Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

C&EN’s Global Top 50 chemical companies of 2015

Sales are down in the low oil price environment, but profits are soaring

by Alexander H. Tullo

July 25, 2016

| A version of this story appeared in

Volume 94, Issue 30

Update

To read the current Global Top 50 Chemical Companies article, please click here

The dollar is strong, oil is cheap, and the global economy is trudging along. Those dominant economic themes are reflected in the current installment of C&EN’s Global Top 50 chemical companies.

Click here for a PDF download of the full Global Top 50 table.

Sales are down dramatically for the Global Top 50. The 50 companies combined for $775.2 billion in sales for 2015, the year on which the survey is based. The figure is a 10.8% decline from what the same firms posted a year earlier.

Profits, however, went in the other direction. The 44 companies in the Global Top 50 that post profit figures reported a total of $96.7 billion, a 15.1% increase from a year earlier. Profit margins for the same firms increased to 13.5% from 10.6%. No company on the list lost money in 2015. It turns out that 2015, though unusual, wasn’t a bad year for chemical companies.

Oil prices averaged about $49 per barrel in 2015, down from $93 in 2014, according to the Energy Information Administration. These lower oil prices pulled down chemical prices, but they also gave chemical companies a break on feedstock costs. On balance, lower oil prices have been good for chemical makers, especially those in Asia and Europe, which had been losing out to natural-gas-based chemical makers in the U.S. and the Middle East.

Another factor influencing the ranking is the strong dollar. In 2014, a euro cost $1.33 on average. In 2015, it cost $1.11. Other major currencies such as the Japanese yen and the South Korean won also decreased in value against the dollar. Currency strength impacts the ranking because C&EN converts foreign company sales from their local currency to dollars.

This year’s Global Top 50 lineup is somewhat changed from last year. Gone from the list is Shell Chemicals, which failed to provide C&EN with a sales figure for its chemical business. Sales declines pushed BP, Tosoh, and Siam Cement off the list.

A new company that made the ranking is the Bayer spin-off Covestro. Other new faces include Lubrizol, Honeywell, and Potash Corp. of Saskatchewan. Interestingly, these three firms all report their results in the strong U.S. dollar.

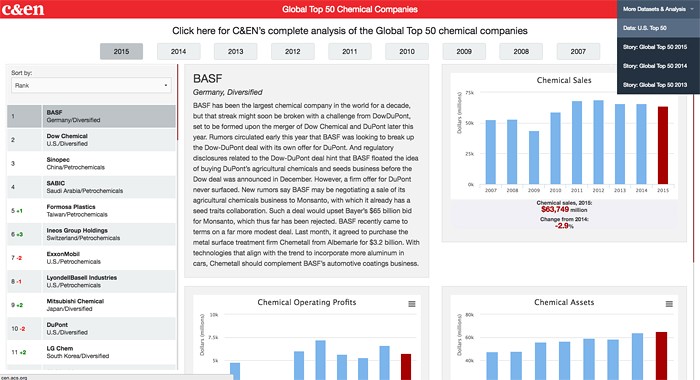

1 BASF

2015 Chemical Sales: $63.7 billion

BASF has been the largest chemical company in the world for a decade, but that streak might soon be broken with a challenge from DowDuPont, set to be formed upon the merger of Dow Chemical and DuPont later this year. Rumors circulated early this year that BASF was looking to break up the Dow-DuPont deal with its own offer for DuPont. And regulatory disclosures related to the Dow-DuPont deal hint that BASF floated the idea of buying DuPont’s agricultural chemicals and seeds business before the Dow deal was announced in December. However, a firm offer for DuPont never surfaced. New rumors say BASF may be negotiating a sale of its agricultural chemicals business to Monsanto, with which it already has a seed traits collaboration. Such a deal would upset Bayer’s $65 billion bid for Monsanto, which thus far has been rejected. BASF recently came to terms on a far more modest deal. Last month, it agreed to purchase the metal surface treatment firm Chemetall from Albemarle for $3.2 billion. With technologies that align with the trend to incorporate more aluminum in cars, Chemetall should complement BASF’s automotive coatings business.

2 Dow Chemical

2015 Chemical Sales: $48.8 billion

Dow Chemical is leading the chemical industry into the largest structural changes it has seen in more than a decade. Its $130 billion merger with DuPont will create a behemoth that would have had nearly $70 billion in 2015 chemical sales, enough to consider the new company, DowDuPont, the largest chemical company in the world. And that’s without Dow’s absorption of Dow Corning, completed last month, which adds more than $4 billion in sales to its top line. But DowDuPont isn’t being built to last. Within two years of its formation, it is set to fragment into three firms—a material science company, a specialty products firm, and an agrochemical giant—each of which has the heft to make it into the Global Top 50. The Dow-DuPont merger is helping instigate other transactions. It isn’t a coincidence that ChemChina’s pending purchase of Syngenta and Bayer’s offer for Monsanto were both unveiled after the merger announcement. Yet another Dow-related transaction could have an impact on the Global Top 50. Dow’s sale of its chlorine business to Olin last year could propel Olin, which will soon have about $7 billion in annual sales, into the ranking.

3 Sinopec

2015 Chemical Sales: $43.8 billion

A big decline in the price of oil and related raw materials last year pinched chemical revenues at Sinopec, as it did for many other firms. At the same time, the lower raw material prices helped Sinopec, China’s largest chemical company, return to profitability last year. Wang Yupu, Sinopec’s chairman, expects 2016 to be another tumultuous year. “Looking ahead, the global economy is expected to be characterized by slow growth, weak international trade, low inflation, sluggish investments, and high levels of debt,” he wrote in the company’s most recent annual report. “The Chinese economy may face downward pressure while maintaining its moderate growth.”

4 SABIC

2015 Chemical Sales: $34.3 billion

In the 2000s, Saudi Basic Industries Corp. led the Middle Eastern building boom by spending billions of dollars on petrochemical projects in its home country, which is blessed with an abundance of cheap natural gas feedstocks such as ethane. Now, as that supply gets tighter, the company is interested in diversification. SABIC and Shenhua Ningxia Coal Industry Group are studying whether to build a coal-to-chemicals plant in China’s interior. SABIC and Saudi oil giant Saudi Aramco are studying a crude-oil-to-chemicals complex in Saudi Arabia. Separately, SABIC and Aramco recently denied rumors that they might merge as part of Saudi Arabia’s economic modernization effort.

5 Formosa Plastics

2015 Chemical Sales: $29.2 billion

The Taiwanese chemical maker Formosa Plastics Group has a healthy appetite for massive U.S. projects that tap into low-cost shale natural gas. U.S. affiliate Formosa Plastics USA is already building an ethylene cracker and propane dehydrogenation plant in Point Comfort, Texas. Last year, another affiliate, Formosa Petrochemical, unveiled a study of a $9.4 billion petrochemical complex that would be built in St. James, La., in two phases spanning about a decade.

6 Ineos

2015 Chemical Sales: $28.5 billion

The past year has been productive for Ineos, which has rocketed up C&EN’s ranking from number nine in 2015. Ineos took over BASF’s share of the Styrolution styrenic resins joint venture late in 2014. And the company just completed acquiring Solvay’s stake in the Inovyn polyvinyl chloride joint venture, two years ahead of schedule. Ineos’s ethylene cracker in Norway recently received its first shipment of ethane extracted from low-cost U.S. shale gas. Similar deliveries will soon reach Ineos’s cracker in Scotland, where the company is restarting an ethylene unit that has been idle since 2008.

7 ExxonMobil

2015 Chemical Sales: $28.1 billion

As the chemical arm of one of the world’s largest oil companies, ExxonMobil Chemical can capitalize on opportunities where they arise. In Texas, the company is building an ethylene cracker and downstream polyethylene plants to take advantage of inexpensive natural gas. In Singapore, where it operates one of its largest chemical and refining facilities, ExxonMobil recently started up a cracker that can process crude oil directly. The company’s R&D organization also has been active. In April, ExxonMobil launched the Exceed XP line of “extreme performance” polyethylene, which allows plastics converters to make film more efficiently and with less material than they can with conventional polyethylene.

8 LyondellBasell Industries

2015 Chemical Sales: $26.7 billion

In 2014, when activist investor Daniel Loeb was trying to instigate a breakup of Dow Chemical, he issued a report comparing Dow unfavorably to LyondellBasell Industries. Dow could earn $2.5 billion per year more, Loeb asserted, if it was more like Lyondell. Lyondell is among the most fiscally conservative of the large chemical makers and a rarity in that it hasn’t launched a grassroots ethylene cracker project in the U.S. But through incremental improvement projects over the past several years, Lyondell has managed to increase its capacity by 20%, adding roughly a cracker’s worth of output more quickly and cheaply than competitors. “I am confident that we are building a company that will remain the benchmark for operational excellence and financial performance,” noted CEO Bhavesh V. (Bob) Patel in his annual letter to shareholders.

9 Mitsubishi Chemical

2015 Chemical Sales: $24.3 billion

Mitsubishi Chemical Holdings’ industrial gas unit, Taiyo Nippon Sanso, is making inroads into the North American market through its recent purchase of air separation, nitrous oxide, and carbon dioxide plants from Air Liquide, which was required to sell the units to quell antitrust concerns over its takeover of Airgas. Taiyo Nippon Sanso, the world’s fifth-largest industrial gas maker, also made acquisitions in Thailand and Australia. Mitsubishi Chemical, meanwhile, has completed formation of an ethylene joint venture in Mizushima, Japan, with Asahi Kasei. In another potential Japanese consolidation move, Mitsubishi Rayon is negotiating an acrylonitrile-butadiene-styrene merger with Japanese rivals Ube Industries and JSR.

10 DuPont

2015 Chemical Sales: $20.7 billion

In a few months, the DuPont we have known since 1802 will be no more. It will merge with Dow Chemical to form DowDuPont and eventually be scattered among three new spin-off firms. But the DuPont name, at least, will live on in one of them—the agricultural chemicals and seeds firm, which will retain headquarters in Wilmington, Del. So will the specialty products firm that will spin out of DowDuPont. That firm, with products such as Kevlar and Corian, will have a hefty dose of DuPont lineage. But it isn’t the merger alone that will forever alter DuPont. Simultaneous with the merger announcement in December came the disclosure that DuPont was cutting 10% of its workforce of 54,000. As part of that program, the company “redesigned” its storied Central R&D operation into a smaller Science & Innovation unit.

11 LG Chem

2015 Chemical Sales: $18.2 billion

LG Chem is another firm that has gotten into the agrochemical mergers and aquisitions act, though not nearly at the same scale as rivals such as Bayer, ChemChina, Syngenta, Dow Chemical, and DuPont. LG is paying $432 million to acquire Dongbu Farm Hannong, which produces generic crop protection chemicals, seeds, and fertilizers in South Korea. Elsewhere in LG, managers have high expectations for the firm’s expanding lithium-ion battery business.

12 Air Liquide

2015 Chemical Sales: $17.3 billion

The French industrial gas giant nabbed a coveted gas property earlier this year with its $13.4 billion acquisition of Airgas. The purchase of the U.S. player diversified Air Liquide geographically. It also added a retail gas business to a firm traditionally focused on large industrial clients. The deal should secure Air Liquide’s position as the world’s largest industrial gas company, comfortably ahead of Linde. The synergy between Air Liquide and Airgas comes at a price. Air Liquide paid about twice what Air Products & Chemicals was willing to pay in its failed 2011 bid for Airgas.

13 Linde

2015 Chemical Sales: $16.8 billion

Linde hasn’t made a big-ticket acquisition like Air Liquide, its main European industrial gas rival. The German firm’s largest transaction over the past year was its purchase of American HomePatient, set to add about $280 million to its annual sales. Linde is expanding much-needed neon capacity at its facility in La Porte, Texas. Another development comes from its engineering unit, which is testing out a “dry reforming” process to make carbon monoxide and hydrogen from methane and carbon dioxide.

14 AkzoNobel

2015 Chemical Sales: $16.5 billion

In recent years, AkzoNobel has been one of the quietest of the big chemical names. However, earlier in 2016, it agreed to purchase BASF’s industrial coatings division for about $500 million. The acquisition strengthens Akzo’s business in coatings for sheet metal used to fabricate objects such as washing machines and refrigerators. In May, the company opened an R&D center in Shanghai that employs 150 scientists.

15 Toray Industries

Advertisement

2015 Chemical Sales: $15.5 billion

Already the world’s largest carbon fiber company, Toray Industries recently expanded a supply agreement with Boeing that will give it $11 billion in business over the next 10 years supplying materials for Boeing’s 787 Dreamliner and other aircraft. To help it fill these orders, the company plans to spend $400 million on carbon fiber precursor, carbon fiber, and resin-impregnated fabric manufacturing in Spartanburg, S.C. Toray may eventually invest as much as $1 billion in the facility.

16 Evonik Industries

2015 Chemical Sales: $15.0 billion

Evonik Industries appears to be making an ideal acquisition in its pending $3.8 billion purchase of Air Products & Chemicals’ performance materials business. Klaus Engel, Evonik’s CEO, called the purchase, his company’s largest ever, “an excellent and complementary fit with Evonik on all levels.” Indeed, nearly all the businesses it is getting in the transaction are closely related to ones it already has. For example, Air Products’ wetting agents for coatings complement Evonik’s dispersants and specialty silicas for paint. Separately, Evonik says R&D initiatives will add more than $1 billion to its sales by 2025.

17 PPG Industries

2015 Chemical Sales: $14.2 billion

PPG Industries is getting the lead out, literally. In May, the company said it would join rival AkzoNobel and remove all lead from its paint, by 2020 in its case. Although lead hasn’t been present in consumer products sold in the U.S. for decades, it is still used in yellow and orange pigments in some industrial coatings. In another environmentally friendly move, PPG began a study with the tire maker Bridgestone into the use of PPG’s Agilon modified precipitated silicas to produce tires that can improve fuel efficiency by up to 6%.

18 Braskem

2015 Chemical Sales: $14.2 billion

Brazil’s largest chemical maker has been able to avoid the misfortunes of its home country. Although Brazil is plagued by economic hardship, scandal, and political turmoil, the collapse of Brazil’s currency, the real, and the fall in oil prices have protected Braskem from cheap U.S. imports and helped make its Brazilian operations more competitive. Moreover, the company started an ethylene and polyethylene joint venture in Mexico, giving it a new low-cost foothold in the NAFTA region. Braskem is also investing $100 million to convert 15% of its chemical production in Camaçari, Brazil, to shale-based ethane imported from the U.S.

19 Yara

2015 Chemical Sales: $13.9 billion

Yara managed to increase sales and earnings in 2015 even though the company faced weak fertilizer markets and production downtime. A pair of Latin American acquisitions lifted regional results. Now, with an ammonia joint venture with BASF under construction in Texas, the company is preparing for its next growth spurt. The proposed merger between CF Industries and OCI would have challenged Yara’s status as the world’s largest publicly traded fertilizer maker, but new U.S. Treasury Department tax rules against corporate tax inversions scuttled that deal.

20 Covestro

2015 Chemical Sales: $13.4 billion

The former Bayer MaterialScience business debuts in C&EN’s ranking this year after being spun off from Bayer on Sept. 1, 2015, and later floated on Frankfurt’s stock exchange. Bayer still owns about 64% of the company’s shares, but it aims to eventually sell them. Covestro has engaged in some restructuring since it became independent, including closing its Tarragona, Spain, methylene diphenyl diisocyanate plant because of high costs and a lack of reliable chlorine supply. The company has also hit some positive milestones. In Dormagen, Germany, it opened a plant to make polyols in part from carbon dioxide.

21 Sumitomo Chemical

2015 Chemical Sales: $13.3 billion

Sumitomo spent the past year beefing up its agrochemical business. Last month, it bought a majority stake in India’s Excel Crop Care to get a foothold in that country’s bustling market. Sumitomo’s Valent USA crop protection division is spending $22 million on a research center in Libertyville, Ill. The Japanese company is also building a research center in São Paulo, Brazil.

22 Reliance Industries

2015 Chemical Sales: $12.9 billion

By this time next year, India’s largest chemical producer could be receiving vessels from the U.S. laden with cheap shale-derived ethane feedstock for ethylene production. Otherwise, Reliance Industries has been focusing on its polyester business. The company recently commissioned new capacity for polyethylene terephthalate and its key raw material, purified terephthalic acid (PTA), in Dahej, India. Next year, the company will complete a project to double its capacity for p-xylene, a PTA raw material.

23 Solvay

2015 Chemical Sales: $12.3 billion

Belgium’s premier chemical maker closed on its purchase of Cytec Industries at the end of last year. The U.S. maker of composite materials will bolster Solvay’s business in materials for aircraft and enhance its high-end polymers business. Earlier this month, Solvay sold its stake in the Inovyn chlorovinyls joint venture to Ineos, completing its exit two years ahead of schedule. The company also inked an agreement to sell Solvay Indupa, its South American chlorovinyls business, to Brazil’s Unipar Carbocloro.

24 Bayer

2015 Chemical Sales: $11.5 billion

Bayer is a vastly changed company from a year ago. In September, it spun off its MaterialScience business. The new polyurethane and polycarbonate company, called Covestro, debuts at 20th on the C&EN ranking. Bayer named a new chairman, Werner Baumann. He is taking over from Marijn Dekkers, who left for the top post at the consumer products giant Unilever. Baumann quickly got down to business, making an unsolicited $62 billion takeover offer for Monsanto. Bayer upped the offer to $65 billion two weeks ago. The bids follow other agricultural chemical and seed deals such as Dow Chemical’s impending merger with DuPont and ChemChina’s upcoming purchase of Syngenta.

25 Mitsui Chemicals

2015 Chemical Sales: $11.1 billion

The past year continued a consolidation theme for Mitsui Chemicals. This year, the company closed a toluene diisocyanate plant in Kashima, Japan. The company is also closing a methylene diphenyl diisocyanate facility in Omuta, Japan. Earlier, Mitsui closed phenol and bisphenol A plants. However, the Japanese firm is also expanding in places. For instance, it is starting up an aliphatic isocyanate plant in Omuta next month.

26 Praxair

2015 Chemical Sales: $10.8 billion

Praxair has prospered by sticking to its knitting. The Danbury, Conn.-based industrial gas maker is consistently among the most profitable of the Global Top 50. The company has tended to grow organically through capital spending initiatives. This year has been unusual for the company in that it made an acquisition, albeit a small one. It purchased Yara’s European carbon dioxide business, as well as Yara’s 34% stake in the Yara Praxair Holding industrial gas joint venture, for $360 million.

27 Shin-Etsu Chemical

2015 Chemical Sales: $10.6 billion

Shin-Etsu Chemical, one of the best-performing Japanese chemical companies, saw profits climb once again in 2015. Polyvinyl chloride-related profits from its U.S. arm Shintech ebbed after several soaring years. But Shin-Etsu’s semiconductor silicon unit pressed ahead with a strong year. In April, the company tapped former Shintech head Yasuhiko Saitoh as its new president.

28 Lotte Chemical

2015 Chemical Sales: $10.4 billion

The past year brought another round of audacious moves from the South Korean petrochemical maker. In October, Lotte inked an agreement to purchase Samsung SDI’s styrenic resins and polycarbonate business for $2.5 billion. It has a separate $200 million deal to buy Samsung SDI’s fine chemicals unit. Other big deals in recent years include its purchases of Malaysia’s Titan Chemicals and South Korea’s Lotte Daesan Petrochemical. Lotte even attempted a white-knight bid for U.S.-based vinyls maker Axiall. However, Axiall and its initial suitor, Westlake Chemical, eventually came to terms in a $3.8 billion agreement.

29 Huntsman Corp.

2015 Chemical Sales: $10.3 billion

Job number one at Huntsman is to improve its titanium dioxide business. The company would have had one of its strongest years ever in 2015 were it not for the $223 million its pigments business lost. TiO2 is a large operation for Huntsman because it bought Rockwood Holdings’ business in 2014 with the intention of combining it with its own pigment business and spinning the whole thing off. In an effort to fix the enlarged operation, the company shuttered TiO2 capacity in France and will close its smallest plant, in South Africa, later this year. It still is looking to carve out the business at the earliest opportunity.

30 Syngenta

2015 Chemical Sales: $9.9 billion

In 2015, Monsanto offered $47 billion to acquire Syngenta. The Swiss firm turned the offer down, but the overture touched off deal talk throughout agricultural chemicals. The Dow-DuPont merger prospectus implies that DuPont had considered a bid of its own for Syngenta before it inked its deal with Dow in December. In February, Syngenta accepted a lower, though all-cash, offer of $43 billion from ChemChina. In a television interview, Syngenta Chairman Michel Demaré noted the appeal of continuing as a stand-alone company after the Chinese conglomerate takes over. “This is not a transaction about cost synergy,” he said, noting that Syngenta will be well-positioned to tap into growth in China’s agricultural sector.

31 DSM

2015 Chemical Sales: $9.9 billion

Advertisement

DSM has been under pressure from activist investor Daniel Loeb to spin off its materials business and focus on its nutrition unit. The company did form a joint venture for its chemical intermediates and composite resins operations last year, but it intends to keep polymers. Meanwhile, the nutrition business Loeb thinks is a keeper faced headwinds last year as markets for vitamin E and omega-3 fatty acids weakened. This prompted a warning from Moody’s that it might downgrade DSM’s credit rating.

32 Air Products & Chemicals

2015 Chemical Sales: $9.9 billion

It appears as though CEO Seifi Ghasemi’s plan to focus Air Products & Chemicals entirely on industrial gases is falling into place. The company had intended to spin off its chemical business as a new company, Versum Materials. Instead, it struck a deal to sell a big chunk of it to Evonik Industries. Versum is still being spun off, but as a pure-play electronic materials supplier. Air Products also abandoned plans to run a plasma gasification waste-to-energy facility in Tees Valley, England, taking a $1 billion write-off for money it sunk into the project.

33 Eastman Chemical

2015 Chemical Sales: $9.6 billion

Eastman has been fairly quiet since it acquired alkylamines specialist Taminco in late 2014. The added sales helped Eastman boost revenues in 2015, bucking an industry-wide trend and helping it ascend C&EN’s ranking from number 39 a year ago. Since the purchase, Eastman has undertaken only minor housecleaning. The company divested a stake in an acetate flake joint venture to partner Solvay. It also retained a financial adviser to sell its excess ethylene capacity in Longview, Texas.

34 Chevron Phillips Chemical

2015 Chemical Sales: $9.2 billion

Chevron Phillips Chemical was among the first companies out of the gate with a Gulf Coast ethylene cracker project meant to take advantage of cheap U.S. shale gas. At the American Chemistry Council’s annual meeting earlier this year, CEO Peter Cella said the plant would start up on time and on budget next year. He added that the downturn in oil- and gas-related construction was providing some relief to the shortage of skilled laborers such as welders, who are in high demand on the Gulf Coast for chemical projects.

35 Mosaic

2015 Chemical Sales: $8.9 billion

Mosaic is suffering from a cyclical decline in fertilizer markets. Operating profits were down about 12% in 2015 on flat sales. The company is thus in cost-cutting mode. During the first quarter of this year, Mosaic cut phosphate production by 400,000 metric tons through rolling outages. The company is also idling a potash mine in Saskatchewan.

36 Lanxess

2015 Chemical Sales: $8.8 billion

It might be appropriate to think of Lanxess as a turnaround story and assign credit to Matthias Zachert, who took over as CEO in 2014 and cut $160 million in costs in his first year. The company’s $638 million in 2015 operating profits is a 41% improvement from the year before. Additional cuts are in the works. Lanxess also reaped $1.3 billion by selling Saudi Aramco half of its synthetic rubber business, which now operates as a joint venture named Arlanxeo. Lanxess is expanding its Saltigo fine chemicals business and acquiring Chemours’s disinfectants business.

37 Borealis

2015 Chemical Sales: $8.5 billion

Like other European petrochemical producers, Borealis is eager to tap into the cheap shale gas available in the U.S. By the end of the year, Borealis will be shipping ethane from Marcus Hook, Pa., to its ethylene cracker in Stenungsund, Sweden. Thought of mostly as a polyolefins producer, the company also has been growing its fertilizers business in recent years and is still considering building a joint-venture fertilizer plant on the Texas Gulf Coast.

38 Arkema

2015 Chemical Sales: $8.5 billion

The French specialty chemical maker has been relatively quiet since it purchased the Bostik adhesives business from its former parent, Total, last year. One move is the planned sale of its activated carbon business to Calgon Carbon for $160 million. Arkema has been more active on the R&D front. With Brewer Science, it is developing polystyrene-polymethylmethacrylate block copolymers for use in directed self-assembly methods of making ultrathin circuit lines. It is also partnering with HP to develop three-dimensional printing materials.

39 Asahi Kasei

2015 Chemical Sales: $8.5 billion

Asahi Kasei has been embroiled in a scandal over a business that has little to do with chemicals. Last October, residents of Yokohama, Japan, noticed their apartment tower was leaning. This led to the revelation that Asahi Kasei Construction Materials had falsified data on hundreds of projects around Japan. Asahi’s president, Toshio Asano, was forced to step down. It hasn’t been all bad news at Asahi. In March, the company announced it was spending $26 million to consolidate research activities in Mizushima, Japan. It expects to complete a six-floor R&D facility in a year.

40 Sasol

2015 Chemical Sales: $8.3 billion

Sasol’s massive project in Lake Charles, La., is a good example of how the cost of projects in the U.S. petrochemical building boom can escalate. The company says the ethylene cracker and derivatives plant will cost $11 billion, up from last year’s estimate of about $8 billion and much higher than the $4.5 billion Sasol said the project would cost when it was unveiled in 2011. Sasol has spent $4.5 billion on construction so far, and it is only 40% complete. The company blames rising labor, raw materials, and contract costs.

41 SK Innovation

2015 Chemical Sales: $8.2 billion

SK’s results were typical for Asian petrochemical makers in 2015. Sales were down considerably—nearly 27% in SK’s case—because of lower prices. However, low oil prices drove prices for naphtha feedstocks down even more, allowing the South Korean company to post a 20% increase in profits.

42 DIC

2015 Chemical Sales: $7.1 billion

DIC has a new strategic plan, “DIC108,” that calls for the company to increase sales 17% by 2018. In the report, released in February, the Japanese company pledged to cultivate next-generation business in areas such as printed electronics, gas-barrier materials, healthy foods, and algae-derived oils. Last September, it opened a $2 million algae research center in Calipatria, Calif.

43 Hanwha Chemical

2015 Chemical Sales: $7.1 billion

Hanwha’s 0.2% decline in sales was minuscule compared with most other petrochemical firms. The South Korean company did experience large sales declines at most of its petrochemical businesses. However, revenues at Hanwha’s photovoltaic materials unit jumped 30%, nearly offsetting the pullback elsewhere.

44 Lubrizol

Chemical sales: $7.0 billion

Lubrizol makes C&EN’s ranking for the first time this year. Since Berkshire Hathaway, a holding company run by investor Warren Buffett, bought Lubrizol in 2011, it has been a platform for Berkshire to bolt on small acquisitions. For example, it recently purchased Diamond Dispersions, a British producer of water-based dye and pigment dispersions, and Particle Sciences, a Pennsylvania-based contract drug formulation and production company. Lubrizol’s architect, James L. Hambrick, is stepping down at the end of 2016 after leading the firm for 14 years. He is being replaced by Eric R. Schnur, currently chief operating officer.

45 Ecolab

2015 Chemical Sales: $6.9 billion

Ecolab has been fairly quiet since acquiring Nalco in 2011 and Champion Technologies in 2013. The Ecolab revenues that C&EN counts as chemical sales are mostly from the old Nalco Chemical. The Nalco name lives on in the company after five years under Ecolab ownership. Ecolab’s oil-field chemicals unit is known as Nalco Champion and its water treatment chemicals division goes by Nalco Water.

46 Indorama

2015 Chemical Sales: $6.9 billion

Indorama has grown quickly in polyethylene terephthalate (PET) fibers and resins over the past decade through bold capital expansions and large acquisitions. Now the Thai company is moving forcefully into PET’s main raw material, purified terephthalic acid (PTA). Earlier this year, Indorama agreed to purchase BP’s PTA plant in Decatur, Ala., which is adjacent to one of its own PET units. Before then, the company purchased PTA plants in Spain and Quebec from the Spanish energy and chemicals firm Cepsa.

47 Johnson Matthey

2015 Chemical Sales: $6.5 billion

The British catalyst and fine chemicals maker has been pushing increasingly into areas of novel chemistry. Last month, it bought MIOX, which makes on-site bleach generators for water treatment. In April, it launched a collaboration with Domainex to provide small-molecule drug discovery and development services in the U.K. However, Matthey was forced to cut some 70 positions late last year because of low oil prices and an economic slowdown in China.

48 Honeywell

2015 Chemical Sales: $6.5 billion

Honeywell squeaked into the Global Top 50 this year. The company’s chemical results include its licensing and catalyst arm, UOP, as well as its traditional nylon and fluorochemical businesses. But 2016 will likely be the company’s only appearance in the ranking. Honeywell plans to spin off its caprolactam and nylon business, which has about $1.3 billion in annual sales, into a new firm to be called AdvanSix.

49 PTT Global Chemical

2015 Chemical Sales: $6.4 billion

Advertisement

The Thai petrochemical maker recently advanced its proposed multi-billion-dollar ethylene cracker project in Mead Township, Ohio, by selecting Fluor and Bechtel as contractors. PTT has set aside a $100 million budget for front-end design and engineering. The company, which has a controlling stake in Myriant and owns half of NatureWorks, derives $435 million of its sales, 6% of its total, from biobased chemicals, including oleochemicals.

50 PotashCorp

2015 chemical sales $6.3 billion

The last company in C&EN’s ranking, Potash Corp. of Saskatchewan, has been suffering a downturn in the potassium fertilizer market. It also met a couple of setbacks over the past year. It is suspending operations at a new potash mine in New Brunswick, Canada, after spending $2 billion on it. And the company had to withdraw its $8.7 billion offer to buy K+S after management at the German potash and salt maker showed no interest in allowing their company to be acquired.

Global Top 50 PDF Table

For the 10th time, BASF leads the ranking, but Dow Chemical’s merger with DuPont might soon change that. Click here for a PDF download of the full Global Top 50 table.

Spending

BASF leads the Global Top 50 in both capital and R&D investment.

| CHEMICAL CAPITAL SPENDING | CHEMICAL R&D SPENDING | |||||

|---|---|---|---|---|---|---|

| 2015 ($ MILLIONS) | % CHANGE FROM 2014 | % OF CHEMICAL SALES | 2015 ($ MILLIONS) | % CHANGE FROM 2014 | % OF CHEMICAL SALES | |

| Air Liquide | $2,172 | 8.40% | 12.50% | $313 | 1.40% | 1.80% |

| Air Products & Chemicals | 1,615 | -4.1 | 16.3 | 139 | -1.4 | 1.4 |

| AkzoNobel | 722 | 10.7 | 4.4 | 385 | -4.4 | 2.3 |

| Arkema | 547 | 4.9 | 6.4 | 231.9 | 34.8 | 2.7 |

| Asahi Kasei | 499 | 13.2 | 5.9 | na | na | na |

| BASF | 4,649 | 1.6 | 7.3 | 2,112 | 3.8 | 3.3 |

| Bayer | 818 | -45.2 | 7.1 | 1,208 | -8 | 10.5 |

| Borealis | 373 | -9.1 | 4.4 | 127 | -11.5 | 1.5 |

| Braskem | 1,216 | -24.5 | 8.6 | 53 | 27.5 | 0.4 |

| Covestro | 565 | -16.8 | 4.2 | 285 | 21.2 | 2.1 |

| DIC | 258 | -4.1 | 3.6 | 100 | 11.1 | 1.4 |

| Dow Chemical | 3,703 | 3.7 | 7.6 | 1,598 | -3 | 3.3 |

| DSM | 508 | -17.6 | 5.1 | 377 | 5.3 | 3.8 |

| DuPont | 773 | -13.9 | 3.7 | 1,683 | -2.9 | 8.1 |

| Eastman Chemical | 652 | 9.9 | 6.8 | 251 | 10.6 | 2.6 |

| Evonik Industries | 1,016 | -16.3 | 6.8 | 482 | 5.1 | 3.2 |

| ExxonMobil | 2,494 | 17.2 | 8.9 | na | na | na |

| Huntsman Corp. | 663 | 10.3 | 6.4 | 160 | 1.3 | 1.6 |

| Indorama | 300 | 21.9 | 4.4 | na | na | na |

| Johnson Matthey | 256 | 4.2 | 3.9 | 287 | 10.7 | 4.4 |

| Lanxess | 482 | -29.3 | 5.5 | 144 | -18.8 | 1.6 |

| LG Chem | 263 | -37.8 | 1.4 | na | na | na |

| Linde | 2,087 | -0.5 | 12.4 | 93 | 16.7 | 0.6 |

| LyondellBasell Industries | 1,319 | -3.7 | 4.9 | 102 | -19.7 | 0.4 |

| Mitsubishi Chemical | 1,199 | 12.9 | 4.9 | na | na | na |

| Mitsui Chemicals | 355 | -9 | 3.2 | 260 | -3.1 | 2.3 |

| Mosaic | 1,000 | 7.6 | 11.2 | na | na | na |

| PotashCorp | 1,217 | 6.9 | 19.4 | na | na | na |

| PPG Industries | 476 | -18.9 | 3.3 | 486 | -1.2 | 3.4 |

| Praxair | 1,541 | -8.8 | 14.3 | 93 | -3.1 | 0.9 |

| Sasol | 1,998 | 39.4 | 24.1 | na | na | na |

| Shin-Etsu Chemical | 1,113 | 22.6 | 10.5 | 439 | 12.7 | 4.2 |

| Sinopec | 2,781 | 10.2 | 6.3 | na | na | na |

| Solvay | 1,056 | 3.1 | 8.6 | 307 | 12.1 | 2.5 |

| Sumitomo Chemical | 690 | 40.8 | 5.2 | na | na | na |

| Toray Industries | 1,062 | 6.9 | 6.8 | na | na | na |

| Yara | 1,194 | 37.2 | 8.6 | 20 | 4.5 | 0.1 |

This article has been translated into Chinese and can be found here.

To see all of C&EN’s articles that have been translated into Chinese, visit http://cen.acs.org/cn.html.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter