Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Linde Bids For BOC

BOC rejects the offer, but stock analysts are intrigued

by Alexander H. Tullo

January 30, 2006

| A version of this story appeared in

Volume 84, Issue 5

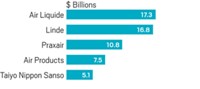

British industrial gas group BOC has rebuffed an unsolicited $13.4 billion takeover offer by German rival Linde. But the deal, which would create the world's largest producer of industrial gases, is not necessarily dead.

Linde's $27.80-per-share offer represents about a 30% premium over BOC's recent share price, a handsome valuation, analysts say. But BOC, citing "preconditions" to the offer-including financing, antitrust approvals, and due diligence-has rejected it. "The board of BOC has met together with its advisers and unanimously rejected the proposal because of its preconditions and its failure to value fully the growth prospects of BOC," the company said.

Linde counters by calling the offer a "friendly approach" that would unlock synergies between the two companies and wouldn't draw the ire of antitrust regulators. The company also says financing arrangements for the cash bid are "well advanced."

A stock analyst who covers BOC is puzzled at the firm's response to the bid, in which it didn't even offer to talk to Linde. "There is something in the preconditions that suggests the offer isn't straightforward," says the analyst, who asked not to be named. Although the deal might still be salvaged, he says, to afford it, Linde would have to divest operations such as its forklift truck business, BOC's logistics business, and BOC's electronic materials business.

Linde is led by Chief Executive Officer Wolfgang Reitzle; Tony Isaac is CEO of BOC.

BOC was once the target of a takeover bid that it initially shunned. In 1999, Air Products & Chemicals and Air Liquide attempted to buy the company and divide its assets between them, but the U.S. Federal Trade Commission nixed the deal.

In light of this failed attempt, BOC and Linde have often been mentioned in the same breath. The "BOC/Linde tie-up is the only major piece of industrial gas consolidation that could occur, given that all other combinations face too many competition overlaps," Robin Coombs, an analyst with Merrill Lynch, says in a report.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter