Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Business

Chemical earnings beat expectations

Consumer demand made up for lower prices in the first quarter

by Melody M. Bomgardner

April 29, 2016

| A version of this story appeared in

Volume 94, Issue 18

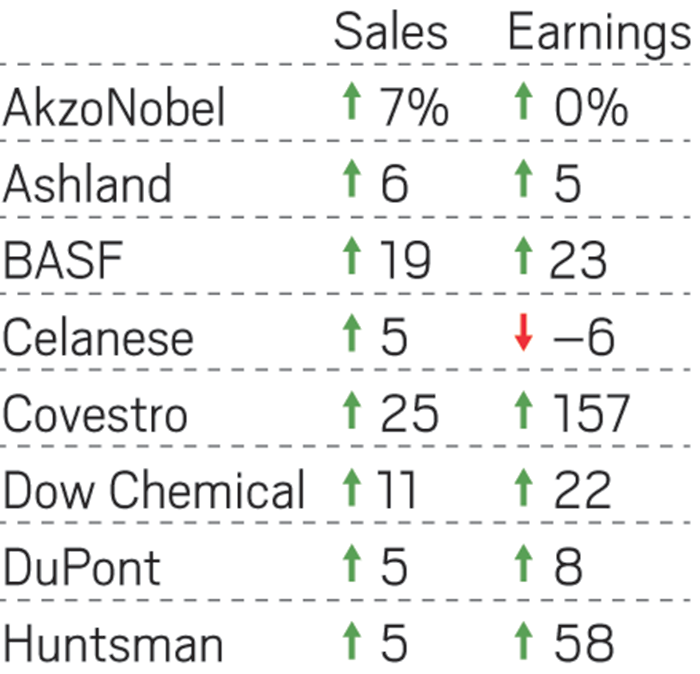

Note: Percent change over first-quarter 2015.

nm = not meaningful Source: Companies

Note: Percent change over first-quarter 2015.

nm = not meaningful Source: Companies

Sales growth was spotty for the chemical industry in the first quarter of 2016, but most companies beat earnings expectations by successfully adjusting to volatile demand and low prices.

As a group, chemical firms in both the U.S. and Europe emphasized their sales of high-margin specialty chemicals and materials aimed at the consumer markets, where demand has been strong. The goal has been to more than make up for lower sales of basic chemicals, where prices have slid because of bottom-of-the-barrel commodity costs.

At Dow Chemical, the commodity glut, a down market in agriculture, and the impact of a strong dollar pushed sales for the quarter down 18% compared with last year. Still, earnings grew 6% to $993 million, beating expectations, thanks to Dow’s “integrated specialty chemicals businesses and our broad geographic footprint,” said CEO Andrew N. Liveris in a call with analysts.

Liveris pointed out that Dow’s sales grew by 13% in India and 5% in China. Sales even picked up in Europe, where demand has lagged in recent years. Overall, the firm benefited from strong global demand for performance plastics, elastomers, and specialty materials used in construction and automotive manufacturing.

The prospect for a speedy merger between Dow and rival DuPont dimmed a bit: Liveris pegged the deal’s closing at sometime in the second half of the year. When the firms announced the deal in December 2015, their goal was the end of the second quarter.

DuPont also had a stronger-than-expected quarter. Though overall sales shrank 6% and earnings eroded 2% to just over $1 billion, the firm’s large agriculture segment performed well in a difficult market. Farmers started their spring season early and planted many more acres than last year with DuPont seed.

At both DuPont and DSM, strong sales of nutrition products boosted results. DuPont’s isolated soy protein, probiotics, and yogurt cultures were all winners. DSM’s increase in sales for the quarter was due largely to a turnaround in its human nutrition business.

Emerging market demand for paint ingredients and consumer care specialties drove earnings up 11% at Clariant. AkzoNobel reported high demand for paints, pushing first-quarter earnings up 50% compared with last year.

Low prices for basic chemicals hindered earnings growth at Huntsman Corp. and Ashland, though productivity improvements helped both firms beat analyst expectations. Huntsman saw prices sink for most products, including polyurethanes and the white pigment titanium dioxide.

At Ashland, sales of industrial specialties were down compared with last year, but the company enjoyed vigorous demand for ingredients used in consumer-oriented markets such as pharmaceuticals, hair care, and coatings. Ashland’s retail motor oil and service brand Valvoline saw earnings rise 8%. It plans to spin off that business by the end of the year.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter