Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Global Top 50

Top three companies retain their positions, but 'other region' producers increase their presence

by Patricia L. Short, C&EN London

July 18, 2005

| A version of this story appeared in

Volume 83, Issue 29

Not much surprise to the top three in C&EN's survey of the global Top 50 chemical companies this year: For the second year running, it was Dow Chemical, BASF, and DuPont, the trio that for four years has dominated this magazine's rankings of the world's top companies. As before, these three make up a "super league," with chemical sales of more than $30 billion each, based on financial results reported in calendar-year 2004.

This year's survey, however, reflects two major trends marking the world's chemical industry: the impact on petrochemical sales from rising oil prices and the increasing globalization of the industry.

Rising prices and strong currencies relative to the U.S. dollar pushed the sales cut-off for C&EN's list to just over $5 billion. It was $3.7 billion in last year's survey, which in turn showed a 15% threshold increase over the previous year.

In this year's ranking, four spots were taken up by the chemical arms of petroleum giants Royal Dutch/Shell, ExxonMobil Total, and BP, which are vying to expand that superleague. Shell and ExxonMobil, in particular, showed sales rapidly approaching that $30 billion-a-year mark. Shell's 2004 sales, in fact, were only 2% lower than DuPont's.

Those four oil companies' chemical units knocked Bayer out of the top five for the first time since C&EN began conducting its analysis of the global Top 50 chemical companies in 1990, basing its analysis on reported results for 1989. Part of Bayer's drop in position reflects, of course, its spin-off last year of the bulk of its chemical operations as Lanxess. Lanxess, in its debut on the rankings, weighed in at number 27. But even had its sales been amalgamated with those of Bayer, Bayer nonetheless would have dropped to the number six slot.

Rounding out the top 10 are two companies that underscore the global nature of the chemical industry. The chemical operations of China Petroleum & Chemical (Sinopec), China's leading petroleum producer, jumped four positions to number nine, while Japan's Mitsubishi Chemical retained its presence in the top 10, although it was pushed back to the last spot.

As the chemical industry's selling prices increased in 2004, profitability zoomed upward, too. In fact, the aggregate profit margin--chemical operating profits as a percentage of chemical sales--in this year's survey snapped back after six years of decline to 8.1%, up from a record low of 5.5% a year ago.

That level was not quite as good, perhaps, as that drawn from the reported results for 2000, but it was still a decided improvement--particularly for companies with petrochemical and basic chemical operations.

The chemical industry continues to raise prices in the face of high raw material costs. But as BASF Chairman Jürgen Hambrecht pointed out at the midyear press conference of the German Chemical Industry Association in Frankfurt earlier this month, "It was possible to bring about price increases only in sectors closely connected with crude oil: petrochemistry and polymers." Other sectors of the industry still faced stubborn resistance to price increases, he said.

Nonetheless, as pointed out in C&EN's Facts & Figures report earlier this month (C&EN, July 11, page 42), price indexes rose in many countries in which the global Top 50 chemical companies are active. "Statistics indicate that price growth was a factor in improving company fortunes," the report concludes.

The reshaping of the worldwide chemical industry into what is indeed a global marketplace and production network also continued to develop during 2004.

The proportion of the Global Top 50's total sales made up by companies in countries outside the historical powerhouse regions of the U.S., Western Europe, and Japan, continued to rise--a development welcomed by BASF's Hambrecht: "As Asian countries develop, they will have more demand for specialties, and these will come from outside their regions. The companies in the 'new regions' will provide more competition, but competition is good," he said.

Countries represented in this segment include Canada, China, India, Saudi Arabia, South Africa, and Taiwan. Companies from those countries accounted for 11.9% of the surveyed companies' aggregate sales, up from 10.6% a year ago. Seven companies from this group showed up in this year's survey, a marked change from the first global Top 50 ranking that C&EN compiled in 1990, when "other regions" was represented solely by Saudi Basic Industries Corp. (SABIC), at number 34. Its sales accounted for 1.2% of the total for the 50 world leaders.

In addition to increasing their share of the global Top 50's sales, companies from other regions reported an overall increase in sales of 34%, paced by surges at six of the seven. Only Sasol showed a decline in sales.

Some 14 companies from the U.S. made the list, up one from the 2004 ranking. U.S. companies on the list had aggregate sales of $181.4 billion, up 25.8% over the previous year. But their share of the overall sales was 30.8%, just a hair more than the proportion a year ago. The U.S. share was 32.5% in the 2003 survey and 33.4% in 2002. Ironically, the appearance in the U.S. ranks of the "new" company Celanese shows a reversal of history, as Celanese has reemerged as an independent company, but based in Texas rather than in Germany.

That reassignment, in turn, held the number of European companies in the ranking at 21 for the third year in a row. The aggregate sales of those companies were $260.5 billion, up 17.4% from a year ago, and they accounted for 44.2% of the total, down slightly from 44.6% in the 2004 survey. That slip continues a four-year trend: European companies made up 46.1% of the 2003 survey and 48.3% of the 2002 survey.

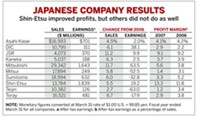

This year's ranking includes eight Japanese companies, down one from the previous year. Their sales accounted for 13.2% of the total, down slightly from 14.2% last year, but up from 13.0% in the 2003 survey and 12.6% in 2002. Aggregate sales of the Japanese companies were $78.0 billion in this year's survey, up 8.1% over a year ago.

There are two newcomers to this year's ranking: Lanxess, the chemical operations carved out of Bayer into an independent company in mid-2004 and officially spun off at the beginning of this year, and Yara, demerged from Norsk Hydro in March 2004. Norsk Hydro dropped off the 2005 list.

THE INCREASE in sales and prices has brought about a substantial improvement in the profit health of the global Top 50. Compared with the ranking last year, when six companies reported operating losses, this year shows a deficit only at BP, which is restructuring its chemical operations into the new company Innovene, and at Rhodia. Rhodia's loss reflects the continuing legacy of an ambitious expansion program in the late 1990s that turned sour; its managers predict, though, that the company will return to profit in 2006.

Next year's ranking, for companies' performance in 2005, however, may reflect some of the latest reshaping in the global chemical industry. For example, the ranking will feature the loss of the Equistar joint venture, following Lyondell Chemical's acquisition of Millennium Chemicals and thus the stake in Equistar that Lyondell did not already own. And the new fertilizers company Mosaic, formed by the merger of IMC Global with Cargill's fertilizers business, will undoubtedly make its debut in the rankings.

MORE ON THIS STORY

DOWNLOAD GLOBAL TOP 50

The entire document has been saved as an Adobe Acrobat PDF file to retain the original formatting of the hard copy version. This file includes the following:

2 - TOP 50 OPERATIONS

Rise In Profits Fails To Lift Investments

3- SPENDING

R&D and capital spending showed mixed picture

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter