Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

Chemical earnings up sharply in the second quarter

Results are a big improvement over a year earlier, with firms expecting a sustained recovery

by Alexander H. Tullo

August 6, 2021

| A version of this story appeared in

Volume 99, Issue 29

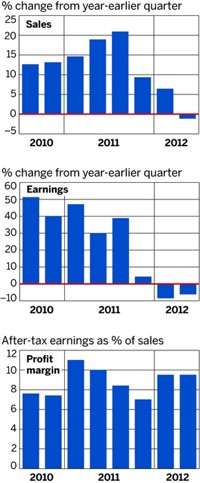

Second-quarter results

The second quarter was an enormous one for chemical producers, with the companies C&EN tracks posting double-digit gains in sales and in many cases triple-digit jumps in earnings versus a year earlier.

Of course, the second quarter of 2020 was the period most impacted by the COVID-19 pandemic. Governments in Asia, Europe, and the Americas instituted lockdowns in February and March last year to stem the spread of the virus. Stores closed, construction was halted, and automobile plants idled—all depressing demand for chemical products. For chemical companies, it was the worst quarter in decades.

The industry appears to be putting those days behind it. For instance, sales doubled and profits rose eightfold in the second quarter at petrochemical maker LyondellBasell.

The world’s largest chemical maker, BASF, saw its results rebound. “We achieved volumes growth and price increases across all regions and all segments compared with the second quarter of 2020,” Martin Brudermüller, BASF’s executive chairman, said in a presentation. “In some businesses, we were able to restore and, in some cases, increase our margins with price increases. In others, there is still some way to go.”

The German company’s commodity businesses, including chemicals and materials, performed better than all other segments in its portfolio, primarily because of higher prices and volumes. Sales in chemicals jumped 91%, while materials rose 75%.

In contrast, profit before taxes at BASF’s nutrition and care chemical unit tumbled. Demand in this segment was strong a year ago compared with other businesses, and raw material prices have increased.

Celanese posted record results for the quarter on the strong performances of its acetyl and engineered materials businesses. “Demand, broadly speaking, was robust across all regions and most end markets due to strong consumer activity, as well as a desire to start to rebuild supply chains that were depleted over the last 18 months,” Celanese CEO Lori Ryerkerk said in remarks to analysts.

At Chemours, sales rose more than 50%, and profits increased nearly sixfold. The firm’s titanium dioxide business, which makes white pigment for paint and other markets, led the charge with a 66% increase in volumes compared with a year earlier.

“Demand momentum from the first quarter continued into Q2 as the global recovery from COVID-19 continued at pace,” Mark E. Newman, who became Chemours’s CEO last month, told analysts. “We’ve set a number of revenue and profitability records across the portfolio in the second quarter, including achieving the third-highest quarterly sales” in the company’s history.

Chemical firms expect the recovery to strengthen over the remainder of the year. “As a result of our strong first half of the year, our expectations of continued momentum within our key end markets, and confidence in our team’s ability to navigate through global supply chain constraints, we are raising our guidance for the year,” says DuPont chief financial officer Lori Koch in its earnings report.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter