Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Novartis Unveils Growth Strategy

September 19, 2011

| A version of this story appeared in

Volume 89, Issue 38

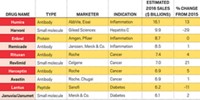

Novartis has joined the ranks of other large pharmaceutical firms, such as Sanofi, in recently announcing growth and cost-saving plans. The Swiss drug firm also is integrating the eye care business of Alcon, which it acquired in April. Although CEO Joseph Jimenez says the Alcon purchase targeted long-term growth and not just cost synergies, Novartis anticipates seeing an extra $350 million in savings by 2013. In the first half of 2011, productivity improvements have already yielded more than $1.2 billion in savings, and the year-end total is expected to exceed the $1.9 billion achieved in 2010. Novartis has or will divest, halt, or reduce operations at 10 manufacturing sites. Growth is expected to come from new product sales that will help offset sales lost when patents expire. So far this year, Novartis has gotten six drugs approved and has filed for another eight, while Alcon has had 11 key approvals. According to Novartis, its diversified portfolio and geographic reach should protect against macroeconomic factors and contribute to high-single- to low-double-digit sales growth.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter