Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Agriculture

Bayer outsources biologicals research to Ginkgo

Ginkgo absorbs a partnership, and Bayer remains an anchor customer

by Matt Blois

April 28, 2022

| A version of this story appeared in

Volume 100, Issue 15

Restructuring an existing partnership, Bayer will fully outsource to Ginkgo Bioworks the R&D for its biologicals business, which is focused on using microbes to fix nitrogen in soils, fight pests, and sequester carbon.

The two companies formed a joint venture called Joyn Bio in 2017, primarily to develop nitrogen-fixing microbes for cereal crops. Now, Ginkgo will absorb Joyn, while Bayer will market the product concepts that emerged from the partnership.

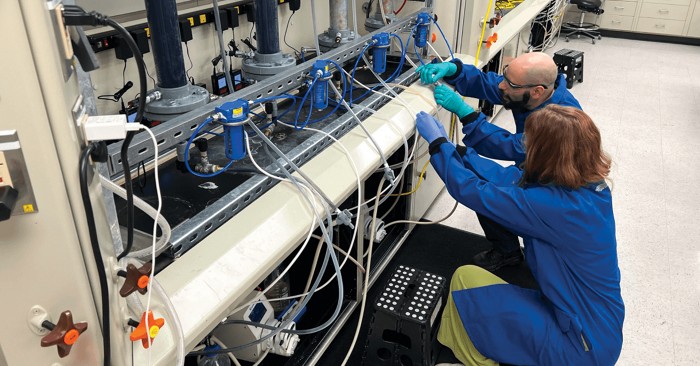

As a part of the deal, Ginkgo is getting Bayer’s biologicals research site in West Sacramento, California, complete with the existing team. Ginkgo’s biologicals research arm will now offer services to other agricultural companies, but Bayer will remain an anchor customer.

Joyn Bio CEO Mike Miille says Joyn is about a third of the way towards commercializing a microbial seed treatment that would fix nitrogen in soil for cereal crops like corn and wheat. He estimates it will take roughly 4 more years to bring a product to market in the US. The company’s goal is to create a microbe that allows farmers to reduce synthetic fertilizer use by 40% without losing any yield.

“We did a lot of work in the first couple of years demonstrating this work,” Miille says, “first in the greenhouse, and then more recently we’ve moved into early, early proof-of-concept field trials.”

Mark Trimmer, who runs the biological consulting firm DunhamTrimmer, says the transition from a joint venture to an outsourcing agreement will allow each partner to focus more on their specialty. Ginkgo can rely on Bayer’s sales team, which is already connected to retailers and farmers. And Trimmer says handing off R&D to Ginkgo is likely easier for Bayer than building up those capabilities internally.

“I think they’ve decided it just doesn’t fit as well into their own R&D organization,” he says.

Trimmer says the new arrangement could help both companies move faster. That’s critical because competitors making nitrogen-fixing microbes like Pivot Bio and Corteva already have commercial products.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter