Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

A Day With Dow

At investor event, the company reports progress on a number of fronts

by Alexander H. Tullo

November 22, 2010

| A version of this story appeared in

Volume 88, Issue 47

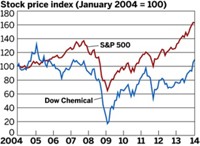

When Dow Chemical held an investor day in New York City last November, its stock jumped 7% the same day. Perhaps because it worked so well then, the company decided to hold another such event, this time on its home turf of Midland, Mich.

Last year’s event was one of the most crucial moments in the career of Dow’s chief executive officer, Andrew N. Liveris. He had the difficult task of explaining how the acquisition of specialty chemical maker Rohm and Haas was the key element in his company’s transformation away from commodity chemicals.

The audience had good reasons to be skeptical. Dow was winding down its most difficult year, which began amid the financial crisis and dissolution of the planned K-Dow Petrochemicals joint venture with Kuwait’s Petrochemical Industries Co. (PIC).

That transaction was meant to provide a down payment on Rohm and Haas, and Dow was left holding the bag at the worst possible time. The firm was forced to cut its dividend for the first time since 1912 and contemplate selling off businesses it would otherwise keep.

At the 2009 meeting, Liveris seized the moment by offering up ambitious goals for synergy and growth stemming from the acquisition. He managed to end the year on an uplifting note.

This year’s event showed how far Dow has come since then. Liveris no longer has to sell the Rohm and Haas deal to shareholders. Instead, the focus at the event was on how well Dow has been meeting its targets and tying up loose ends.

“The leadership team and our board and I thought deeply several years ago about the changes that we saw sweeping across our world and the changes that we needed to make as an organization to seize new opportunities,” Liveris told the audience. “We have worked hard in the years since to put those changes in place and to transform our company. Today, as a result, we are without question on the right trajectory with the right portfolio.”

As evidence of that trajectory, Liveris highlighted the goals Dow has met. The company is on track for a 28% jump in sales in 2010, well ahead of the 10% per annum increase he promised a year ago. He said Dow has exceeded $2 billion in cost-cutting ahead of schedule. And Dow increased the risk-adjusted value of its R&D pipeline from $10 billion a year ago to $12 billion today.

Profit margins, Liveris noted, are already up to prerecession levels, even though sales volumes aren’t. This is a testament, he asserted, to Dow’s smaller manufacturing footprint and focus on higher margin products.

Liveris didn’t lay it on too thick. Because of sluggish construction markets, Dow’s coatings and infrastructure business is subpar, he admitted. Dow AgroSciences is also performing below normal but “will expand nicely as we monetize the innovation pipeline.” He noted that SmartStax, a seed technology Dow developed with Monsanto to combine eight different insect- and herbicide-resistance traits, is “beginning to deliver on its promise.”

Dow is also reaping a big windfall from its plastics unit, which is performing better than Liveris and others expected. So far this year, sales and pretax profits are both up by about 30%.

Liveris has changed his thinking on the basic plastics business. Polyethylene and polypropylene were to be included in the K-Dow joint venture. With the sale of Dow’s polycarbonate unit and restructuring of the polyethylene business, however, Liveris is now pursuing a different strategy.

Instead of divesting the entire enterprise, he suggested that only the more commoditized businesses—high-density polyethylene and polypropylene—would be up for sale or joint venture. Dow’s linear low-density polyethylene business, based on its versatile solution-based manufacturing process, is more likely a keeper.

Another loose end that the company intends to tie up is arbitration with PIC over the failed venture. Liveris is confident he’ll get a sizable payment. “The number that is very visibly out there is $2.5 billion,” he told reporters. “I have no reason to think that my lawyers can’t bring that number home.”

Liveris was noncommittal about the notion creeping into stock analyst reports that a settlement with the Kuwaitis might mean that Dow would divest its 42.5% share in Equate Petrochemicals, their ethylene glycol and polyethylene joint venture, which has recently been expanded. “We have never had that conversation” with the Kuwaitis, he said. However, he wouldn’t rule out a transaction, either.

The investor event didn’t pump Dow’s stock as much as last year’s did. Share price rose a mere 1.6% the next trading day. But the presentation went over well with stock analysts.

Dow’s reaffirmation of earnings targets, commitment to accelerate plastics ventures, and focus on innovation led David Begleiter of Deutsche Bank to “believe Dow’s investor meeting met expectations.” John P. McNulty of Credit Suisse said Dow has greater earnings power than Wall Street appreciates and predicted that it would be the best-performing large chemical company over the next year.

If so, Dow will have a topic for its next investor day.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter