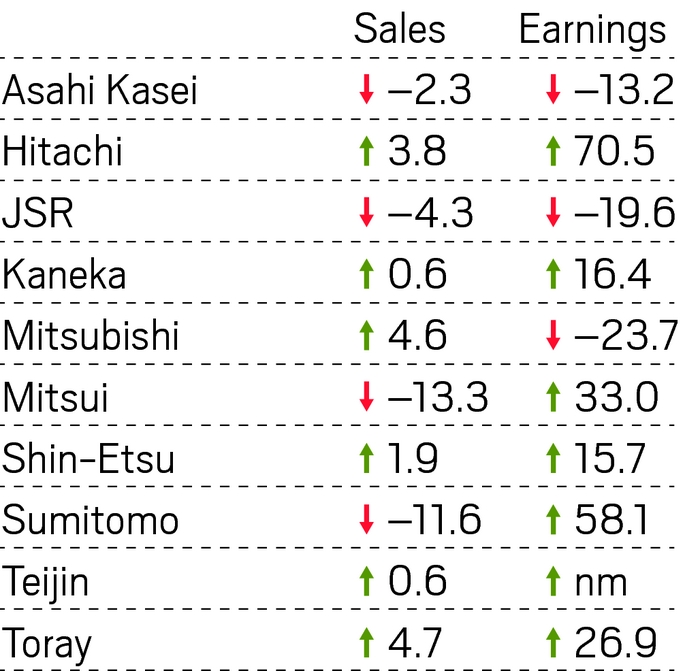

Major Japanese chemical firms posted a sharp improvement in earnings in the first half of the fiscal year that ends on March 31, 2011. Companies that recorded losses a year ago are now profitable.

Japanese companies said they experienced strong export demand across all their product lines, mostly from customers based in other Asian countries. Demand was particularly strong for electronic materials, and Mitsubishi Chemical reported healthy demand for its petrochemical products as well.

Companies noted that demand from the U.S. and Japan remains weak. Despite boosting its net earnings by more than five times compared with a year ago, Asahi Kasei said it has been facing a “particularly challenging” environment because of the slowing U.S., Japanese, and Chinese economies.

In contrast, the profit margin at Shin-Etsu Chemical soared to nearly 12% after net earnings increased by 75%. Although demand for polyvinyl chloride resins in the U.S. was weak, Shin-Etsu was able to find buyers in other parts of the world. The company said it enjoyed strong global demand for another one of its core products, 12-inch silicon wafers.

Sumitomo Chemical also enjoyed strong demand for its electronic materials, which are mostly used in the manufacture of liquid-crystal displays. Whereas Sumitomo had recorded an operating loss in its electronics segment one year ago, the business achieved profits of more than $150 million in the past six months.

Despite the business improvements, Sumitomo achieved overall net earnings of only $30 million in the fiscal first half because of a sharp drop in the valuation of its 20% stake in Nufarm, an Australian producer of generic agrochemicals.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter