Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Biotech Milestones

Product successes in 2006 translate into growing sales and profits for biopharmaceutical firms

by Michael McCoy

February 26, 2007

| A version of this story appeared in

Volume 85, Issue 9

Thanks to a variety of new peaks in product sales, total revenues, and earnings, 2006 was a year of billion-dollar milestones for several companies in the global biopharmaceutical industry. The recent acquisitions of two successful biotech firms show that traditional pharmaceutical companies want to make some of these milestones their own.

C&EN typically tracks the financial performance of 20 biopharmaceutical companies. However, two longtime members of C&EN's survey left the list in the fourth quarter after being acquired. In January, Icos went for $2.3 billion to Eli Lilly & Co., its partner in marketing the erectile dysfunction drug Cialis. And last month, Germany's Merck purchased the Swiss biotech giant Serono for about $14 billion.

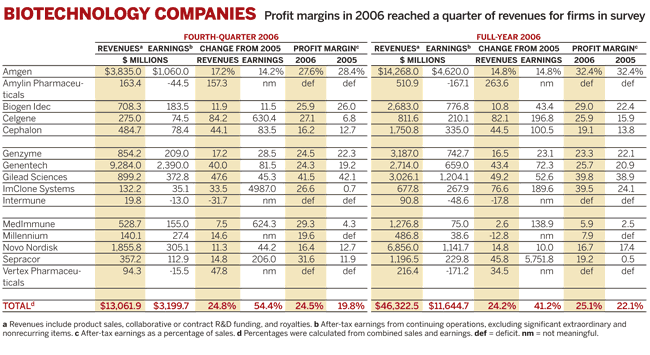

Three other companies—PDL Biopharma, QLT, and Shire—didn't report fourth-quarter earnings by C&EN's deadline for the survey. For the 15 companies remaining, 2006 was a good year. Earnings for the group rose 41.2% on a 24.2% increase in revenues. Combined profit margin was 25.1%, up from 22.1% in 2005.

For the October-to-December quarter, revenues increased 24.8% and earnings were up 54.4%. The companies' average profit margin in the quarter rose to 24.5% from 19.8% in the final quarter of 2005.

Industry veteran Genentech marked its first quarter in which U.S. product sales surpassed $2 billion. For the full year, the South San Francisco-based firm reported earnings of $2.4 billion, a 72.3% increase over 2005's, on a 40.0% increase in revenues to $9.3 billion.

Arthur D. Levinson, Genentech's chief executive officer, notes that the company received eight Food & Drug Administration approvals in 2006. The company is most bullish on Lucentis, a treatment for age-related macular degeneration that was approved at the end of June 2006. Lucentis pulled in $380 million in sales for the year.

Amgen, the largest biopharmaceutical company, reported 2006 revenues of $14.3 billion, a 14.8% increase over 2005's. With those revenues, Amgen eclipses the traditional drug company Schering-Plough in size and approaches Eli Lilly & Co. Amgen's full-year earnings increased to $4.6 billion, also a 14.8% increase over 2005's.

Amgen's top-selling product, the anemia drug Aransep, continued to do well, posting worldwide sales of $4.1 billion, a 26% increase over 2005's. Sales growth of several other Amgen products, however, came down to earth in 2006.

The Amgen arthritis drug Enbrel is meeting competition from newer products such as Bristol-Myers Squibb's (BMS) Orencia and Abbott Laboratories' Humira. Enbrel's 2006 sales increased a more modest 12% to $2.9 billion. And sales of Neupogen and Neulasta, Amgen's white blood cell boosters, reached $3.9 billion for the year, also a 12% increase.

Despite maturation for some of its products, Amgen expects continued growth in 2007. The company anticipates overall revenues to be in the range of $15.4 billion to $16.0 billion. "I expect that we will continue on a solid growth path in 2007 while key products in our pipeline continue to progress," says CEO Kevin Sharer.

Biogen Idec had a good 2006 that was made even better by FDA's agreement to let Tysabri, its new treatment for multiple sclerosis, back on the market. Tysabri was approved in November 2004 but withdrawn by the company in February 2005 after three patients in a clinical trial developed a rare brain infection.

The company resumed trials last February after demonstrating that no other trial patients came down with the disease. In June, FDA cleared the drug to return to the market under a restricted distribution program. Biogen and its marketing partner, Elan, sold $30 million of Tysabri in the fourth quarter.

Biogen's two key products, Rituxan for arthritis and non-Hodgkin's lymphoma and Avonex for multiple sclerosis, both had good years that allowed the company to report a strong 43.4% increase in 2006 earnings to $777 million. The company's revenues rose a more modest 10.8% to $2.7 billion.

At Gilead Sciences, the fastest growing of the big biopharmaceutical firms, the billion-dollar milestone was exceeding $3 billion in revenues for 2006. Just one year ago, the company celebrated hitting $2 billion in revenues.

Gilead's earnings rose strongly as well in 2006, hitting $1.2 billion, up 52.6% from the previous year. The company's growth continues to be driven by its HIV product franchise. Its latest addition is Atripla, a combination of three antiviral molecules that was launched in July 2006. Atripla sales in the fourth quarter were $137 million, more than double the third-quarter sales.

Gilead doesn't expect to slow down in 2007, either. In a conference call with analysts, it forecast product sales this year of as high as $3.5 billion, a 35% increase over 2006's. Gilead's overall revenues also include sizable royalties from Roche's sales of the antiviral Tamiflu, which Gilead discovered.

Amylin Pharmaceuticals, which not long ago struggled without any products, hit a half-billion-dollar milestone in 2006 following the launch of two diabetes treatments, Byetta and Symlin. "In our first full commercial year, we exceeded $500 million in total revenues," says CEO Ginger L. Graham.

The company posted 2006 revenues of $511 million, more than three times those in the previous year, and a net loss for the year of only $167 million, an improvement over the $207 million it lost in 2005.

ImClone Systems achieved its first billion-dollar sales quarter, due to $1.1 billion in sales of its cancer treatment Erbitux by its partners BMS in the U.S. and Germany's Merck elsewhere in the world. These sales translated into 2006 revenues for ImClone of $678 million, almost double the previous year's. Earnings were $268 million, almost triple the $92.5 million the company earned in 2005, thanks to a $250 million milestone payment from BMS triggered by approval of Erbitux for cancer of the head and neck.

ImClone's strong financial results belie a turbulent year in which it got a new CEO and considered, then abandoned, various strategic options, including the sale of itself.

Sepracor reported its "first full year of operating profits and the first year that revenues exceeded $1 billion," according to CEO Timothy J. Barberich. The Marlborough, Mass.-based company enjoyed $567 million in sales of its Lunesta sleep aid and $555 million in sales of Xopenex, its treatment for bronchospasm in patients with asthma and other breathing disorders.

Also posting its first year of profitability was Millennium Pharmaceuticals. The Cambridge, Mass.-based company reported earnings for the year of $38.6 million versus a loss of $87.2 million in 2005. Revenues were $487 million, down from $558 million, due largely to the absence of copromotion revenue in 2006.

Millennium's key product is Velcade, a treatment for relapsed multiple myeloma. Despite new competition, the product achieved a 15% increase in U.S. sales last year to $221 million. Millennium is forecasting 2007 Velcade sales in the range of $240 million to $260 million, plus healthy royalties from Ortho Biotech Products, which markets Velcade outside the U.S.

"In 2006, we continued to strengthen the business by driving Velcade, advancing our clinical pipeline, and bringing forward two new molecules from discovery to development, all while streamlining our infrastructure," says Deborah Dunsire, Millennium's CEO.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter