Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Slower Going

As portfolios mature, big biotechs struggle to meet lofty growth of years past

by Lisa M. Jarvis

February 25, 2008

| A version of this story appeared in

Volume 86, Issue 8

TOUGHER TIMES for major companies pulled down the performance of the biopharmaceutical sector in 2007. The biggest biotech firms are facing the same quandary as their major pharma brethren-a need to rebuild their portfolios amid slowing product sales but a relatively limited late-stage pipeline with which to do it.

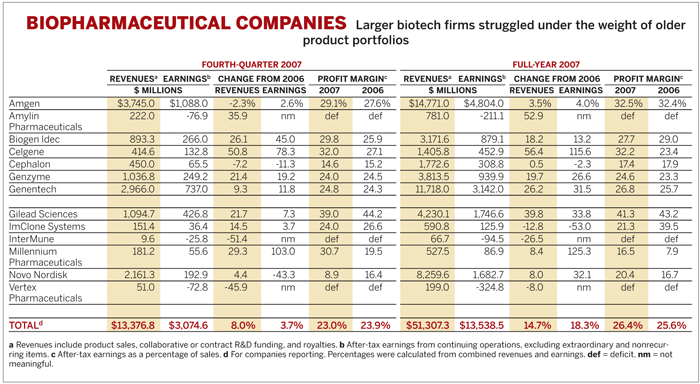

Two of the 15 biopharmaceutical companies tracked by C&EN, Onyx Pharmaceuticals and Sepracor, didn't report earnings by the deadline for the survey. For the remaining 13 companies, average fourth-quarter revenues grew by 8.0%, and earnings were up just 3.7%. Average fourth-quarter profit margins dipped to 23.0%, compared with 23.9% in the fourth quarter of 2006.

For the full year, average earnings improved 18.3%, while revenues increased by 14.7%. Yet these growth rates were only about half those reported in 2006.

A fourth-quarter slowdown at top players Amgen and Genentech had a big impact on overall biotech results. Amgen turned in a lackluster quarter, though its results were mildly better than analysts had expected. Fourth-quarter sales fell 2.3% to $3.7 billion, and earnings increased 2.6% to $1.1 billion. For the year, earnings were up 4.0% to $4.8 billion, based on a 3.5% rise in sales to $14.8 billion.

Amgen's portfolio is looking shopworn. Sales are drifting for its erythropoeisis-stimulating agents, Aranesp and Epogen, and for its newest drug, the colon cancer treatment Vectibix, which was approved in September 2006.

Aranesp sales fell 25% in the quarter to $825 million, primarily due to declining demand in the U.S., which accounts for more than half of the drug's sales. Aranesp's performance has weakened in the past year after safety concerns led to a labeling change; insurance providers changed their reimbursement structure for the product as a result. For the full year, Aranesp sales fell 12% to $3.6 billion.

Although the overall population of patients on Epogen grew in the quarter, sales declined because physicians were administering the drug in lower doses. Fourth-quarter Epogen sales fell 3% to $638 million, and annual sales dipped 1% to $2.5 billion.

Sales of Vectibix slid in the past three quarters after new studies questioned its efficacy. The drug brought in $33 million in the fourth quarter, down from $41 million in the year-earlier quarter.

Meanwhile, Amgen's arthritis and psoriasis treatment Enbrel and white-blood-cell treatment Neulasta offered modest growth, though in the case of Neulasta, the improvement was due to price increases rather than higher demand. Fourth-quarter sales of Enbrel increased 8% to $856 million, and Neulasta sales were up 9% to $1.1 billion.

Amgen appears to be looking for novel ways to diversify risk and fund the development of its pipeline. Earlier this month, the company announced a deal with Takeda Pharmaceutical that gives the Japanese company access to a slew of drugs in the Amgen pipeline in exchange for hefty licensing and development fees. The partnership covers only Japan, a market that analysts say would not make sense for Amgen to tackle alone.

Genentech, meanwhile, had a strong year, but is starting to see growth moderate as demand for older drugs levels. Full-year earnings jumped 31.5% to $3.1 billion, based on a 26.2% rise in sales to $11.7 billion. That robustness, however, had worn off by the fourth quarter. Sales rose a more temperate 9.3% to $3.0 billion, and earnings increased 11.8% to $737 million.

DEMAND FOR Genentech's stable of older drugs is growing, though not at the fast pace of earlier in the decade when products were approved for new indications. Fourth-quarter sales of the breast cancer treatment Herceptin increased 2% to $327 million, while the lung cancer drug Tarceva brought in $112 million, a 5% increase. Rituxan, for arthritis and lymphoma, had sales of $596 million, or 6% growth.

Sales of Avastin, which is approved to treat colon and lung cancers, totaled $603 million in the quarter, a 23% increase. For the year, Avastin sales improved 32% to $2.3 billion.

Avastin is now Genentech's primary growth driver, and the company has been banking on an approval for treatment of breast cancer to further expand its use. But analysts are unsure the Food & Drug Administration's advisory committee will give its nod to this new use when it meets next month. Trials submitted in its application showed that the drug slowed tumor progression but did not prolong survival. Genentech just released new data showing that adding Avastin to chemotherapy does indeed extend progression-free survival in patients who had never been on a chemo regimen, though those results are unlikely to be considered by the committee.

Biogen Idec's results, meanwhile, illustrate how just one new product can reinvigorate a biotech firm. The company, benefiting from the uptake of its multiple sclerosis drug Tysabri, saw fourth-quarter earnings grow 45.0% to $266 million, based on a 26.1% rise in revenues to $893 million. Tysabri revenues totaled $90 million in the quarter, compared with $18 million in the fourth quarter of 2006.

The major biotech firms may be stagnating, but smaller companies are enjoying robust growth as newer products gain momentum. Amylin Pharmaceuticals has not managed to get into the black-the company posted a $76.9 million loss for the quarter-but sales of its diabetes products are growing steadily. Revenues for the quarter grew 35.9% to $222 million, based on a 29% bump in sales of Byetta, the type 2 diabetes treatment approved in 2005.

Amylin plans to seek approval to market Byetta as a stand-alone therapy in the first half of this year and could gain approval by the end of the year. Such a monotherapy indication could help Amylin get the drug to patients earlier in their disease.

Millennium Pharmaceuticals enjoyed its second year of profits based on continued robust growth of its cancer drug Velcade, which was approved in 2003. U.S. sales of Velcade, for multiple myeloma and lymphoma, grew 20% to $265 million in 2007, while royalties on sales in other countries grew 24% to $167 million. As a result, Millennium's fourth-quarter earnings more than doubled to $55.6 million, based on a 29.3% rise in sales to $181 million.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter