Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

Chemical makers cut back amid uncertainty

BASF, LyondellBasell, and Eastman reevaluate in light of dim outlook

by Alexander H. Tullo

August 7, 2024

The second quarter was a challenging one for US and European chemical makers. Sales crept up, but lower selling prices derailed the industry’s efforts to post substantive gains from a year ago. With expectations of sluggish business for the remainder of the year, chemical firms are taking matters into their own hands by cutting costs and trimming unprofitable assets and questionable projects.

Results at the world’s largest chemical maker, BASF, were mixed. Sales declined by 6.9% from the prior-year quarter, but earnings excluding special items rose by 29.2%.

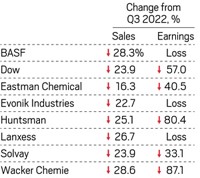

SECOND-QUARTER RESULTS

“We saw a continuation of the dynamics of the first quarter, marked by positive volume momentum across most of our businesses,” BASF CEO Markus Kamieth says in prepared remarks. Lower selling prices for its products drove the sales declines.

A bright spot for the diversified German company was its chemical business, which saw a 6.0% increase in sales driven largely by stronger petrochemical volumes.

A weakness for BASF was agricultural chemicals, particularly for glufosinate-ammonium. Due to heavy competition, the company is ending production of the weed killer at its sites in Knapsack and Frankfurt, Germany, by the end of 2024.

BASF is also cutting investment in battery materials. It has canceled plans for a nickel-cobalt refining complex in Indonesia and paused work on a battery recycling plant in Spain. “Recent dynamics have changed, and the market penetration of electric vehicles has slowed down significantly outside of China,” Kamieth said.

Performance was similar at Covestro, another German chemical company. The specialty chemical and polyurethane maker experienced a 9.3% surge in volumes, but that was more than offset by a 9.7% decrease in prices. The company posted a 0.8% decline in sales and a loss of $81 million.

Markus Steilemann, Covestro’s CEO, sees positive momentum. “Our sharp rise in volumes sold shows that we’re prepared for the market recovery,” he says in an earnings announcement.

For many chemical executives, the recovery isn’t happening fast enough, and they are prescribing intervention.

In its earnings presentation, LyondellBasell Industries disclosed more details about a review of its European assets that it launched in May as a reaction to the region’s weakening competitiveness in petrochemicals.

The review pinpointed six sites that do not meet the company’s “criteria for a core business,” CEO Peter Vanacker said in a conference call with analysts. The sites are in Berre l’Etang, France; Meunchmeunster, Germany; Brindisi, Italy; Tarragona, Spain; Carrington, England; and Maasvlakte, the Netherlands.

“Divestiture of the assets as a group or separately is a possibility,” Vanacker said. Some could be closed, he noted. The company listed eight European sites, including Knapsack and Wesseling in Germany, as core facilities that have a more secure future with the company.

At Eastman Chemical, sales increased by 1.7%, and earnings increased by 7.6%. And while the company’s results were positive, it doesn’t foresee a coming bonanza.

“Looking forward to the second half, we do not expect an improvement in primary demand in our key markets and geographies,” Eastman CEO Mark Costa said in remarks to analysts. “In this context, our innovation-driven growth model, including our circular products, is creating our own growth.”

Following technical challenges, Eastman is ramping up production at a plastics recycling plant in Kingsport, Tennessee, where it uses methanolysis to break down post-consumer polyethylene terephthalate into dimethyl terephthalate and ethylene glycol.

Costa says the company will make an investment decision on a second US methanolysis plant in Longview, Texas, during the current quarter.

However, a recycling project in France that Eastman unveiled in 2022 is in doubt. Costa said the project is advancing more slowly than the company had originally expected. Whereas Eastman signed up Pepsi to buy the output from the Texas project, lining up major customers for the French plant has been slow going. “If we don’t get these long-term take-or-pay contracts as we did get with Pepsi, we will not build the French project,” Costa said.

With near unanimity, chemical executives say they will need to prod their companies into better performance in the months ahead.

Evonik Industries saw second-quarter earnings surge by 90.2%, even though sales climbed only 1.1%. “We are cutting our costs and doing our homework, and it shows,” CEO Christian Kullmann says in the company’s earnings report. Evonik has started a program to reduce annual costs by about $440 million. “We have to rely primarily on ourselves at the moment as there is no real tailwind from the economy,” Kullmann says.

At Huntsman, second-quarter sales slipped by 1.4%, and earnings fell by 38.5%. “We do not expect global economic activity to change substantially from the current levels through the remainder of the third quarter,” CEO Peter R. Huntsman says in an earnings report. “We will continue to control our costs, focus on cash flow, and drive stronger sales volumes.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter