Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Biotech Earnings Jump in Quarter

Companies average double-digit sales and earnings growth despite losses at many firms

by WILLIAM J. STORCK, C&EN NORTHEAST NEWS BUREAU

March 21, 2005

| A version of this story appeared in

Volume 83, Issue 12

Biopharmaceutical and drug discovery companies continued their upward momentum both in the fourth quarter of 2004 and for the full year.

In fact, the biotech companies outperformed their bigger siblings, the major pharmaceutical firms (see page 18), in sales and earnings growth in both the quarter and the year.

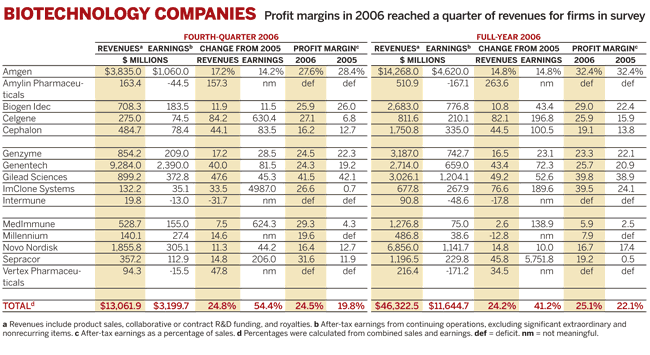

While drug company sales and earnings increased by 8.2% and 10.7%, respectively, in the October-to-December period, total revenues at the 25 biotech firms surveyed by C&EN rose 20.0% to $9.61 billion. Earnings at the biotech companies rose 18.7% to a cumulative $1.49 billion.

The same comparison was true for the full year, but even more so. The biotech sample's revenue growth for all of 2004 was 22.6%, to $34.5 billion, more than twice that of the major pharmaceutical firms' cumulative 9.0% sales increase. And biotech's 28.9% earnings increase to $6.31 billion was more than five times the increase seen at the drug companies.

Because of the biotech companies that had losses in the quarter, however, that sector's profitability lagged, with an aggregate profit margin for the quarter of 15.5% compared with 19.0% for the pharmaceutical firms. For the full year, the biopharmaceutical firms had an aggregate profit margin of 18.3%, again slightly less than the drug companies' 19.4%.

Profit margin for the biotech firms slipped slightly from 15.6% in the same quarter a year earlier but rose for the full year from 17.4% in 2003.

Of the 25 biopharmaceutical and drug discovery firms surveyed by C&EN, 12 had positive earnings for the quarter, while 13 showed losses. These are the same numbers as in the 2003 fourth quarter, but the companies are slightly different.

Chiron went from earnings of $56.5 million in the 2003 quarter to a $6.9 million loss in the 2004 period, the decline coming from its influenza vaccine problems. Meanwhile, ImClone Systems, which had a $26.3 million loss in the last quarter of 2003, jumped to $39.7 million in earnings in the final three-month period last year, largely on the strength of Erbitux, the company's cancer drug.

The 12 companies showing positive earnings in the fourth quarter did very well. Their combined revenues of $8.73 billion were up 24.9% in the quarter, although earnings increased slightly less, rising 22.6% to $1.83 billion. The aggregate profit margin for the group thus fell to 21.0% from 21.4%.

FOR THE FULL YEAR, however, earnings for the 12 rose faster than revenues, driving profitability upward. Revenues increased 26.1% to $31.1 billion, while earnings jumped 30.1% to $7.45 billion. The aggregate profit margin was 23.9% in 2004, up from 23.2% the year before.

Industry leader Amgen showed revenue growth for both the quarter and the year that was pretty much in line with the average for the 12 companies with positive results. Amgen's revenues in the fourth quarter increased 24.0% to $2.91 billion, and earnings improved 21.8% to $749.0 million. The firm's margin in fourth-quarter 2004 was 25.7%, down from 26.2% in fourth-quarter 2003.

For the full year, Amgen's revenues increased 26.3% to $10.6 billion, while earnings increased slightly less--24.0% to $3.15 billion. This lowered the company's full-year profit margin to 29.8% from 30.4%.

"All of our key products made significant gains or maintained market share," Amgen CEO Kevin Sharer says of the year's results. "We also progressed on the regulatory front with four new product approvals and on the legal front with the recent ruling by the U.S. District Court of Massachusetts affirming that our patents on erythropoietin are valid and enforceable."

Genentech, the number two U.S. biotech company, though less profitable than Amgen, had higher revenue and earnings growth in both the quarter and the year. Genentech's earnings in October through December rose 55.4% to $225.4 million on a 40.8% improvement in revenues to $1.32 billion. The company's profit margin was 17.1%, up from 15.5% in the year-earlier fourth quarter.

For all of 2004, Genentech's earnings rose 40.9% to $894.4 million on a 40.0% sales increase to $4.62 billion. The company's profit margin improved slightly to 19.4% from 19.2% in 2003.

Myrtle Potter, president of Genentech's commercial operations, says that "2004 has been a year of significant achievement for the product sales of both our new and more established products. We launched two breakthrough oncology products in 2004. Our latest approved product, Tarceva, reached sales of $13 million for the year since its launch in November. Avastin, in less than one year on the market, has achieved sales of $555 million. Rituxin continues to perform well, with sales of $1.7 billion in 2004."

The largest percentage increase for earnings among the group was at Celgene, which has seen great results from its Thalomid leprosy treatment. Fourth-quarter earnings at the company rose 220% to $17.3 million on a 30.4% revenue increase to $105.4 million. Thalomid drove the company's results all year. Celgene's 2004 earnings were up 351% to $60.9 million as revenues increased 39.0% to $377.5 million.

Celgene CEO John W. Jackson is optimistic about the future, saying, "In 2005, we expect to continue to build on our solid foundation to accelerate key investments, both commercially and in our regulatory and discovery pipelines, while at the same time delivering significant revenue and earnings growth."

Jackson is not the only executive looking forward to what 2005 brings. Genentech's chief financial officer, Louis J. Lavigne Jr., says the company is currently expecting growth in earnings per share, excluding one-time items, to be greater than 25% this year.

Amgen expects revenue growth to be in a range between the high single digits and the low teens this year. The company also sees 2005 adjusted earnings per share to be between $2.70 and $2.85. In 2004, the company earned $2.40 per share.

Serono says it expects product sales to grow between 10 and 15% in 2005, leading to revenues of at least $2.6 billion and net income between $520 million and $540 million, based on prevailing currency exchange rates. In 2004, the Swiss company had $495.8 million in earnings on revenues of $2.46 billion.

Even companies that show losses see better times this year. Icos expects a net loss in the range of $57 million to $77 million this year. In 2004 it lost $198.2 million. "The decrease in net loss, compared to 2004, is due primarily to our expectation that Lilly Icos [the company's Cialis erectile dysfunction drug joint venture with Eli Lilly] will become profitable in 2005," the company says. "We expect Cialis market share and sales to grow in 2005, and we expect certain Lilly Icos marketing and selling expenses to decline."

MORE ON THIS STORY

- BIOPHARMACEUTICAL COMPANIES (PDF)

Biotech revenues and earnings continue double-digit growth

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter