Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Europe: Fragile recovery awaits the return of end-market demand

by Melody Voith

January 11, 2010

| A version of this story appeared in

Volume 88, Issue 2

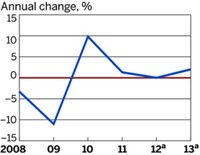

In Europe, evidence suggests that most chemical sectors are over the worst of the downturn. But in the new year, the pace of growth will be modest and the overall recovery fragile. It will likely be several years before European chemical output regains the peak seen in the first quarter of 2008.

COVER STORY

Europe: Fragile recovery awaits the return of end-market demand

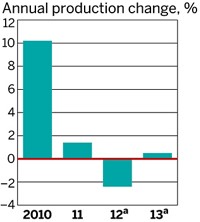

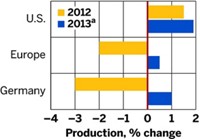

In 2009, chemical output excluding pharmaceuticals fell an estimated 12.4%, according to Moncef Hadhri, an economist with the European Chemical Industry Council (CEFIC). As in the U.S., basic chemicals suffered the most, thanks to steep drops in demand from the automotive and construction markets. As the turnaround begins, CEFIC forecasts that chemical output will grow 4.7% in 2010.

Hadhri calls 2010 a transition year. “As the considerable stimuli given by government incentives such as car scrappage schemes are withdrawn, real consumer demand has to take over,” he says. But he sees no sign of major inventory rebuilding by customers. Firms will proceed with caution as difficult credit and liquidity conditions continue to plague manufacturing industries.

The recession took the biggest bite out of chemical powerhouse Germany, where the drop in demand for basic chemicals led overall chemical output to plunge 13.9% in 2009, says David Thomas, senior industrial economist at consultancy Oxford Economics. Oxford’s “World Chemical Service” report predicts that German output will grow 9.0% this year.

Germany’s turnaround began the second quarter of 2009, Thomas observes. “Basic chemicals grew more than 10% between the first and second quarter of 2009 and again in the third quarter.” But the recovery has been modest. “Customers are not restocking to build stocks to a high level but to a level necessary to work with.”

Compared with basic chemicals, German pharmaceuticals took a relatively gentle dip, declining about 3% in 2009. But Thomas forecasts slow growth of 1 to 2% in 2010. “There has been a lot of cutting back on new products,” he says.

The economic picture is similar outside Germany. But because France, Italy, and the U.K. depend less on basic chemicals, the downturn was not as sharp, Thomas observes.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter