Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Finance

First-quarter chemical earnings please

Chemical makers posted a strong start to 2021, despite challenges

by Alexander H. Tullo

May 6, 2021

| A version of this story appeared in

Volume 99, Issue 17

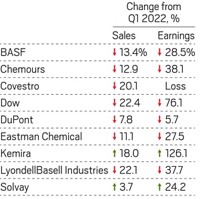

The economic recovery from the COVID-19 pandemic appears to be gaining steam. Nearly every large chemical company posted increases in first-quarter sales and earnings from a year earlier, and double-digit sales gains were the norm.

First-quarter chemical results

The world’s largest chemical maker, BASF, posted a 16% increase in sales for the quarter, while earnings swelled 59%. The big gainers for the German company were chemicals and materials, as well as its surface technology unit, which includes its coatings and catalysts businesses.

BASF attributed the gains in all three segments to higher prices and volumes, a theme seen across the chemical industry as the economy recovers.

“We had a strong start to the year,” BASF chairman Martin Brudermüller said in a statement announcing the results. “The positive earnings momentum of the fourth quarter of 2020 continued.”

In late April, the largest US chemical maker, Dow, reported increases of 22% in sales and 133%in earnings for the period.

One outlier was Solvay. The Belgian chemical maker reported only a slight rise in earnings compared with the year-earlier quarter, with sales actually down 4%. Notably, its materials sales fell by almost 13%. The segment was dragged down by Solvay’s business in composite materials, which took a 42% sales hit because of poor demand from the civil aerospace sector. The firm’s specialty polymer sales rose by 6%.

One headwind chemical makers faced in the first quarter was freezing weather in Texas in February that shut down some of the electrical grid and halted much oil, gas, and chemical production.

Celanese idled its Texas facilities before it lost access to electrical power, natural gas, water, and raw materials. In remarks to analysts, CEO Lori Ryerkerk said the financial impact to Celanese was about $75 million; some $40 million of that was repair and start-up costs. For example, at the company’s facilities in Bishop and Clear Lake, Texas, workers fixed 1,600 leaks and laid 6,000 m of replacement pipe. The remaining $35 million was primarily higher energy and raw material costs.LyondellBasell reported that volumes in its olefins and polyolefins segment decreased because of weather-related downtime. The decline was partially offset by additional volumes from a new joint venture in Louisiana.

Chemical makers that serve the auto industry with products like engineering polymers are watching a semiconductor shortage that is crimping car production, but the effect is muted so far. “We have not seen any material change in order patterns for our products,” Ryerkerk said.

DuPont CEO Ed Breen echoed the sentiment in his conference call with analysts. “Our first-quarter engineering polymers volumes were not materially affected by the chip shortages,” he said, noting that the company did experience constrained supply of raw materials.

Chemical makers are optimistic about the rest of 2021. BASF expects the global economy to grow by a hearty 5% this year. Still, with COVID-19 stubbornly hanging on in many parts of the world, the company cautions that the “situation is extremely fragile.”

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter