Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

IRS May Prohibit MLPs For Chemicals

by Alexander H. Tullo

May 11, 2015

| A version of this story appeared in

Volume 93, Issue 19

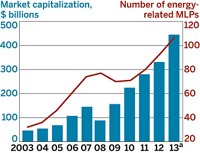

Proposed Internal Revenue Service rules may stem the tide of chemical master limited partnerships (MLPs) and nullify existing ones. MLPs do not pay income taxes. Instead, investors who hold MLPs’ “common units” pay taxes on earnings from the MLPs at their own personal tax rates. MLPs were once the domain of natural resource extraction industries such as oil and gas. But the IRS has allowed olefin producers to form MLPs in recent years. The new rules may roll that back. Some MLPs, such as Westlake Chemical’s, would have to revert back to a conventional corporate structure within 10 years. Axiall recently announced that it was seeking an MLP structure for its chlor-alkali operations.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter