Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Thermo Fisher To Buy Affymetrix For $1.3 Billion

Deal expands instrument maker’s reach in genetic analysis for clinical and diagnostics markets

by Marc S. Reisch

January 11, 2016

Thermo Fisher Scientific has reached a deal to buy gene-sequencing expert Affymetrix for $1.3 billion. The $14.00-per-share price is about 50% above Affymetrix’s share price after the stock market closed on Jan. 8.

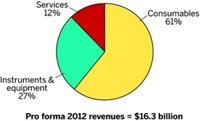

Although not as large as Thermo Fisher’s $13.6 billion acquisition of Life Technologies in 2014, this latest acquisition further cements the firm’s role as a supplier of equipment and consumables to the life sciences research and diagnostics communities.

Affymetrix, based in Santa Clara, Calif., has 1,100 employees and annual sales of about $350 million. Thermo Fisher has sales of about $17 billion.

The purchase will “create new market opportunities for us in genetic analysis,” says Thermo Fisher CEO Marc N. Casper, and “significantly expand our offering in the fast-growing flow cytometry market.”

Thermo Fisher’s distribution network will increase availability of Affymetrix technologies to customers in markets such as single-cell biology, reproductive health, and agricultural biotechnology, notes Affymetrix CEO Frank Witney.

The deal is Witney’s second with Thermo Fisher in the past five years. In 2011, as CEO of Dionex he sold the liquid and ion chromatography firm to Thermo Fisher in a $2.1 billion transaction.

When the Affymetrix acquisition is completed by the end of June, the business, which includes antibodies as well as protein and single-cell assays, will be integrated into Thermo Fisher’s life sciences solutions segment.

“While the deal appears expensive, the synergies are many,” Dan Leonard of Leerink Research told clients in a research note. He suggests that shares of other small to mid-size tool makers could strengthen “as investors ponder who’s next.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter