Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

Biotechs queue up for IPOs as window cracks open

After the doldrums of 2022 and 2023, biopharma companies are going public again

by Rowan Walrath

February 6, 2024

Is the biotech IPO market back? It depends on whom you ask.

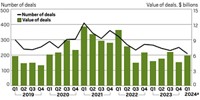

Four biopharma companies held initial public offerings in the first five weeks of 2024, raising a combined total of $794 million. So far, so good—but experts say it may be too early to tell whether their performance is a bellwether for the rest of the year.

As of market close on Feb. 5, diabetes and weight-loss drug developer Fractyl Health, psychiatric drug maker Alto Neuroscience, and cancer drug developers ArriVent BioPharma and CG Oncology had held IPOs, with only Fractyl trading down. Two more—gene-editing firm Metagenomi and immunology company Kyverna Therapeutics—were expected to price by the end of the week.

“It’s a positive sign, unlocking a market that’s been pretty much closed for the last couple years,” says Stacie Aarestad, a partner and co-chair of the capital markets practice at Foley Hoag. “There’s some light coming through . . . but not enough to give you comfort that the window is wide open. I think it’s open a crack.”

In a healthy year for the public markets, about 50 biopharmaceutical companies might hold IPOs, according to Arda Ural, EY’s Americas industry markets leader for health sciences and wellness.

By that measure, the last several years have not been healthy. After a flood of investor interest in biotech during the pandemic, the industry did an about-face in 2022. Generalist investors, suddenly aware of the riskiness of drugmaking, stopped investing. Pandemic-era stimulus checks had been spent. Inflation was rising, and so were interest rates. Compared with the nearly 100 biotech firms that went public in 2020, 22 went public in 2022 and 19 in 2023, according to a tracker maintained by Biopharma Dive.

Jordan Saxe, head of US health care listings at Nasdaq, expects somewhere between 25 and 30 biotech companies to go public via IPO by the end of the year, based on conversations he’s had with executives. (Most biotech companies price on the Nasdaq in the US rather than the New York Stock Exchange.) Nasdaq’s total pipeline of health care and biotechnology companies stands at about 45, he says.

Much of the pipeline consists of companies making radiopharmaceuticals and other cancer drugs, as well as inflammation and immunology drug developers, Saxe says. That pipeline consists of firms with early-stage assets in addition to the firms with mid- and late-stage ones that have attracted the most investment lately. Saxe also sees retail investors returning.

“The bear market for biotech is officially over,” Saxe says. “It’s been the doldrums, but it has really come back.”

EY’s Ural has a different opinion. “Yes, there are bright spots, but the overall IPO market remains anemic,” he says. “Until probably the second half of the year, we’ll probably continue to see a depressed IPO market.”

Saxe and Ural agree on one thing: The window will likely open wider in the summer. That’s when the Federal Reserve has indicated it will lower interest rates, and that’s also when many of the biotech companies in Nasdaq’s pipeline will have data readouts that should enable them to launch an IPO roadshow.

That will also allow enough time to see whether the firms that went public in the winter continue trading up, as Foley Hoag’s Aarestad notes.

“Whether this is going to translate into valuations that get the companies off the sidelines—those who may have a stronger balance sheet and may not necessarily need to access the market—is an open question,” she says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter