Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

Economy buoys Japanese chemical makers

Strong demand and Chinese environment controls lead to robust earnings

by Jean-François Tremblay

May 17, 2018

| A version of this story appeared in

Volume 96, Issue 21

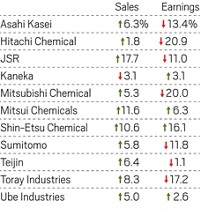

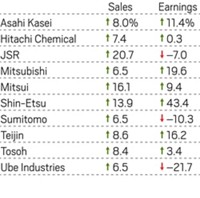

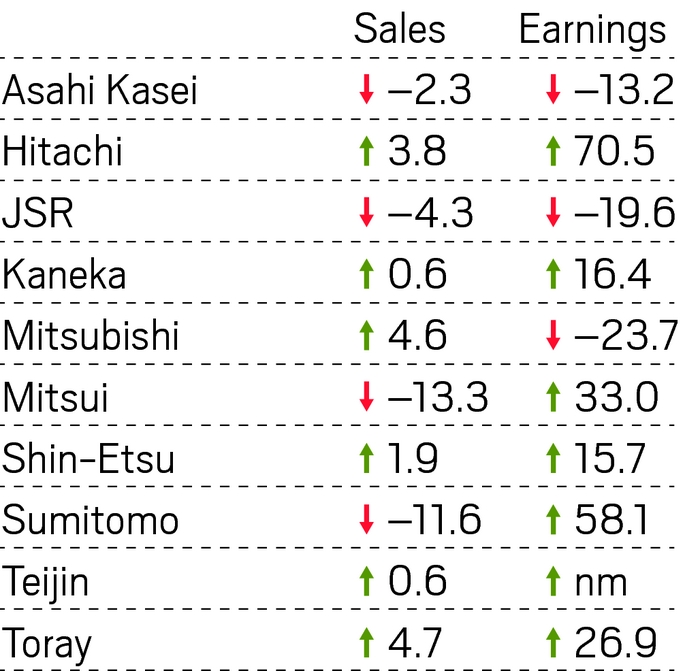

Several of the largest chemical companies in Japan reported surges in earnings for the fiscal year that ended March 31. The companies credited strong demand across their product lines, some of this partly the result of environmental crackdowns in China.

While some experienced declines, many firms enjoyed sharp earnings increases.

Note: Percent change from previous fiscal year.

Source: Companies

Asahi Kasei, a producer of plastics, industrial materials, health care products, and residential homes, embodies the trend. The company’s profit margins have steadily increased in recent years and now stand at a healthy 8.3%. Asahi reported that it experienced strong sales across its product lines in the fiscal year, singling out acrylonitrile, synthetic rubber, synthetic suede, and battery separators for mention. However, profits in its residential home business stagnated despite higher sales.

Shin-Etsu Chemical’s net profit, meanwhile, shot up by more than 50% to provide the company a profit margin exceeding 18%. The world’s largest producer of polyvinyl chloride and semiconductor wafers, Shin-Etsu commented that PVC sales were strong because of both global investment in infrastructure and environmental restrictions in China that hampered PVC production there.

JSR’s net profit jumped by over 16%. Several segments performed strongly, and the start-up of a plant in Thailand producing solution-based styrene-butadiene rubber was a big help to the rubber business.

Despite the good results, the financial community wasn’t impressed. Few stock prices moved significantly. Yoshihiro Azuma, a chemical analyst at the investment firm Jefferies, noted that Asahi’s prospects for homes and battery separators are not all that encouraging and that Mitsubishi Chemical seems to be investing too aggressively in capacity expansion and new assets. About Sumitomo Chemical, where profits surged 75% in the fiscal year, Azuma observed that the firm’s petrochemical margins have probably peaked.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter