Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Stock Market

Indexes Track Pool Of Public Nanotech Companies

by Ann M. Thayer

March 31, 2008

| A version of this story appeared in

Volume 86, Issue 13

Since about 2004, a few analysts have been interested in following the fortunes of nanotechnology companies. They needed a benchmark, so they created indexes to track companies' stock performance. Some investment firms even built nanotech funds in which investors can buy shares.

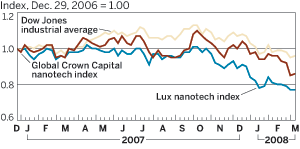

It can be tricky to find companies for which stock market success or failure relates directly to their nanotech efforts, says John M.A. Roy, senior executive director at the technology-focused investment firm Global Crown Capital (GCC) in San Francisco. Roy was at Merrill Lynch in 2005 when that firm set up its nanotech index; the index stopped appearing on the American Stock Exchange (AMEX) in late 2007.

GCC, meanwhile, has its own index of 28 small technology companies in areas such as electronics, materials, research tools, and health care. Calling the index a nanotech "pure play," GCC chooses companies that comply with U.S. government definitions of nanotechnology. The New York City investment firm Punk, Ziegel & Co. posts a 22-company index on its website, while the International Securities Exchange lists a 27-company index on its options exchange. An index from Newbridge Securities in Florida appeared on the New York Stock Exchange until Nov. 30, 2007.

An index from New York City-based Lux Research trades on the AMEX. It includes 15 "nanotech specialists," most of which appear in the other indexes, but also lists nine large companies—including BASF, DuPont, General Electric, IBM, 3M, and Toyota—that are pursuing nanotech applications.

"It is meant to be a representative tool of the value the markets place on nanotechnology," says Lux Research Director Michael Holman. That the Lux index performed less well than the overall stock market during the past couple years reflects Wall Street's less positive view of nanotech now compared with two years ago, he explains.

During 2007, the GCC index at times outperformed other technology-related indexes, GCC Senior Managing Director Nikolay Tishchenko says. But any correlation to broader market indexes is extremely small. "You have a different investment vehicle and pattern of investing by people looking at emerging technologies," Tishchenko says.

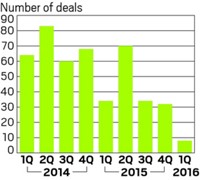

The nanotech indexes are dynamic, which means the companies on the list change as they are acquired or go out of business, or as new companies go public. But over the past three years only modest shifts have been evident among the companies that appear in the indexes.

A few have been taken off, such as Cambridge Display Technology, bought by Sumitomo Chemical in 2007. Those added after recent initial public offerings (IPOs) of stock include Nanosphere, Luna Innovations, and Nucryst Pharmaceuticals. European companies, such as Oxonica and Nanogate, have also become public companies, but they don't appear on the U.S.-based nanotech indexes.

Some companies long considered likely IPO candidates haven't gone public, such as Nano-Tex and Nanosys, which cancelled an offering in 2004. NanoDynamics filed for a U.S. IPO in late 2007 but then postponed it due to market conditions. The company later held and immediately cancelled an offering in Dubai. And the assets of once-promising NanoOpto were sold to API Nanotronics in July 2007.

A tough market for IPOs, especially in recent months, has limited the number of new public nanotech companies. Several companies have been scared off from IPOs, Tishchenko says. "But as soon as the market stabilizes, I can foresee an additional five or six nanotech names coming to the market."

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter