Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Pharma's Outlook Sour After Good 2007

Drug firms' new product shortage could lead to a tougher 2008

by Lisa M. Jarvis

February 25, 2008

| A version of this story appeared in

Volume 86, Issue 8

AFTER A WAVE of patent expiries and product setbacks produced uncharacteristically poor results in 2006, U.S. drug companies returned to double-digit sales and earnings growth in 2007. The industry could have a tougher time in 2008, however, as the benefit of cost-cutting begins to wear off and the pain of a dry product pipeline sets in.

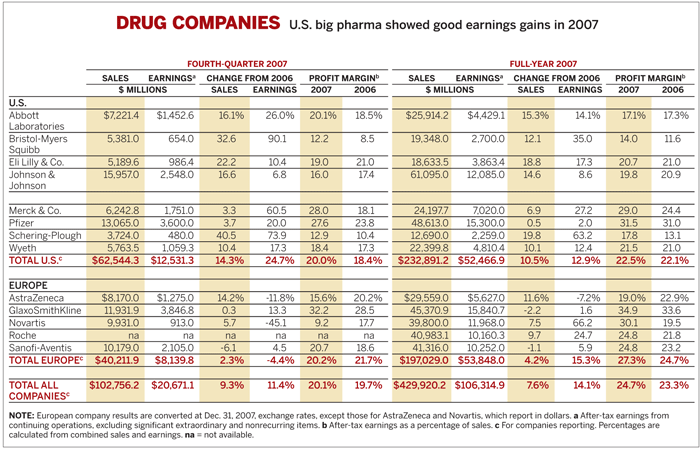

Overall, U.S. drug firms had a robust 2007, largely due to strong rebounds at companies that had been languishing in the past two or three years. The average fourth-quarter profit margin for the eight U.S. companies tracked by C&EN improved to 20.0%, compared with 18.4% in the fourth quarter of 2006. Average fourth-quarter earnings grew 24.7%, based on sales growth of 14.3%.

Meanwhile, European companies, which in recent years have eclipsed their U.S. competitors in sales and profit growth, had a more challenging year. Average fourth-quarter sales growth for the companies tracked by C&EN came in at a modest 2.3%, while earnings declined by 4.4%. Profit margins were 20.2%, down from 21.7% in the fourth quarter of 2006.

But a dearth of new drug approvals and issues with key products could lead to a tougher 2008. Just 16 new molecular entities (NMEs) were approved in 2007, the lowest level in 24 years, according to a report by the investment firm Friedman, Billings, Ramsey Group.

In addition to weak productivity, several of the industry's growth engines-including some drugs that have been expected to power companies for several years-are losing steam. Sales of statins, a class of cholesterol drug that has long driven profits at several drug companies, have stagnated as generics infiltrate the market. And safety issues are impacting a slew of products—both well-established medicines, such as GlaxoSmithKline's diabetes drug Avandia, and newer treatments, such as the cholesterol-lowering drug Vytorin from Merck & Co. and Schering-Plough.

The latest bout of bad product news could swipe two companies at once. Merck and Schering-Plough both have been on a steady upward climb after a stretch of declining profits. Merck is finally recovering from the withdrawal of Vioxx and the introduction of generic competition to its statin drug Zocor, and Schering-Plough has bounced back from patent losses for Claritin and manufacturing woes that had delayed new product launches.

Merck's fourth-quarter profits were up 60.5% to $1.8 billion, based on a 3.3% rise in sales to $6.2 billion. For the full year, its sales improved 6.9% to $24.2 billion, while profits jumped 27.2% to $7.0 billion.

Schering-Plough, meanwhile, saw fourth-quarter sales increase 40.5% to $3.7 billion and earnings jump 73.9% to $480 million. For the year, its earnings were up 63.2% to $2.3 billion, based on a 19.8% increase in sales to $12.7 billion.

The improvement at both firms is in large part due to the success of their cholesterol drug joint venture, which sells Zetia and Vytorin, a pill that combines Zetia with Merck's Zocor.

Fourth-quarter sales for the cholesterol franchise reached $1.5 billion, up 34% over the prior year. For the full year, sales grew 34% to $5.2 billion. Both companies report the profits from the venture as equity income, which means their annual sales and earnings figures do not reflect the full benefit of the drugs' performance.

But that performance could be tempered in 2008 on the basis of new questions about the benefits of Vytorin. Last month, the companies released preliminary data from a study comparing the arterial wall thickness of patients with an inherited form of high cholesterol who took Vytorin with that of patients taking Zocor alone.

The trial, called Enhance, showed that patients taking Vytorin had significantly lower levels of LDL, or "bad" cholesterol, compared with those taking a statin alone. But patients taking the combined therapy also had more plaque gumming up their arteries, a finding that bucked the conventional wisdom that lower is better when it comes to bad cholesterol.

The news would have been bad enough on its own, but industry critics have accused Merck and Schering-Plough of dragging their heels on publishing the trial results. The companies' actions are now being investigated by several committees in the House of Representatives.

Fred Hassan, Schering-Plough's chief executive officer, responded to the criticism earlier this month in the company's 2007 earnings announcement. "We and our joint-venture partner, Merck, acted with integrity and good faith with respect to that trial," he said. "We stand behind Vytorin and Zetia, behind the validity of the science, and behind our commitment to doing what's right for patients and physicians."

Bank of America pharmaceutical stock analyst Chris Schott is forecasting sales of Vytorin and Zetia to shrink 4% in 2008, with "a more muted impact thereafter." Still, the analyst plans to "watch the cholesterol situation closely, as there is the potential for further revisions going forward."

Morgan Stanley analyst Jami Rubin cut her U.S. sales forecasts for the drugs by 10% but believes the reaction to the Enhance trial may be overdone. She says she is "confident that this trend will moderate once the full scientific data come out" at the American College of Cardiology conference next month.

A slowdown in Vytorin sales would have the most impact on Schering-Plough, which otherwise depends on squeezing growth out of older products in its allergy and infectious disease franchises. Fourth-quarter sales of the anti-inflammatory agent Remicade were up 35% to $455 million, and the hepatitis C treatment PegIntron brought in $239 million, a 15% increase. Clarinex, the follow-on to the popular antihistamine Claritin, had sales of $174 million in the quarter, a 6% improvement. Yet growth in each of these drugs has been mainly overseas; sales are shrinking in the U.S.

Merck, on the other hand, has launched a cache of products in the past two years whose growth should offset any slowdown in the cholesterol franchise. Three new vaccines-Gardasil, RotaTeq, and Zostavax-brought in $339 million, $149 million, and $85 million, respectively, in the quarter. And Januvia, Merck's new diabetes drug, had sales of $252 million in the quarter.

Merck and Schering-Plough could have a hard time maintaining the growth of their cholesterol franchise, but Pfizer's blockbuster cholesterol drug Lipitor finally seems to be stabilizing. Lipitor sales had dropped off in the two prior quarters because of competition from newer drugs, such as Vytorin, and generic versions of Zocor. But Pfizer recaptured ground in the fourth quarter, increasing sales 3% to $3.4 billion, thanks to higher international use. For the year, sales came in at $12.7 billion, down 2%, but still better than what many analysts had expected.

In fact, Lipitor may be the beneficiary of fallout from the Enhance study. Although Bank of America's Schott says he does not expect any substantial change in Lipitor sales, the situation for Pfizer's drug could improve "if Vytorin's market share falls dramatically over the coming weeks on concerns over the manner through which the drug lowers cholesterol."

Overall, Pfizer's fourth-quarter sales were $13.1 billion, a 3.7% improvement, while earnings were up 20.0% to $3.6 billion.

Pfizer's newer products fared well. Fourth-quarter sales of the smoking-cessation drug Chantix more than tripled to $280 million, and the pain management drug Lyrica raked in $564 million, up 60%. The cancer drug Sutent brought in $182 million, a 75% increase.

MEANWHILE, European companies struggled with unexpected product setbacks, weak new drug pipelines, and generic competition. Novartis, AstraZeneca, and Sanofi-Aventis all had tough fourth quarters, and GlaxoSmithKline struggled throughout the year.

For Novartis, profits were severely cut by the withdrawal of the irritable bowel syndrome drug Zelnorm and generic competition for the hypertension drug Lotrel, the antifungal Lamisil, and the epilepsy treatment Trileptal. Fourth-quarter earnings dropped 45.1% to $913 million, based on a 5.7% increase in sales to $9.9 billion.

Fourth-quarter sales at Sanofi-Aventis were down 6.1% to $10.2 billion, due in large part to generic competition for the sleep aid Ambien, while earnings were up 4.5% to $2.1 billion. AstraZeneca, meanwhile, saw earnings in the quarter sink 11.8% to $1.3 billion and sales rise 14.2% to $8.2 billion.

GSK's results reflected the sharp decline in sales of its diabetes drug Avandia due to concerns that its use may increase the risk of heart attack. Sales in the Avandia franchise sank 55% in the quarter to $472 million. As a result, GSK had virtually flat fourth-quarter sales of $11.9 billion and a 13.3% rise in earnings to $3.8 billion. For the year, its earnings were up 1.6% to $15.8 billion, and sales were down 2.2% to $45.4 billion.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter