Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Earnings Yet to Slip

Foreign sales are bailing out ebbing U.S. growth

by Alexander H. Tullo

February 4, 2008

| A version of this story appeared in

Volume 86, Issue 5

DESPITE ALL the gloom about the U.S. economy and high energy prices, chemical company fourth-quarter results thus far have held relatively firm. Chemical companies are crediting continuing strength in overseas markets for their good fortunes. Profits also depended on how well companies were able to pass along higher costs to their customers.

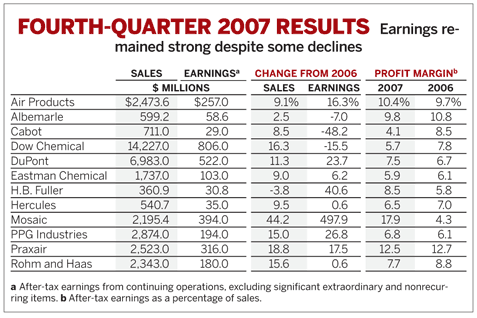

The largest U.S. chemical company, Dow Chemical, posted record sales of $14.2 billion in the quarter, representing a 16.3% increase over the same period in 2006. Yet the company's earnings slipped, dropping 15.5% during the quarter, down to $806 million. Earnings for Dow and other companies are from continuing operations and exclude significant extraordinary and nonrecurring items.

But Dow CEO Andrew N. Liveris regards the quarter as successful for his company, with results still among the strongest in the company's history. He credits this to company efforts to raise prices in the face of escalating hydrocarbon costs. "Given the very difficult conditions we faced—a weak U.S. economy paired with purchased feedstock and energy costs that rose 11% year-over-year—these results demonstrate yet another year where our strategy to mitigate these high input costs was proven successful," he told analysts.

DuPont posted a strong rise in both sales and profits. Sales during the fourth quarter increased 11.3% versus the year–ago period, reaching nearly $7.0 billion, while earnings increased by 23.7% to $522 million. The company says global diversification has helped offset slumping U.S. markets. DuPont's sales in emerging markets such as Brazil, India, and China grew by 20% during the quarter.

Carbon black maker Cabot saw a large earnings decline. Although sales increased by 8.5%, earnings fell 48.2%, down to $29 million. The company says that its selling prices have not increased fast enough to offset rising energy costs.

Two specialty chemical makers have continued to increase volumes but they experienced little change in earnings. Rohm and Haas and Hercules both saw sharp increases in sales while earnings remained flat. Raj L. Gupta, Rohm and Haas's CEO, says he is pleased that earnings kept pace with high energy costs and "despite steady deterioration in the U.S. building and construction markets."

Industrial gas makers continue to rack up strong earnings. Air Products saw sales increase in its most recent quarter by 9.1% while earnings climbed by 16.3%. Praxair posted an 18.8% increase in revenues while profits increased by 17.5%. Praxair CEO Stephen F. Angel says overseas results drove the company's success. "Sales growth was robust globally, led by South America and Asia," he says.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter