Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Company Of The Year

The slow and steady professionalism of BASF makes it this year’s choice

by Alexander H. Tullo

January 3, 2011

| A version of this story appeared in

Volume 89, Issue 1

When BASF, C&EN’s 2010 company of the year, began its modern incarnation 58 years ago, no one could have imagined that it would become, by a $10 billion margin, the largest chemical company in the world.

Back then, Germany’s Badische Anilin und Soda Fabrik was the Ludwigshafen-based fragment of the IG Farben cartel being broken up by the Allies after World War II. According to an article in C&EN’s March 24, 1952, issue, Allied warplanes caused $160 million in damage at BASF’s flagship plant during the fighting (page 1218). Coincidentally, $160 million was also BASF’s 1951 sales figure. “All the postwar Farben combines are small compared to the top chemical companies in the U.S. and Britain,” the article remarked.

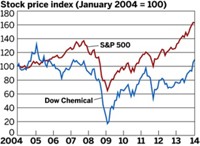

But riding on Germany’s Wirtschaftswunder, or postwar economic miracle, and adding in its own devotion to integration and efficiency, BASF more than caught up. In 2006, BASF edged out Dow Chemical to begin its current term as the world’s largest chemical firm. Since then, the gap between “The Chemical Company,” as BASF calls itself, and its peers has grown.

Even by BASF’s standards, though, 2010 stands out as a banner year. The company recovered strongly from the Great Recession. Sales, which include an oil and gas business, increased 26.5% during the first three quarters of the year to $63.1 billion. Earnings over the same period jumped 262.0%, to $4.6 billion. BASF peers Dow and DuPont also saw earnings recover, but not by as much.

BASF executives expect that 2010 will end up a record year. They believe revenues will climb to about $84 billion, surpassing the mark reached in 2008. “We are now profiting from the favorable economic environment because we further improved our competitiveness in the crisis and made our portfolio even more cyclically resilient through the rapid integration of Ciba,” said Chairman Jürgen Hambrecht at the end of October 2010.

Indeed, acquisitions have been an unsung part of BASF’s strategy in recent years. And in 2010, Hambrecht put the final touches on his company’s portfolio shuffling, buying Cognis in a deal worth $3.8 billion. The purchase strengthened BASF in personal care ingredients such as emulsifiers, emollients, and surfactants. It also enhanced BASF operations in nutritional ingredients such as vitamin E and functional products such as lubricant additives.

The Cognis deal was BASF’s fourth major acquisition in the past five years. The company purchased catalyst maker Engelhard and Degussa’s construction chemicals business in 2006. It bought out Swiss specialty chemical maker Ciba in 2009.

Throughout this process, BASF hasn’t heralded transformation as loudly as other large chemical companies have. There hasn’t been “the new BASF” like there has been “the new Dow” after that firm’s acquisition of Rohm and Haas. When the Cognis deal was unveiled, BASF managers stressed that their acquisitions target above-average growth, a focus on innovation, reduced cyclicality, and a rapid contribution to earnings. Although soberly expressed, the themes echo those of Dow’s more ballyhooed transformation.

In addition, the deals didn’t seem revolutionary for BASF because none of them was a single magic bullet. But taken together, BASF’s four purchases cost more than $18 billion, only about $1 billion less than Dow’s Rohm and Haas transaction.

When Hambrecht announced the Cognis deal, he pledged that it would be BASF’s last major purchase for “the foreseeable future.” A bigger priority, he told analysts, was improving cash flow and reducing levels of debt. He said he wanted to maintain BASF’s relatively strong credit ratings.

The debt ratings agencies were, in fact, concerned about the deal: Standard & Poor’s downgraded BASF from having an A+ to an A, and Moody’s put BASF bonds “under review for downgrade.” In a note last month affirming her outlook, Moody’s analyst Elena Nadtotchi wrote that “BASF has increased its debt levels progressively as a result of acquisitions.” But she noted that the Cognis transaction was “supportive of the company’s strong business profile.”

In 2010, BASF also found a home for a business it had been trying to divest for some time: In November, it announced the formation of the Styrolution styrenics joint venture with Ineos. Analysts were disappointed that BASF didn’t sell the unit. But the business, which has seen more downs than ups in recent years, will at least no longer put a damper on BASF’s ledgers as a consolidated subsidiary.

The company of the year is spending on organic growth as well, especially in Asia. Two weeks ago, BASF announced a $1 billion expansion of its joint venture with Sinopec in Nanjing, China. The companies plan to build new plants to make acrylic acid, acrylic acid derivatives, surfactants, styrene, and, possibly, propylene oxide. Earlier in December 2010, BASF announced it was studying a $1.3 billion specialty chemical complex in Malaysia with state oil company Petronas.

C&EN considered other firms as its company of the year. Dow is a perennial candidate, and in 2010, it did make substantial progress integrating Rohm and Haas and meeting lofty financial targets. LyondellBasell Industries fought off a takeover overture from India’s Reliance Industries, emerged from bankruptcy, and became a public company again. Brazil’s Braskem acquired its chief Brazilian rival and got a toehold in the U.S. by purchasing Sunoco’s polypropylene unit.

But 2010 will be remembered as the year when a number of important initiatives came together for BASF, the world’s largest chemical company.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter