Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Tiny Tools

Instrument makers pack increased power into miniaturized analytical gear

by Marc S. Reisch

August 26, 2013

| A version of this story appeared in

Volume 91, Issue 34

Thank the smartphone for blazing a trail toward a robust gas chromatograph that is smaller than an iPad and a mass spectrometer that will fit in the palm of your hand.

Today’s phones owe much of their smarts to semiconductors and microelectromechanical systems (MEMS) that allow people to talk wirelessly with distant relatives, take pictures, and view movies on small screens. Semiconductor chips provide the raw processing power. MEMS chips add various sensors and devices that interact with the world outside. So with a bit of tweaking, scientific instrumentation companies are using these same technologies to take instruments out of the lab and onto the street.

Advances in the processing power of semiconductor chips have helped shrink console-sized X-ray or ultraviolet spectrometers to handheld devices. These point-and-shoot instruments can analyze the purity of pharmaceutical ingredients on a shipping dock or verify the composition of a metal alloy intended for a chemical plant reaction vessel. MEMS-based devices are now showing promise in transforming other large chemical analyzers such as gas chromatographs and mass spectrometers.

Although past attempts to incorporate MEMS into chemistry tools weren’t very successful, start-up companies such as Analytical Pixels Technology (Apix) and Microsaic Systems think they can make it work. MEMS have recently become robust enough to form the basis of reliable commercial instruments. “There’s a lot of potential in small mass spectrometers and gas chromatographs,” says John Hinshaw, a senior scientist at BPLGlobal, a provider of services to electric utilities, and a columnist for LC/GC magazine. Earlier chip-based systems had uniformity and leakage problems, he says.

Although they have improved in these areas, many of the smaller instruments still lack the flexibility of their larger cousins, Hinshaw notes. Another strike against them is that prescribed methods of analysis often depend on large, well-known equipment.

So resistance to change isn’t unreasonable, notes Michael Tice, vice president of Strategic Directions International, an instrumentation consulting firm. Smaller handhelds, for instance, still can’t match their larger cousins in accuracy and resolution, he says.

Still, miniaturization is a powerful trend. “I have a distinct memory 30 years ago of monstrous gas chromatograph/mass spectrometer systems that measured 6 feet wide and stood 4 feet high,” Hinshaw says. Today’s units are about one-quarter the volume. “I can believe that in the not-too-distant future, even smaller GC/MS systems will find their way into common applications,” he adds.

Firms developing the miniature instruments say they aren’t necessarily trying to replace the larger workhorses. But they do see opportunities to leverage the expertise phone makers have gained in consumer markets and apply it in industrial products.

“MEMS components allow us to reduce the size, weight, power use, and cost” of scientific instruments, says Joshua J. Whiting, production development director and a founder of two-year-old Apix.

Taking advantage of such a component at the heart of its gas chromatograph, the Max-One, the company has been able to reduce the unit’s size to an iPad-like footprint. That’s about one-eighth the size of a traditional gas chromatograph, Whiting says.

The chromatograph’s separations column is etched onto a silicon chip that fits inside the instrument’s housing. The firm, which introduced its instrument at the Pittsburgh Conference on Analytical Chemistry & Applied Spectroscopy in March, intends to start shipping to customers by the end of 2013.

Apix isn’t targeting analytical lab customers but rather is working to make field-worthy instruments for petrochemical industry customers. Some of those customers are testing prototypes of the Max-One hooked into a plant’s piping to monitor processes in situ and in real time. The instrument could replace centralized sample analysis equipment. Other potential markets include defense, security, air quality, and medical diagnostics.

Whiting explains that the column-on-a-chip chemically separates analytes and delivers them to the firm’s proprietary MEMS device. It houses hundreds of resonating detectors that look like small tuning forks. As a sample passes over the resonators, “the vibration frequency of the little tuning forks changes because of the sample’s mass, and that is what we measure,” he says.

The technology for the MEMS chromatography chip was developed over the course of 20 years by scientists at the University of Michigan, Ann Arbor; Sandia National Laboratories; California Institute of Technology; and France’s Alternative Energies & Atomic Energy Commission, which has expertise in MEMS fabrication.

Jean-Pierre Braun, Apix’ chief executive officer, says GC instruments are a $3 billion-a-year market. “Much of it is for large lab-based equipment, which we don’t pretend to replace,” he says. “But we expect to open several new segments of the market with our analyzers,” which will be initially priced between $40,000 and $50,000.

Many of the bigger instrument companies are intrigued by the opportunities available through miniaturization. For instance, Thermo Fisher Scientific, the world’s second-largest scientific instrument maker, bought handheld spectrometer makers Niton, Polychromix, and Ahura Scientific in recent years, giving the firm expertise in semiconductor-based miniaturized X-ray fluorescence, near-infrared, and Raman analysis.

But Thermo Fisher managers are wary about jumping into newer technologies such as MEMS before they are ready for prime time. “Ten years ago, people thought MEMS were the next wave in instrumentation sensors,” says Daryl Belock, vice president for innovation and R&D collaboration at Thermo Fisher. But few MEMS chips were a fit for analytical instruments, and the cost to redesign successive iterations of MEMS sensors was excessive, he says.

In 2009, Thermo Fisher even bought Concept to Volume, a Dutch maker of a MEMS-based gas chromatograph. Thermo Fisher intended to sell the instrument for remote monitoring of natural gas lines, but the device didn’t meet customer needs, Belock says.

MEMS are a continuing area of interest, but Thermo Fisher is more focused on shrinking conventional instruments by using techniques such as 3-D printing to speed the development of prototypes, Belock notes. Getting MEMS to work in the guts of a scientific instrument is more suited to a start-up firm, he adds.

Apix’ Whiting admits that multiple MEMS fabrication runs to fix errors can be costly. In his firm’s case, “much of the early-generation trial-and-error work was done with U.S. and European development grants adding up to tens of millions of dollars over 20 years.”

Once the design of an electronic component is fixed, getting it from third-party fabricators is not at all difficult, notes Dennis Merrill, vice president for product development at Rigaku Raman, a maker of semiconductor-enabled handheld Raman, infrared, and UV spectrometers. The firm has adapted laser light sources widely used in the telecommunications industry for its instruments.

Rigaku leverages third-party fabrication facilities already set up to make thousands of light sources for optical fibers that transmit voice and data. An extra thousand units specially made to Rigaku’s standards are a drop in the bucket for the component suppliers, Merrill says.

However, he is not quite ready to accept a MEMS chip-based version of a UV or X-ray spectrometer. The challenge, he says, would be to get light into and out of a MEMS detector using fiber optics, which can’t be easily done now. As the technology improves, “chip-based detectors will be more interesting in another four to five years,” Merrill predicts.

One company convinced that MEMS chip-based instrument technology is ready for the market right now is mass spectrometer start-up Microsaic. It’s one of several firms targeting MS because the quadrupoles that the devices use to separate ions with different mass-to-charge ratios have resisted miniaturization so far.

“We are taking MEMS technology into the laboratory,” says Richard Moseley, the firm’s commercial manager. “We’re using etched silicon and glass wafers bonded together to align the rods of a quadrupole mass analyzer in a small package that fits in the palm of your hand.”

Packaged into a desktop unit about the size of two bread boxes, the Microsaic 4000, can fit easily under a laboratory hood coupled with a standard liquid chromatography system. The chip-based ionization module looks like an ink-jet printer cartridge, and the vacuum chip, which passes ions to the quadrupole chip, can be removed and cleaned to remove clogs.

Most mass spectrometers are much larger. Going from a conventional entry-level single-quadrupole analyzer to a lab-grade single-quadrupole Microsaic 4000 is like the shift in the 1970s from mainframe computers to desktops, Moseley says. The England-based firm develops its own MEMS chips and can manufacture prototypes in-house. However, it engages chip foundries to make the components it requires for commercial products.

Microsaic is a 2001 spin-off from Imperial College London’s optical and semiconductor devices group. The company, which went public in 2011 on the London Stock Exchange, is still getting off the ground and faces many of the same challenges that most start-ups experience as they grow. The firm lost nearly $3 million last year on revenues of less than $1 million.

The road to profitability for Microsaic is expansion into fields such as forensics and environmental monitoring, Moseley says. Another market is pharmaceutical quality control, where Microsaic is looking to adapt the instrument for installation on a production line. Partnerships figure into its expansion plans as well. Biotage is coupling its flash chromatography system with Microsaic’s spectrometer and selling the combination as the Isolera Dalton.

Also using semiconductor-based fabrication techniques to make a mass spectrometer is 908 Devices, a firm launched with technology developed at Oak Ridge National Laboratory and the University of North Carolina, Chapel Hill. CEO Kevin J. Knopp calls the ion trap core of the spectrometer, which fits between a thumb and forefinger, “a chiplike device.”

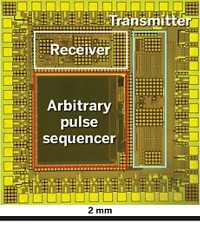

Rather than rely on silicon, 908 Devices uses a stack of electrodes to make up the ion-holding chamber. Integrated circuits patterned after cell phone processor chips power the unit, which is also packaged with a small high-pressure vacuum pump and software.

A prototype mass spectrometer the firm has developed for military applications “looks like a Nintendo Wii game controller and weighs just 3 lb, including a lithium-ion battery which can last all day,” Knopp says. Compare that with other field-portable mass spectrometers that can weigh as much as 40 lb, he says. The press of a button can identify the presence of explosives or toxic chemicals in a combat zone.

J. Michael Ramsey, one of the founders of the firm, started research into the technology behind the miniature mass spectrometer in the late 1990s while at Oak Ridge and continued when he moved to UNC. Ramsey’s earlier work on molecular imaging and microfluidic devices formed the basis for Caliper Life Sciences, which PerkinElmer bought in 2011 for $600 million. Knopp was a cofounder of Ahura Scientific, the handheld optical spectrometer maker that Thermo Fisher acquired in 2010.

“We see a multi-billion-dollar market for our spectrometers,” Knopp says. Other potential markets include food safety monitoring, industrial hygiene, and in-line process monitoring for chemical makers, he says.

So far, the U.S. government has provided $17 million in funding for Ramsey’s research in the form of grants to develop the miniature spectrometer. Private equity investors have put another $8 million into the firm, which is based in Boston. 908 Devices is looking for further investment to develop its spectrometer, Knopp says. “We think our future is bright,” he adds.

Another company, Advion, makes a range of compact mass spectrometers patterned after conventional devices. But the firm has also developed semiconductor fabrication technology for a miniaturized spray ionization emitter used to introduce samples into LC/MS systems made by firms such as Bruker, Waters, and Thermo Fisher.

Advion started work on the chip about 14 years ago, according to the firm’s president, David B. Patteson. Each chip, the size of a 35-mm slide, has up to 400 emitters. A single chip accommodates one of four emitter types that range in size from 5 µm for protein studies to 20 µm for lipids.

A machine dispenses the sample into the chip through an electrospray ionization injector. If the robot senses a plugged nozzle, it engages an adjacent unplugged port, “so you never have to lose a sample run,” Patteson says.

Miniaturization has also come to the world of nuclear magnetic resonance spectroscopy (NMR). For one thing, the large, power-hungry electromagnets used 20 years ago have been replaced by smaller rare-earth magnets for the latest generation of low-frequency portable benchtop NMR devices, says Andrew Coy, CEO of seven-year-old Germany- and New Zealand-based NMR instrument maker Magritek.

Advertisement

But another part of the story is the use of processor chips adapted from mobile phones and used to modulate, filter, and digitize NMR frequencies. The chips effectively replace two or three large circuit boards that the NMR device would otherwise require, Coy says, and help make the instruments affordable. A little less than $15,000 gets a scientist a 2-kHz unit principally aimed at the academic market.

Scientists at RWTH Aachen University, in Germany, and at Massey University and Victoria University of Wellington, both in New Zealand, developed Magritek’s technology, Coy explains, because they needed a unit they could take to the Antarctic for sea ice characterization. The firm is now exploring markets where its machine would help monitor the quality of goods produced in the chemical, oil and gas, and food industries.

Recalling the Dutch gas chromatography technology that Thermo Fisher tried to make work, LC/GC magazine columnist Hinshaw cautions that incorporating MEMS and other semiconductor-based technology into scientific instruments doesn’t guarantee success. “For me it comes down to one question: Can they get industry to adopt it?” Hinshaw says. If so, then several companies will have winners on their hands.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter