Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Trade

China creates world’s largest carbon trading program

Cap-and-trade approach will start with power-generating companies

by Jeff Johnson

December 21, 2017

The Chinese government announced on Dec. 19 the start of what could become the world’s largest carbon emissions trading program. The program will begin with the nation’s electric utility sector and branch out to other emitters of carbon dioxide, according to the government’s National Development & Reform Commission (NDRC).

China began a trial carbon emissions trading marketplace in 2013, which consisted of seven regional and city-specific pilot programs. These will serve as models for the national program, which will be phased in over three years, the government says.

The trading program will be a conventional cap-and-trade approach in which covered companies and other enterprises are assigned emission caps and those producing more carbon than their assigned share must buy unused allowances from those producing less pollution on an exchange market.

“The scheme is a bold movement by the government,” says Ranping Song, senior associate at the World Resources Institute’s Global Climate Program. “It is a move toward a market-driven approach to cut emissions and a shift from the government’s past reliance on command and control. It is also a cautious move as it will be tested over the next three years.”

In the first year, the government will closely examine the sector’s emissions data and compliance-assurance mechanisms, Song says. In the second year, trading will be simulated. In the third year, actual trading will begin.

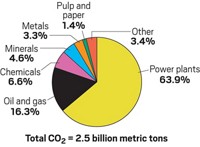

Power-generation companies will begin trading first, as that industrial sector is the best prepared and has the most complete data on emissions, the government says. It includes 1,700 power-generating firms, which emit 39%, or 3.3 billion metric tons, of the nation’s carbon emissions, officials say. That quantity will make the trading program bigger than any other market in the world, including the European Union.

The chemical industry will likely enter the trading program in a later phase, Song estimates.

Coal use in China is already declining, says the International Energy Agency, dropping each of the last three years. However, coal still is projected to supply 55% of China’s energy demand in 2022.

Unlike the U.S., says Zhang Yong, NDRC vice minister, the introduction of the nationwide carbon market demonstrates that China is delivering on its Paris Agreement greenhouse gas reduction promises.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter