Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Economy

Chemical industry stumbles out of the gate

Job cuts at Eastman and a lower forecast at Huntsman point to a challenging year ahead

by Alexander H. Tullo

March 18, 2019

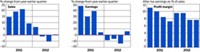

Early warnings from manufacturers and stock analysts are flashing on the chemical industry’s radar screen, indicating that 2019 may be off to a slow start.

Eastman Chemical says it will implement “a modest and targeted reduction” in its global workforce. It is also delaying salary increases, except for plant operators and mechanics.

The Tennessee-based company attributes the actions to a business environment that is more difficult than it had earlier hoped. “The ongoing U.S.-China trade dispute and the associated economic slowdown in China and Europe have created tremendous uncertainty, which has resulted in reduced demand for our products,” Eastman says.

Huntsman announced that it expects a 10% decline in its earnings before taxes in the first quarter of 2019 compared to the fourth quarter of 2018. It also expects to see a 5% to 7% decline in full-year 2019 profits versus 2018.

The company is seeing improved polyurethane demand in China, but this gain is being offset by slower demand in North American construction and automotive markets as well as soft demand across major European markets. Huntsman’s performance chemical business is experiencing sluggish demand for agricultural and oilfield chemicals.

The firm’s advanced material business is having trouble in construction and coatings markets. And its textile effects business is experiencing “lingering challenges” in China.

Financial analysts, meanwhile, are tempering their outlook for some major firms. Laurence Alexander, a stock analyst with the investment firm Jefferies, just lowered his 2019 earnings estimate for BASF. In a report to clients, he said the action reflects “further destocking in some downstream chains in Europe and North America.” He also noted “softness in particular in automotive value chains.”

And in a report on the approaching launch of the independent Dow, Morgan Stanley stock analyst Vincent Andrews pointed to the risk of economic slowdown. “While discussions in 2018 were largely focused on supply, we see demand playing an increasingly important role in 2019,” he wrote, “particularly in light of geopolitical concerns, recession fears, trade uncertainty, and the sharp correction in commodity prices we saw in 4Q18.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter