Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical Earnings Edge Up Despite Uneven Demand

Third Quarter: Firms look to internal strategies, restructuring to drive profits

by Melody M. Bomgardner

October 25, 2013

| A version of this story appeared in

Volume 91, Issue 43

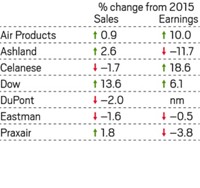

Third-quarter results from U.S. chemical firms show that the industry has found ways to increase profits despite wobbly global demand.

Executives at diversified companies such as Dow Chemical and DuPont told analysts that they have turned to “self-help” to grow earnings rather than waiting for stable economic growth. For example, they are shifting resources to high-margin product lines.

These strategies have helped companies claw back from the precipitous declines seen in last year’s third quarter. Dow raised earnings by 20.5%, to $599 million, this year compared with a 31.8% drop in the year-ago quarter. Overall, the company saw sales edge up by less than 1%, but prices were 3% higher across its businesses.

The results show Dow’s “ability to execute in the face of uncertainty,” CEO Andrew N. Liveris told analysts in a conference call. The global business environment still has not stabilized, he reported.

Demand for Dow’s products was highest in its agriculture, performance plastics, and coatings segments. Geographically, product volumes sold in developing economies grew only 2%—a slower rate than in previous quarters—led by Latin America. Volumes in Europe shrank 6%, partly related to capacity shutdowns.

Liveris provided new details on Dow’s divestment plans; he said the company is targeting businesses worth $3 billion to $4 billion, including chlorine derivatives, epoxies, and low-margin polyurethanes.

DuPont is another company with a big business on the block—its performance chemicals segment. The firm’s quarterly results did not bring new information about the sale process, but they did reveal that lower prices for titanium dioxide crushed the segment’s operating earnings and swamped gains in electronic chemicals, performance materials, industrial biosciences, and safety products. Overall, earnings increased 2.6% to $359 million compared with the year-ago quarter.

In a conference call with analysts, DuPont CEO Ellen J. Kullman pointed out that sales in developing Asian countries were up 14%. She said strong demand for DuPont’s performance materials from China’s automotive sector was proof that local attention to customer needs is paying off.

Europe is finally showing signs of a pickup in demand, says John Roberts, a stock analyst at investment bank UBS. DuPont’s volumes in the region were up 10%, which Kullman attributed to growth in Eastern Europe.

Looking ahead, the fourth quarter is normally the slowest of the year for chemical consumption. But industry trade group American Chemistry Council says its Chemical Activity Barometer increased by 0.3% in October compared with September. ACC Chief Economist T. Kevin Swift says trends for inventories, orders, and production suggest consumer demand and business confidence are strengthening.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter