Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Building Business

Custom chemical firms showcase technology and modest expansions at InformexUSA 2008

by Ann M. Thayer

February 18, 2008

| A version of this story appeared in

Volume 86, Issue 7

THOUGH ATTENDEES were mostly in high spirits at InformexUSA 2008, the custom manufacturing trade show held in New Orleans late last month, talk of a recession and recent setbacks in the pharmaceutical industry dampened the mood. Active pharmaceutical ingredients (APIs) and intermediates are still the most important markets for contract manufacturers. And many believe that having specialized technologies and production capabilities remains a good way to attract business.

Custom chemical companies are enjoying healthier times than they were earlier in the decade, with many smaller firms reporting full capacity and claiming to be turning business away, explained industry analyst Howard J. Foote of Meadowbrook Associates. Attendees maintained that their industry is relatively recession-proof because sick people need drugs in good times and bad.

A scanning electron micrograph image shows the interface of two entangled fibers, where millions of tiny nanowire bristles generate electricity upon mechanical deformation.

"We're not recession-free, but the effect may not be quite as bad as in other industries," said James Bruno, director of the consulting firm Chemical & Pharmaceutical Solutions.

Yet companies and industry observers alike indicated that a downturn in the U.S. economy could impact investment decisions for both drug firms and their suppliers. At the same time, recent woes for big pharma—especially new uncertainties about how cholesterol drugs will be prescribed—will eventually impact custom manufacturers. The fine chemicals industry might look healthy now, Foote said, but that could change depending on what happens to companies in the second half of the year and beyond.

A weaker drug pipeline is also a problem, Bruno told C&EN. There are fewer projects to choose from, making competition tougher. Choosing the right project—a drug with a good chance of commercialization— is difficult. With their profits dwindling, pharmaceutical companies are going to squeeze out costs wherever possible, an action that will likely translate into tighter profit margins for custom manufacturers, Foote added.

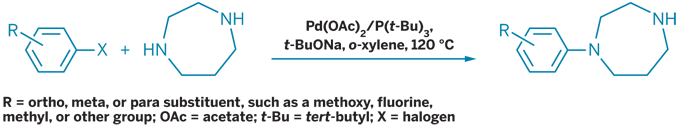

Tosoh';s route to substituted aryl homopiperazine derivatives uses palladium-catalyzed coupling instead of cyclization.

"It's quite important that the industry retains its memory and a sense of perspective," said Ian Shott, chairman of the Newcastle, England-based process development firm Excelsyn, alluding to difficulties endured just a few years ago. At the same time, he pointed out that big pharma's turmoil could bring opportunities for partners that can improve manufacturing efficiencies.

To attract business, custom chemical firms showcased targeted expansions and new technologies. For example, many players have shown interest in manufacturing capacity for highly potent compounds, said Dave Clary, Albemarle's vice president of fine chemistry services.

Albemarle is eyeing internal investments or acquisitions in high-potency compounds and peptides to help broaden its offerings to biotech firms and small drug companies. The company hopes also to have a competitive edge based on its experience with "extreme chemistry" such as high-pressure processes or hazardous materials.

Likewise, Nicholas Piramal India Ltd. has invested $270,000 to add a sixth synthesis suite in Grangemouth, Scotland, for making up to 50 kg per year of high-potency APIs. France's Novasep has invested nearly $11 million and has opened a new high-potency API plant at its Le Mans facility. And high-potency player Ash Stevens has been making capital investments to upgrade its Riverview, Mich., site.

SAFC, the fine chemicals business of Sigma-Aldrich, is in the process of expanding its high-potency API capabilities across three global sites, said company President Frank Wicks. The fact that its soon-to-open suite for conjugating antibodies and high-potency compounds is already 100% committed is a sign that the technology is needed in the marketplace, he said.

Wicks also announced that SAFC has launched a $600,000 expansion of Pharmorphix, its solid-state services unit. It is adding 7,500 sq ft of lab space to the Pharmorphix research facility in Cambridge, England.

Meanwhile, Cambrex increased its high-potency capabilities in Charles City, Iowa, last year. The company also recently agreed to purchase ProSyntest, an Estonian R&D company focused on APIs, for an undisclosed sum.

Cambrex is concentrating on emerging and midsized customers in the U.S., which generally prefer to have contract manufacturing done in the U.S. or Europe, said Steven M. Klosk, its chief operating officer. His main concern about an economic downturn is that investment might dry up for start-up drug companies-"those emerging guys we love to do business with."

Also reaching out to North American customers, India's Shasun Chemicals & Drugs will complement its Indian and European operations with the addition of a process development facility in Piscataway, N.J. The first phase is expected to open in April.

Richmond Chemical has also expanded its U.S. facilities by acquiring new lab space in Elk Grove Village, Ill., for chemical and biological process development. At the same time, it has been expanding its facilities in Edinburgh, Scotland.

MOVING IN the opposite geographic direction, Cary, N.C.-based CiVentiChem is investing in its Indus BioSciences subsidiary in India. The company is spending more than $7 million to build a pilot plant. Customers can choose to work with the company either in the U.S. or India, with all projects managed from the U.S., CiVentiChem President Bhaskar Venepalli said.

India and China have contributed significantly to strong sales growth at Halocarbon Products, said Sales & Marketing Director Ronald Epstein. Exports accounted for 60% of 2007 sales for the New Jersey-based fluorochemicals manufacturer. Responding to growing demand, the company will complete a doubling of its production capacity next month and intends to double it again in about 15 months.

Another route to business growth has been through mergers and acquisitions. Vertellus Specialties, formed in July 2006 from the combination of Reilly Industries and Rutherford Chemicals, has a new owner: investment firm Wind Point Partners, which recently bought the company from Arsenal Capital. Vertellus President Robert Morlino said the new investors are looking to grow the business organically and through acquisition. Although Vertellus is a leading producer of pyridine and pyridine derivatives, he expects to expand "outside the pyridine sphere" in growth areas such as biomaterials.

International Chemical Investors Group (ICIG) has also brought together custom chemical operations and is finding synergies among their operations. The German investment firm owns Clariant's former custom manufacturing business and Solvay's former Synkem business and it also owns Weylchem and Corden PharmaChem. According to Weylchem Managing Director Georg Weichselbaumer, the firm is striving for a broad portfolio of technologies as it consolidates these acquisitions.

For example, Weylchem expanded its nonpharmaceutical product base, particularly in agrochemicals, with the Clariant acquisition. ICIG Managing Director Achim Riemann is optimistic about the year ahead, claiming that large drug companies are currently increasing their outsourcing of small-molecule APIs. The economy is less of a concern than the weather, he said, noting that agricultural chemicals are currently benefiting from a strong Asian market.

Investors are helping other companies expand. Prosonix, a particle engineering firm based in Oxford, England, raised nearly $10 million in late 2007. At the show, it announced a licensing deal with Rafael, a technology developer in Israel, under which it gains access to additional ultrasonic process technology.

Excelsyn has raised nearly $2 million to support development of a process for making high-purity nonnatural amino acids, which are useful synthetic building blocks. Although the technology is being used for three drugs now in clinical trials, Shott is considering spinning it off into a separate company. Doing so, he believes, might help attract the added resources needed to reach the technology's full potential and extend its customer reach.

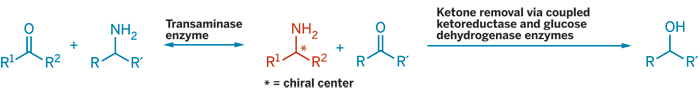

TARGETING TECHNOLOGY for another key product, Masahiko Yamada, senior manager for new business development at Kaneka, described a new method for making chiral amines. The Japanese company has developed a practical transaminase technology by creating a three-enzyme whole-cell system to convert ketones into amines. The system offers high yield and high enantiopurity by coupling a transaminase enzyme to an enzyme module, which converts unwanted by-products irreversibly into separable compounds. Yamada said Kaneka is using the technology commercially and has a library of transaminases to handle different starting ketones.

Similarly, Richmond Chemical is scaling up a chemobiocatalytic process for producing a nonnatural chiral amino acid, reported Ian Fotheringham, director of Richmond's biosciences operations, at the InformexUSA 2008 meeting. The company works with a South Korean manufacturing partner to produce material at the ton scale. Extending its technology into other areas, Richmond also has engineered microbes for carbon conversion to make alternative fuels.

In a related vein, the Dutch firm Avantium has applied high-throughput research methods to the development of chemical catalytic routes for making biofuels. It has begun testing its "Furanics" fuels, which are derived from sugars and other carbohydrates, including biomass. And, biocatalysis process developer Codexis has a biomass conversion program based on optimized enzymes.

Codexis, which has its headquarters in Redwood City, Calif., also introduced a research tool, the Codex MicroCyp Plate, at InformexUSA 2008. Employing bacterial cytochrome enyzmes, the plate can be used either to screen drug metabolites for toxicity or to identify metabolites that might be drug candidates themselves.

More traditional chemical products were offered as well. International Specialty Products (ISP) is increasing production of pharmaceutical-grade tetrahydrofuran at its Marl, Germany, site. The project will nearly double ISP's annual capacity for the solvent to 36,000 metric tons. Ferro has added high-purity cyclic and linear carbonates to its solvents product line as cost-effective and less toxic alternatives to halogenated solvents and N-methyl-2-pyrrolidinone.

Tosoh Organic Chemical of Japan is offering unique aryl homopiperazines. Instead of typical cyclization methods, the Tosoh route uses a palladium-catalyzed coupling. In addition to high yields and purities, an advantage of the new route is the ability to synthesize various substituted aryl homopiperazines, said Thijs W. Braam, Tosoh Europe's product manager.

In another development, SK Life Science touted advances in continuous processing to convert an aryl halide into an aryl acetal that is in turn an intermediate for an API. According to Jaeyon Yoon, SK's director of marketing for pharmaceuticals and fine chemicals, batch production is difficult to scale up since it usually requires low temperatures to control two exothermic steps and yields a product of less than 70% purity because of an unstable intermediate.

SK's continuous process, however, requires only modest cooling because the amounts of material reacting at any given time are small. Product purity is greater than 85% because the intermediate is instantly quenched to form the required acetal. And whereas batch processing takes three hours to make 30-40 kg, the continuous mode takes only 30 minutes. In July 2007, Yoon said, SK prepared two tons of the product for a customer.

Whatever the technology development or business approach, custom manufacturers share the common goal of trying to please their customers. At InformexUSA 2008, many tried to put on their best show and attract new customers to please.

- Building Business

- Custom chemical firms showcase technology and modest expansions at InformexUSA 2008

- To China With Eyes Wide Open

- The China Opportunity Day Conference at the InformexUSA 2008 trade show last month helped demystify the country.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter