Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Fertilizer Makers Almost Celebrating

But companies and consultants are concerned that products may be nearing the top of the cycle

by William J. Storck

November 7, 2005

| A version of this story appeared in

Volume 83, Issue 45

North American fertilizer producers seem to be happy these days. Fertilizer prices are rising, profits are improving, and expanding economies in China and India are creating robust demand for many products.

This picture is a far cry from the one seen in past years. Troubles for the North American fertilizer industry actually started in the late 1960s when oil companies began entering the market. Having lots of money, they simply built plants whether they were needed or not. The result was overcapacity that lasted for decades-compounded in recent years by high prices for natural gas feedstock.

It has taken the consolidation of the industry and the resulting shutdown of marginal production facilities to rectify the problems. The result has been an ability to raise prices and make them stick. Earnings at fertilizer companies have been increasing-perhaps more than they have in years.

For instance, last month Potash Corp. of Saskatchewan reported third-quarter earnings of $130 million, a 73.3% increase over the same period in 2004. Sales for the third quarter were up 15.0% to $938 million.

Terra Industries said third-quarter earnings more than doubled, rising 129.2% from the same quarter the year before to $14.9 million. Sales at the company were up 28.9% to $486 million.

Of the near term, PotashCorp says: The factors that have been driving tight potash fundamentals and higher prices remain, and the global agricultural economy is strong. Many countries in Asia and Latin America continue to experience significant economic growth, leading to a demand for better diets and more fertilizer. In 2006, according to the International Monetary Fund, China's gross domestic product growth is expected to be 8.2%, while India's growth is projected at 6.3%.

At Mosaic Co., the company formed in 2004 by the combining of Farmland Industries and Cargill's agricultural chemical operations, Chief Executive Officer Frederic W. (Fritz) Corrigan says: Mosaic remains optimistic about the prospects for fiscal 2006. The phosphorus market is strong right now, and with our annual summer maintenance downtime behind us, we expect improved potash volumes for the remainder of the year. For fiscal 2006, our focus remains on cash generation and reducing costs, including the capture of synergies. Clearly, we are going to focus on costs in all aspects of our business.

In the first quarter of Mosaic's fiscal year, which will end May 31, 2006, the company earned $76.1 million, up 54.7% from pro forma earnings in the comparable quarter of the previous year. Sales on a pro forma basis declined 3.7% to $1.40 billion.

However, not all are so sanguine. Terra CEO Michael L. Bennett says, Since it is difficult to predict at this time how farmers may change their 2006 crop plans in light of the high cost of fertilizer and other inputs, we will continue to adjust our production plans to limit carrying inventories that are not covered by sales orders.

One securities analyst who is less than certain about the future for fertilizers is Donald D. Carson, research analyst at Merrill Lynch. The near-term outlook is clouded by low grain prices and high input costs for growers, Carson says. We expect reduced demand for fertilizer this fall as growers appear to be delaying purchases in the hope that near-term fertilizer prices will decline with energy prices by the spring planting season.

It is easy, looking at data from the U.S. Department of Agriculture, to see what Carson is describing. According to USDA, the average annual index of prices received by U.S. growers for all crops rose 11.4% between 2002 and 2004 to 117 (1990–92 = 100). Between August 2004 and August 2005, though, the index for prices received by farmers fell 2.5% to 116.

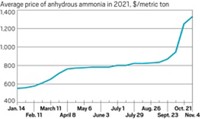

Meanwhile, the prices paid by U.S. farmers for all items going into production rose 10.9% between 2002 and 2004, and between August 2004 and August 2005, the index climbed 4.4% to 132. The August-to-August increase was sparked by two crucial inputs to the farm economy-fuels and fertilizer-according to USDA data. The fertilizer index rose 13.4% to 161, while the index for fuels soared 38.8% to 236.

The result of the higher costs, according to USDA projections, will be fewer acres planted for some crops during the 2006 fertilizer year, which will end on June 30. Of the three largest crops-wheat, soybeans, and corn-only corn will show an increase in acreage, rising slightly to 81.6 million acres from 80.9 million acres in the 2005 fertilizer year.

Wheat planting will decline to 58.1 million acres from 59.7 million acres, and soybeans will be down to 73.1 million acres from 75.2 million acres. Total acreage for the eight major crops-which also include rice, sorghum, barley, oats, and cotton-will fall to 245.7 million acres from 248.9 million acres.

Some consultants, however, see it differently. According to Ken Nyiri, principal consultant at British Sulphur, while total acreage may be little changed next year, corn, which requires large amounts of nitrogen fertilizer, may be down as much as 8 million acres in 2006, or about 10% of 2005 planted acreage.

Some of the corn acreage may just be allowed to lie fallow, Nyiri says, while other acreage may be switched to soybeans, which fix nitrogen in the soil rather than taking the nutrient from the soil. In addition, soybeans and other crops that are not nitrogen intensive can take advantage of residual phosphates and potassium in previously planted soils, allowing the farmer to cut down on fertilizer applications for a year or two.

For the longer term, Nyiri says, the U.S. is reaching the peak of the nitrogen business cycle, while some of the phosphate price increases are not being accepted this year.

So we think global capacity is going to build up and the cycle is going to go in the other direction, he says. I don't think potash is going to be increasing as much as it has and could actually soften just a wee bit by spring. Phosphates look like they have peaked out as well. So the good news is that fertilizer prices are going to stop climbing like they have and could start coming down. Nyiri also believes that energy costs are going to decline.

For the U.S. producer, Nyiri says, that means more offshore competition. As a world player, he's going to have to deal with competition from other players, but I tell my clients that even though there may be fewer U.S. producers, there may be more imports, and they are going to see pretty much the same suppliers.

But one of the real concerns for farmers, according to Nyiri, is that foreign-made fertilizer takes longer to get from the production source to the end user. Right now, he says, if you are going to buy urea from Bahrain, for instance, it could take a month and a half to two months before that product arrives in New Orleans, so it has just extended your supply chain by anywhere from six weeks to two months.

The good news is that when that ship arrives in New Orleans carrying 20,000 to 50,000 tons, he continues, it's one big chunk of production that has arrived all in one day. This creates opportunities for buying, because the owner doesn't want the product sitting around.

Nyiri says the bottom line is that the industry has been going through a tough transition over the past several years-especially North American fertilizer producers, who have had to struggle with oversupply and high natural gas prices. They have been reinventing their businesses and trying to take advantage of their strengths and trying to offset their weaknesses.

They will be going through a difficult time, he says. The question is, Will they pull through it?' The answer is, We had better hope they do, because we certainly need those folks.'

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter