Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

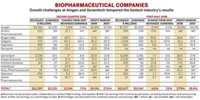

Better Results For Biotech Firms

Companies see across-the-board growth in their biopharmaceutical portfolios

by Lisa M. Jarvis

November 17, 2008

| A version of this story appeared in

Volume 86, Issue 46

NOW THAT THE DUST has settled on several issues impacting the biotech industry, three of its biggest companies are reporting an improved third quarter. Safety concerns for some products, the major problem for Biogen Idec and Amgen, have not disappeared, but doctors, regulators, and insurance companies appear to have agreed on the best way to balance the risks and rewards of those drugs. Genentech, meanwhile, enjoyed a return to double-digit sales growth for nearly every product in its portfolio. As a result, these companies' sales and profits are once again growing at a healthy clip.

Biogen Idec, which did well across its portfolio, had a strong quarter, with earnings soaring 69% to $288 million, based on a 38% rise in sales to $1.1 billion. Sales of the multiple sclerosis drug Avonex were up 26% to $573 million, while Tysabri, another MS treatment, nearly tripled sales to $171 million. Meanwhile, revenues from Rituxan, the arthritis and non-Hodgkin's lymphoma drug Biogen comarkets with Genentech, increased 27% to $299 million.

However, Biogen's results are marred by three more reports of patients contracting progressive multifocal leukoencephalopathy (PML), a rare and potentially deadly brain infection, after taking Tysabri. Biogen took Tysabri off the market when a handful of PML cases surfaced just months after its launch. The drug was relaunched in late 2006 with a carefully mapped-out patient-monitoring program that has been fairly successful at catching signs of PML.

The new cases of PML were not entirely unexpected—the infection appears to strike about one in every 1,000 patients—but could lead to a decline in the number of new patients taking Tysabri, according to Citigroup stock analyst Yaron Werber. "The Tysabri franchise now appears severely battered since there is little question that even as a monotherapy Tysabri can cause PML," Werber says.

Others have more confidence in the company's MS franchise. A slowdown in Tysabri sales is likely, Robert W. Baird & Co. analyst Christopher J. Raymond says, but both patients and investors appear to have accepted the drug's shortcomings. Furthermore, Avonex is still going strong, largely because of price improvements, and is unlikely to face significant competition in the near future. Raymond notes that MS drugs in late-stage development from Novartis and Genzyme won't hit the market before 2010 and suggests that only the Genzyme drug could pose a real threat.

AFTER A ROCKY few quarters, Amgen also appears to be doing well again. The company's net income increased 11% to $1.3 billion, based on a 7% rise in sales to $3.9 billion, thanks to improved sales across every product in its portfolio.

The erythropoietin-stimulating agents (ESAs) Aranesp and Epogen had been a major sore spot for Amgen in recent quarters. Sales of the ESAs eroded after studies showed that cancer patients suffered serious side effects when given high doses. Government agencies subsequently adopted strict new prescription and reimbursement guidelines.

The two drugs had stronger third-quarter sales than expected, but analysts point out that the results are largely due to higher selling prices and accounting quirks rather than a rebound in demand. Aranesp, used to treat anemia in cancer patients, had a 3% bump in sales to $845 million. In the U.S., however, sales dropped 12% in the quarter.

Sales of Epogen, taken by dialysis patients, rose 5% to $634 million. Although the patient population for Epogen continues to grow, the dose given to those patients is dropping, and Amgen is primarily benefiting from higher prices of the drug and changes in the inventory levels of wholesalers.

OTHER DRUGS from Amgen also had a good quarter: Sales of the arthritis and psoriasis drug Enbrel were up 9% to $893 million, and those of Sensipar, for kidney disease patients with hyperthyroidism, posted a 32% rise to $161 million. Even Vectibix, the colon cancer drug that faltered upon market launch after its efficacy was questioned, had stable sales of $41 million.

In more positive news, Amgen has two new drugs poised for the market. In August, the biotech firm received Food & Drug Administration approval for Nplate, a treatment for chronic immune thrombocytopenic purpura, an autoimmune disease in which the body destroys platelets faster than it can make them. The drug is being distributed through a special program designed by Amgen and FDA to ensure it is administered properly and to facilitate the collection of follow-up safety data.

Amgen also recently reported more positive late-stage data for denosumab, a monoclonal antibody in development to treat osteoporosis. Denosumab is viewed as the key to Amgen's future growth.

Citigroup's Werber projects the drug will launch in 2010 and believes sales will peak at $1.6 billion per year. Werber's forecast assumes only osteoporosis sales, but Amgen is also testing the drug as a treatment for prostate and breast cancer. Although data to confirm its efficacy in those indications are still limited, future positive results could substantially add to sales.

Amgen is now preparing for a cost-effective launch for denosumab, which will require a major sales team. The company recently told investors it was considering partnering the drug in Europe.

And despite a lack of new product launches in recent years, Genentech is also looking strong again. Third-quarter earnings rose 11% to $863 million, based on a 17% rise in revenue to $3.4 billion.

After failing to meet analysts' lofty growth expectations in recent quarters, Genentech's oncology portfolio enjoyed a healthy uptick in the last period. Third-quarter sales of the breast cancer drug Herceptin increased 15% to $368 million, and Genentech's share of Rituxan revenues also rose 15% to total $655 million.

Avastin—approved for colon, lung, and breast cancers—brought in $704 million, an 18% improvement. Trying to further expand the market for Avastin, Genentech recently asked FDA to approve the drug to treat an aggressive form of brain cancer. The company also recently reported promising early data from a Phase III trial assessing whether colon cancer patients survive longer if Avastin is added to their chemotherapy regime.

Although the new data for colon cancer were not a surprise, some analysts think they could prompt Roche to sweeten its offer for Genentech. The Swiss drug firm has owned a majority stake in Genentech since 1990, and this summer, it made an unexpected $43.7 billion bid to take it over completely. Genentech said the price tag undervalued the business, but the expectation on Wall Street is that the deal will go through at a higher price.

"With this update now complete, we think the pathway for a timely completion of the Roche deal may be clearer," Baird's Raymond says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter