Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Petrochemicals

Indorama looks to shut big Dutch polyester plant

Company prepares workers as Europe imposes tariffs on cheap imports

by Alexander H. Tullo

April 10, 2024

Europe’s polyester production crisis is deepening. Indorama Ventures is taking steps to shutter a large polyethylene terephthalate (PET) plant in the Netherlands, and the European Commission is attempting to stem further production cuts by imposing long-term antidumping duties on imports from China.

Indorama is entering a consultation process with employee representatives at its site in Rotterdam “to evaluate the possible future for production activities”—language that is often a harbinger of a plant closure. The site has an annual capacity for 426,000 metric tons (t) of PET and 700,000 t of the raw material purified terephthalic acid (PTA).

Indorama bought the facility from Eastman Chemical in 2008 when Eastman was shedding “underperforming” assets outside the US. Indorama attempted to rehabilitate the site, doubling PTA capacity in 2017 to make it more competitive. “The Rotterdam facility is well positioned to support the continued growth as its location allows access to the whole of Europe,” Indorama CEO Aloke Lohia said in an announcement at the time.

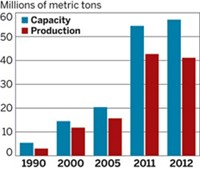

However, over the past 2 years, the economics of making PET in Europe have gone downhill. The energy crisis resulting from Russia’s invasion of Ukraine has pushed costs up. And the region faces an onslaught of new capacity from massive refining and petrochemical complexes in China.

“Structural shifts in the industry are contributing to a growing divergence in raw material expenses between China and Europe, with limited anticipated recovery,” an Indorama announcement now says.

The Netherlands isn’t the only place where the company is scaling back. In November, it idled a PTA plant in Portugal. And Indorama recently unveiled a plan to scale back its global capacity for PET and raw materials by 10%. Other firms, such as Ineos, have also curtailed PTA production in Europe.

The European Commission (EC) is trying to come to the industry’s assistance. The commission is extending provisional duties on Chinese PET producers—originally imposed last November—for a 5-year term. The tariffs range between 6.6% and 24.2%, depending on the producer.

The duties are the result of an investigation the EC began about a year ago. “It showed that the influx of dumped Chinese imports at artificially low prices was undercutting EU industry’s prices, forcing the EU industry to reduce its prices to such a low level that they were selling their products at a loss,” the EC says in a statement.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter