Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Coal: The New Black

Long eclipsed by oil and natural gas as a raw material for high-volume chemicals, coal is making a comeback

by Alexander H. Tullo, and Jean-François Tremblay

March 17, 2008

| A version of this story appeared in

Volume 86, Issue 11

ONLY A FEW YEARS AGO, an executive offering up the idea of making chemicals from coal would have been laughed out of the boardroom. But coal champions no longer have to dread jokes about steam locomotives and telegraphs. With oil priced at more than $100 per barrel, chemical companies are giving coal a serious look as a feedstock.

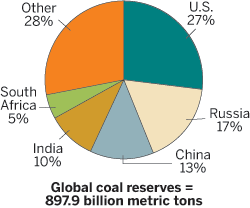

Coal's potential as a chemical raw material is greatest in China, the U.S., and India. Not only do these countries have about half of the world's coal reserves combined, they also are suffering from dwindling domestic supplies of oil and natural gas and are seeking to reduce dependence on foreign resources. As a result, they are exploring the gasification of coal to make methanol, which can be transformed into ethylene and propylene, the major building blocks of today's chemical industry.

"If the price of oil stays above $50 or $60, I think that within 10 years, using coal as a chemical feedstock will be a very big industry in China," says Zhang Yuzhuo, a Shenhua Group vice president and chairman of China Shenhua Coal Liquefaction. "The potential depends totally on the oil price," he adds. Shenhua, China's largest coal producer, is building plants in the Chinese provinces of Inner Mongolia and Ningxia that will convert coal into polyolefins on a production scale comparable to the world's largest petrochemical plants.

Dave Witte, executive vice president of strategy consulting for the Houston-based consulting firm Chemical Market Associates Inc. (CMAI), agrees that the current climate favors coal. "It is a relatively cheap feedstock," he says. "It certainly has the ability to compete in today's world."

On an energy-equivalent basis, coal is a quarter of the price of crude oil. Witte notes, however, that depending on the location the capital costs of making chemicals out of coal are much higher than those of traditional processes based on oil and natural gas. Thus, coal-based chemical plants require a big, sustained advantage in feedstock costs. When oil is selling at $50 per bbl, coal is a profitable option; below about $35 per bbl, the expensive coal complexes start losing money.

Robert Rigdon is the product line leader for coal-to-chemicals projects at GE Energy, which claims more gasification licensees for chemicals than any other firm. Rigdon says China has been by far his most active customer in recent years. There, the company has signed 14 coal-to-chemical licenses, including projects to make methanol, the raw material used to make the diesel substitute dimethyl ether. Half of these projects turn out ammonia, and most of the rest yield methanol. The largest uses for the methanol, he says, are manufacturing chemicals and dimethyl ether.

One reason for China's enthusiasm about coal is that the country is even less confident in its ability to secure oil from abroad than are the U.S. and other major countries. In fact, according to the U.S. Energy Information Administration, coal already accounts for nearly 70% of China's energy consumption. "China wants to be self-sufficient in feedstock, and coal is their way to do it," says Marc Berggren, managing director of Singapore-based Methanol Market Services Asia.

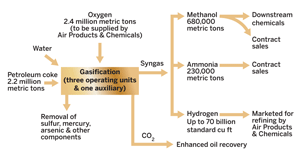

Eastman Chemical and Green Rock Energy will partner in a project in Texas to make hydrogen, ammonia, and methanol from petroleum coke.

SOURCE: Eastman

Although China may be ahead of others in terms of the number of projects it has begun to implement, it is not alone in looking at coal as a feedstock. "There's interest worldwide," says David Jiang, chief representative in China for the consulting firm Nexant Chem Systems.

In the U.S. high natural gas prices have prompted chemical producers to consider incorporating coal into their feedstock diet. Traditionally, the U.S. chemical industry consumes natural gas, cracking ethane into ethylene and transforming methane into methanol and ammonia. That's because in the decades before 2000, natural gas prices were about $2.00 per million Btu, making the U.S. an attractive place to invest in petrochemicals.

But the days of $2.00 natural gas appear to be gone. Since the turn of the century, natural gas prices have more than tripled, largely because of a surge in demand from the electric power sector. This has eroded the competitiveness of the U.S. chemical industry. But while natural gas prices have risen, coal still sells for about the same price as natural gas did back in its heyday.

Eastman Chemical is behind the most ambitious chemical gasification projects in the U.S. It will be a partner in and operator with Green Rock Energy of two $1.6 billion projects to make hydrogen, ammonia, methanol, and downstream chemicals from the coal-like refinery by-product petroleum coke, otherwise known as "petcoke." Other companies are looking to deepen their involvement in coal and petcoke as well.

Coal's lineage in the chemical industry is actually far longer than that of oil or natural gas. Coal tar has been a key source of organic chemicals since the 19th century. Originally the by-product of the coal gasification process used to fuel streetlights, coal tar is still distilled to yield cresols, dye intermediates, and naphthalene.

Additionally, geographical curiosities, including regions with lax environmental standards or oil scarcity, have spawned pockets where coal-based routes to commodity chemicals more commonly derived from petroleum or natural gas have thrived for years.

For example, the acetylene route to making vinyl chloride, the raw material for polyvinyl chloride, is widely practiced in China, although Shenhua, the country's largest producer of chemicals from coal, shuns the route because of environmental concerns. In this process, coal and limestone are used to make calcium carbide, which in turn is reacted with water to make acetylene. Acetylene is then converted into vinyl chloride with hydrogen chloride acid.

Over the years, a handful of companies in China and the U.S. have made fertilizers via the gasification of coal. Additionally, for decades South Africa's Sasol has been making chemicals such as α-olefins as a coproduct of its Fischer-Tropsch process for producing synthetic fuels out of coal.

Similarly, Eastman has been making chemicals from coal for nearly 25 years in Kingsport, Tenn. There the company gasifies coal to make methanol, which it converts into acetic acid, acetic anhydride, and acetate fiber. It is because of this experience with coal that the company is encouraged to invest further. The firm's coal-based production stream represents only about 20% of its product volumes but has provided about half of its profits in recent years, according to Mark Costa, Eastman's senior vice president of corporate strategy and marketing. "The gasification facility has been a big driver for our success," he says.

But the future vision for coal is to make olefins, which can be transformed into such chemical industry mainstays as ethylene oxide, polyethylene, and polypropylene. Newly developed technologies that can convert methanol to olefins are making this goal a reality.

THE PROCESS BEGINS with gasification. Coal is treated with oxygen and steam to partially oxidize it into synthesis gas, or "syngas," a mixture of hydrogen, carbon monoxide, carbon dioxide, and trace impurities like hydrogen sulfide.

At this stage the syngas doesn't necessarily have the right proportion of constituents to be used for chemicals. In another reactor, water and carbon monoxide are run over a metal-based catalyst to yield equal parts hydrogen and carbon dioxide in what is called the water-gas shift reaction. To make methanol the water-gas shift runs until there are 2 moles of hydrogen for every mole of carbon monoxide. When hydrogen or ammonia is the desired product, the reaction is carried out all the way to carbon dioxide and hydrogen.

Methanol is raw material for the next stage of the coal-to-chemicals route: the conversion into olefins via the intermediate dimethyl ether. Such processes were originally designed for methanol derived from natural gas. But at today's coal and gas prices, they are ushering coal beyond its role in more archaic routes to chemicals like PVC and fertilizers. The major vendors of this technology are UOP and Lurgi, the respective chemical engineering arms of Honeywell and Air Liquide.

The U.S. and China are among the nations with the largest recoverable coal reserves.

ALTHOUGH SIMILAR, the catalysts used in the UOP and Lurgi processes lead to different product slates. UOP's technology, called methanol-to-olefins, uses SAPO-34, a silicon-aluminum-phosphorus-based molecular sieve. Lurgi's technology, dubbed methanol-to-propylene, is based on a ZSM-5 type catalyst. The pores in the UOP catalyst are smaller than those in ZSM-5, says Tim Foley, UOP's product line manager for light olefins. "After methanol enters the pores and reacts, the smaller molecules can exit the pores but the larger by-products will never leave," he says.

As a result, the UOP process makes ethylene and propylene plus some heavier olefins. For this reason, UOP is pairing its technology with a cracking technology, developed with Total Petrochemicals, to convert butylene and hexene into ethylene and propylene.

The Lurgi process yields propylene but no ethylene. Coproducts include gasoline and propane. Claus Greil, senior product manager for gas production at Lurgi, calls the high propylene production an advantage because the value of the propylene molecule in today's market is increasing relative to ethylene's.

Neither Lurgi nor UOP has commercial-scale plants in operation, but that will soon change. Lurgi has licensed its technology to Datang International Power Generation and Shenhua's Shenhua Ningxia Coal, both of which are building plants in China with about 500,000 metric tons per year of capacity. The company is also licensing a natural-gas-based unit that will feed a new Basell polypropylene plant.

UOP has a pilot plant in operation. In addition, it is constructing a $75 million semi-commercial-scale plant integrated with the olefin-cracking technology at Total's Feluy, Belgium, site. In January, UOP signed a commercial license for the technology with Nigeria's Viva Methanol. That complex, based on natural gas, is expected to produce 1.3 million metric tons of ethylene and propylene per year when it is completed in 2012.

James H. D'Auria, director of UOP's petrochemical business, says the company is also working on methanol-to-olefins projects based on coal-derived methanol. No such licenses have been signed, but he is cultivating interest in China. "I have a lot of stamps on my passport," D'Auria says.

Companies considering coal-to-chemicals facilities must weigh whether the plants will be located near the sources of coal, which are often inland and far from population centers, or closer to where the final products will be consumed or distributed.

At Shenhua Group, Vice President Zhang says this question leads to many discussions, particularly when foreign partners are involved. In the case of a proposed joint-venture project with Dow Chemical, the two partners have been considering either to locate the entire project in the Chinese hinterland, where the coal mines are, or to split the project, with the methanol being made inland and the downstream operations built near the coast.

Zhang says the question has yet to be answered, but he thinks that locating the entire complex next to the coal mines makes more sense. He believes it's just too difficult to build an efficient chemicals complex if it's broken up into two parts separated by hundreds of miles. Besides, shipping large quantities of methanol over long distances would be costly, he adds.

Jiang, the Chem Systems consultant, warns that making chemicals from coal can be a risky economic proposition, even in China. "You have to be very selective in terms of the derivatives you make from coal and also about the logistics of your location," he says. Gas-fed petrochemical plants recently built in the Middle East remain very competitive against coal-based plants, he warns.

And companies have more than economic and technical challenges. Environmental considerations, especially among countries that either have signed the Kyoto protocol or may regulate carbon dioxide as a greenhouse gas, are a key obstacle for coal. Moreover, coal contains sulfur, mercury, arsenic, and other contaminants. And the ruined landscapes, compromised miner health, and accidents associated with coal extraction weigh heavily on the public's perception of coal-based industry.

IN THE U.S., Witte says, environmental considerations have thus far been a big obstacle to coal-based chemicals. "One of the big disadvantages of coal is that you make CO2," he says. "And unless you are located in an area where you can dispose of that at some reasonable cost, it's a potential economic hit on the project. Even if it isn't a hit today, it could be at some point in the future if carbon taxes are enacted." He says technologies to capture impurities add costs, but they aren't as big a hurdle as carbon dioxide.

Advertisement

According to GE's Rigdon, in making chemicals, some of the carbon is captured in the final products themselves. "In methanol, for example, you end up with a pretty large percent of the carbon going into the methanol," he says. "As you get closer and closer to hydrogen or products with high hydrogen-to-carbon ratio, more and more of your carbon has been converted into CO2." In addition, he notes that some of the CO2 from a chemical-oriented gasification complex can be used to make the carbon-containing fertilizer urea.

Instead of venting all excess CO2 into the air, chemical companies are eyeing enhanced oil recovery, whereby CO2 is injected into the ground to pressurize oil wells and make them more productive. Eastman is considering this technology for its Gulf Coast projects. Dakota Gasification, which makes methane and chemicals from coal in Beulah, N.D., sends its by-product CO2 north of the border to oil fields in Saskatchewan. Observers note, however, that the market for such CO2 is limited.

Tom Hansen, senior vice president of the global chemicals market for Air Liquide, which provides air separation units, says chemical-oriented gasification complexes lend themselves to such CO2 management schemes. Because the plants use pure oxygen in the gasification process, a side benefit is a purer by-product CO2 stream, which is more valuable to markets such as oil recovery.

IMPURITIES ARE MORE of an issue for coal-based chemical manufacturing than they are for power generation, Hansen says, because impurities can contaminate catalysts. "If you are just going to burn the gas in a gas turbine, it is no big deal," he says. "But if you are going to make methanol or ammonia, you really need to have your impurities down below the parts-per-billion range." Lurgi, the engineering firm that Air Liquide purchased last year, has one of the leading technologies for purifying syngas. Called Rectisol, it is a fluid-based process that relies on chilled methanol to absorb impurities.

It isn't only in the U.S. where the environmental implications of coal gasification are a concern. Shenhua's Zhang says the challenge of operating coal-fed facilities in a clean and resource-efficient manner is a top priority for his company. "As long as seven years ago, when I first joined Shenhua and we were planning the first direct liquefaction plant, we challenged ourselves to make a zero-discharge facility," he recalls. "We are very close to zero emissions now."

Shenhua is building its first methanol-to-olefins plant in the inland province of Ningxia, and construction of that project is about one-third completed, Zhang says. Shenhua is building another methanol-to-olefins complex at its coal mines near Baotou in Inner Mongolia that is scheduled to start coming on line at the end of the year. A more advanced, almost completed project is a coal-to-liquid fuels facility that Shenhua is building at its coal mines near the city of Ordos in Inner Mongolia. The plant makes use of a process developed by Shenhua that allows the direct liquefaction of coal into fuels without having to first gasify the coal.

The recipient of a Ph.D. from the Beijing University of Science & Technology, Zhang spent four years in England and the U.S. conducting postdoctoral research on clean-coal technologies. From 1993 to 1996, he worked at Southern Illinois University, Carbondale's College of Engineering on projects supported by the U.S. Department of Energy. After returning to China, he joined the China Coal Research Institute in Beijing, eventually becoming its president. The various projects Shenhua is building or planning to build are giving Zhang a chance to put into practice the theoretical knowledge he has acquired about clean coal over the years.

Ordos is next to the Yellow River. In recent years, both the increasing pollution and decreasing flow of the river have been the source of much controversy in China. But Zhang says his firm's coal-to-liquid-fuels facility will be "water-serene." It will not draw its water from the Yellow River but instead from a reservoir next to Shenhua's coal mines. "The water from the reservoir would evaporate if we did not use it," he says. The quantity of water consumed by the facility will be about the same as would be consumed by a petrochemical plant of the same size, he says.

AS FOR WASTEWATER, there won't be any. Shenhua has spent $16 million on a GE Betz technology that will allow the company to recycle its used water.

Zhang claims airborne emissions will not be much of an issue either. Advanced scrubbing technology means the facility will emit only a small fraction of the sulfur that a coal-fired power plant would. The other major gas emission, the carbon dioxide, will be taken care of by concentrating it to 97% purity and selling it for use in enhanced recovery projects to the oil companies operating wells in western China. Shenhua has collaborated with DOE to develop the carbon dioxide concentration process, he says. "We want to show the world that this is an ultraclean plant," he adds.

In the area of making chemicals from coal, Shenhua is China's most active firm. The projects in Ningxia and Inner Mongolia will feature polypropylene and polyethylene plants that will be among the largest in the world.

The company is also looking at a third project that would be a joint venture with Dow in the province of Shaanxi. Products slated for the complex include ethylene, propylene, caustic soda, vinyl chloride, glycols, amines, solvents, surfactants, and acrylic acid.

The partners have been studying the project for the past three-and-a-half years. Dow says details such as technology, capacity, and how the partners will deal with emissions depend on the results of the feasibility study. According to Zhang, that study will be completed by the end of this year. "The project is very much a priority for us and we are moving forward," a Dow spokesman indicated in a written statement.

According to Jiang, the Chem Systems consultant, about 300 coal-to-methanol plants in China are either being built or have been built by Chinese and foreign companies. In Nanjing, for example, the chemical engineering firm Wison Chemical has built a plant that uses coal as a feedstock for carbon monoxide that is supplied to an adjacent acetic acid plant owned by Celanese.

IN INDIA coal has attracted attention too. The Gas Authority of India has signed a memorandum of understanding with Coal India Ltd. about a coal gasification project that would consume 5,000 metric tons of coal daily to produce 3,500 metric tons of urea fertilizer.

In the U.S. Eastman is transforming gasification from a cash cow into a growth area. It is planning the two $1.6 billion projects with Green Rock Energy, a company formed by Goldman Sachs and venture capital firm D. E. Shaw to invest in gasification.

One will be based in Beaumont, Texas. Eastman will have a 50% stake in the project and operate it after completion in 2011. The plant will have the capacity to process 2.2 million metric tons of petroleum coke per year, about five to six times greater than the volume of coal used at its Kingsport complex. Air Products & Chemicals will build an air separation plant for the gasifier.

The syngas will be put to various uses. Some 70 billion cu ft of hydrogen per year may be marketed by Air Products, mostly for use by refineries on the Gulf Coast. In a sign of coal's potential to make the U.S. competitive in fertilizers again, Eastman has purchased an idle natural-gas-based chemical facility in Beaumont from Terra Industries. The plant will be restarted on the new feedstock to produce up to 680,000 metric tons of methanol and 230,000 metric tons of ammonia per year.

Eastman's other venture, called Faustina Hydrogen Products, is slated for completion in St. James Parish, La., by the end of 2010. Like the Beaumont plant it will make ammonia and methanol, but will be geared more toward ammonia. Fertilizer makers Mosaic and Agrium have contracts to purchase the plant's 1.3 million metric tons per year of ammonia output. Methanol output will be about 500,000 metric tons per year.

Eastman will buy the methanol from both plants. It says it is developing technologies to convert the methanol into downstream chemicals but that it is too early to disclose what the slate of derivatives would be. "We are looking at a spectrum of different options that include both olefins and other derivatives," Costa says.

"We have evolved our strategy," he adds. "Initially, we started out only looking at raw material replacement, critical raw materials to our production like p-xylene, ethylene glycol, and propylene. Those are still under consideration, but we are also looking at products that would be new to Eastman."

But Eastman figures that even selling methanol and ammonia on the market without upgrading into derivatives would be economical for the plants. Petcoke has lots of sulfur in it and is thus usually even cheaper than coal. A traditional high-volume use for petroleum coke is firing cement kilns, says David Denton, Eastman's business development director. The company envisions that the two gasification projects will account for some 20% of its earnings by 2012.

Advertisement

IN ADDITION TO EASTMAN, other U.S. chemical companies that are pursuing gasification include Agrium, which is studying the conversion of its Kenai, Alaska, natural-gas-based nitrogen fertilizer plant to a coal-fed facility. Dow is also looking at gasification, albeit not as a route for producing feedstock. It has agreed to allow Hunton Energy to build a coke-based gasification complex at its Freeport, Texas, property. Dow would receive syngas and steam in return.

Companies already gasifying coal and coke have found it to be profitable. In Kansas, Coffeyville Resources Nitrogen Fertilizers operates what it claims is the lowest cost producer of ammonia and urea ammonium nitrate (UAN) fertilizers in North America. The plant, which gasifies coke from the affiliated CVR Energy refinery, produced 525,000 metric tons of UAN fertilizers in 2007, earning it $24 million on $187 million in sales. The company plans to spend $85 million to expand the UAN plant by 50% over the next two years.

Dakota Gasification's Beulah plant converts 5.7 million metric tons of coal into roughly 50 billion cu ft of synthetic natural gas per year. Coproducts include 360,000 metric tons of ammonia, plus ammonium sulfate fertilizer, cresylic acid, and phenol. Last year, the company made about $70 million on $460 million in sales.

The plant wasn't always so profitable. A product of the late-1970s energy crisis, it was built by a consortium of natural gas companies for $2.2 billion, $1.5 billion of which was guaranteed by DOE. Natural gas prices were plummeting by the time the facility started up in 1984, and the partners walked away from it a year later, leaving DOE to run it. In 1988, another firm, Basin Electric Power Cooperative, stepped in and bought the plant for $85 million, along with profit sharing and other financial considerations that to date total about $1 billion.

A company spokesman says the plant's fortunes have changed considerably in recent years, thanks to high natural gas prices. "I remember when it was considered a white elephant; now it is the technology of the future," he says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter