Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Biotech's Financing Drought

Downturn in financial markets has brought IPOs to a standstill

by Ann M. Thayer

November 10, 2008

| A version of this story appeared in

Volume 86, Issue 45

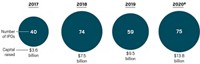

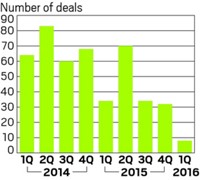

THE DOWNTURN in financial markets has stemmed the flow of capital for biotechnology start-ups, bringing initial public offerings (IPOs) of stock to a standstill. Some financing still trickles in through private equity, venture capital, and partnering investments, but at levels about half of what they were in 2006 and 2007, San Francisco merchant bank Burrill & Co. reports.

According to the firm, 2008 is shaping up to be one of the industry's worst years for IPOs, in contrast to 2007 when they generated more than $2 billion. So far this year, only Sunrise, Fla.-based BioHeart has held an IPO, raising just $6 million.

About 16 biotech companies have withdrawn their IPOs in 2008, according to investment research firm Renaissance Capital. Aldagen, CyDex Pharmaceuticals, Phenomix, and Xanodyne Pharmaceuticals canceled just last month. Last week, Cardiovascular Systems Inc. (CSI) pulled its IPO and opted instead to merge with Louisville, Colo.-based Replidyne.

"Given the uncertainty regarding timing of a market recovery, we believe that this transaction offers the best opportunity at this time for continued growth and for our company to gain access to the public capital markets," CSI CEO David L. Martin said in announcing the deal.

A handful of biotech firms—including Aegerion Pharmaceuticals, Alimera Sciences, BioTrove, and Omeros—have filed for IPOs, but it's uncertain whether they'll move forward. Other biotech companies are laying people off (see page 24).

"After roughly 40 years, where biotech companies have had reasonably easy and inexpensive sources of capital, the world has changed for them and it is going to get much more difficult," Burrill CEO G. Steven Burrill says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter