Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

DSM Strikes A Deal With CVC For Polymer Intermediates Business

Dutch firm furthers transformation by forming new company with investment firm CVC

by Michael McCoy

March 19, 2015

| A version of this story appeared in

Volume 93, Issue 12

Continuing to move away from its industrial chemical roots, the Dutch firm DSM has signed a deal to put its polymer intermediates and composite resins businesses into a new company run by the investment firm CVC Capital Partners.

The yet-to-be-named firm will be owned 65% by CVC and 35% by DSM. It will have annual sales of more than $2 billion and close to 2,000 employees. DSM expects a net of up to $370 million from the deal.

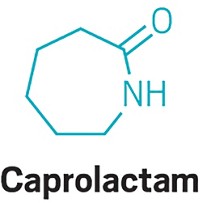

More than 60% of the new firm’s sales will be of caprolactam, a nylon 6 raw material that DSM has made for 60-plus years. Its other products will be the intermediate acrylonitrile and polymers such as unsaturated polyester and vinyl esters used to make fiberglass composites.

DSM put the businesses up for sale last November, saying they no longer fit its focus on nutritional ingredients and performance materials. However, DSM will continue to buy caprolactam from the new company for use by the performance materials business, one of the world’s largest producers of nylon 6.

Last summer, Third Point, an activist investment firm that owns a stake in DSM, suggested that the Dutch company should also exit performance materials and become a pure-play supplier of nutritional ingredients. DSM CEO Feike Sijbesma has resisted the argument.

For DSM, the strategy of putting an unwanted business into a joint venture is tried and true. Almost exactly a year ago it completed the formation of DPx Holdings, a company that combines DSM’s pharmaceutical chemicals business with the drug services firm Patheon. DSM owns 49% of DPx.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter