Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Huntsman Sues Apollo

Huntsman has strong words for Apollo now that its merger with Hexion is on the rocks

by Alexander H. Tullo

June 30, 2008

| A version of this story appeared in

Volume 86, Issue 26

HUNTSMAN CORP. has filed a $3 billion-plus lawsuit against the private equity firm Apollo Management, parent of Hexion Specialty Chemicals, for luring Huntsman away from a merger agreement with Basell but then failing to close its own $10.6 billion deal.

Earlier this month, Hexion filed a lawsuit in Delaware seeking to back out of the merger, claiming the deal would render the combined company insolvent and that it could no longer secure the necessary financing (C&EN, June 23, page 8).

In its countersuit, filed in Texas, Huntsman recounts being the subject of a bidding war last summer between the polyolefins producer Basell, backed by industrial conglomerate Access Industries, and Apollo. Huntsman had agreed to be acquired by Basell for $25.25 per share. The company says it chose that deal over a $26.00 proposal from Apollo because of a greater certainty that it would actually close. Huntsman and Hexion are among the world's largest producers of epoxy resins, guaranteeing close regulatory scrutiny.

Huntsman changed its mind when Apollo returned with a $28.00-per-share offer and said its financing commitments were "rock solid."

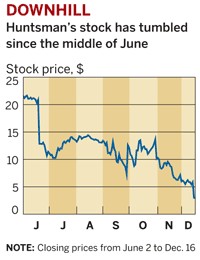

Huntsman is now charging that Hexion later secretly retained the investment bank Duff & Phelps to draft an unflattering report about the merger in an attempt to scuttle it. Huntsman says the Hexion lawsuit caused it to lose $3.6 billion in stock market value in a single day, compared with what it would have gotten from Apollo.

"It is now clear that to get Huntsman to terminate its contract with Basell, Apollo falsely represented to Huntsman its commitment to closing a merger with Hexion at $28.00 a share, when it really intended all along to then delay the process and create enough problems with the transaction to bring us back to the table at a lower price," Huntsman CEO Peter Huntsman says.

In a statement, Hexion defends its actions. "As we alleged in our suit, primarily due to Huntsman's underperformance, we believe that consummating the merger on the basis of the capital structure agreed to with Huntsman would render the combined company insolvent," it says. "In fact, Huntsman's suit does not dispute that the combined company would be insolvent."

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter