Advertisement

Grab your lab coat. Let's get started

Welcome!

Welcome!

Create an account below to get 6 C&EN articles per month, receive newsletters and more - all free.

It seems this is your first time logging in online. Please enter the following information to continue.

As an ACS member you automatically get access to this site. All we need is few more details to create your reading experience.

Not you? Sign in with a different account.

Not you? Sign in with a different account.

ERROR 1

ERROR 1

ERROR 2

ERROR 2

ERROR 2

ERROR 2

ERROR 2

Password and Confirm password must match.

If you have an ACS member number, please enter it here so we can link this account to your membership. (optional)

ERROR 2

ACS values your privacy. By submitting your information, you are gaining access to C&EN and subscribing to our weekly newsletter. We use the information you provide to make your reading experience better, and we will never sell your data to third party members.

Instrumentation

Top Instrument Firms of 2018

Ranking of scientific instrument makers finds companies growing with minimal impact, so far, from the trade dispute between the US and China

by Marc S. Reisch

March 4, 2019

| A version of this story appeared in

Volume 97, Issue 9

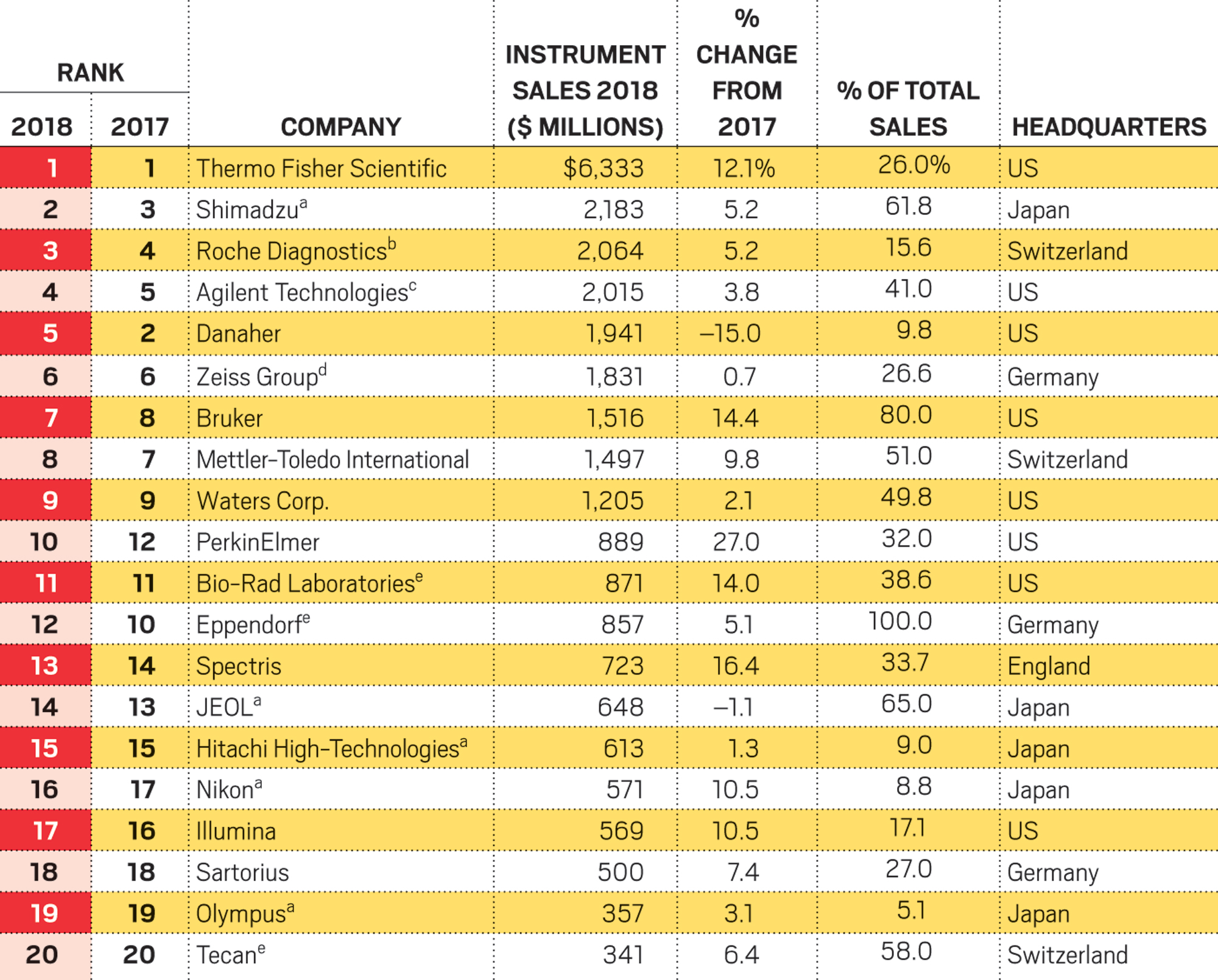

In 2018, life sciences and analytical instrument makers kept up the momentum of the last few years: overall instrument sales for the 20 firms that C&EN tracks rose 6.2%. Although economic conditions were good, trade issues complicated the operating environment. Notably, tariff disputes, principally between the US and China, threatened to upset manufacturing arrangements and the cost of instruments.

Overall, a few large players dominate the market for scientific instruments. The top 5 instrument makers accounted for more than half the sales of the top 20 firms last year. Thermo Fisher Scientific alone accounted for 23% of the top 20’s instrument sales.

The top 10 firms were responsible for 78% of sales, down from 79% in 2017. Combined sales for the top 10 grew 5.8% last year, whereas sales at the bottom 10 firms increased 7.5%.

This year’s ranking reflects several notable shifts in position. Danaher slipped from number 2 to number 5 as it reported lower instrument sales than in 2017. Three firms moved up as a result: Shimadzu now ranks second, followed by Roche Diagnostics and Agilent Technologies.

On average, only about 24% of the overall sales for ranked companies are of analytical and life sciences lab instruments. Some also sell industrial measuring devices and other nonresearch equipment, but for the most part, the bulk of sales are of lab consumables, software, and services.

In addition to the ranking, C&EN provides short profiles of the top 20 companies. Beyond the numbers, these vignettes review key changes that affected industry leaders during 2018 and offer glimpses into where they may head this year.

1. Thermo Fisher Scientific

▸ 2018 instrument sales: $6.33 billion

The largest maker of scientific instruments completed $540 million worth of acquisitions in 2018. Among them was the purchase of Becton, Dickinson and Company’s advanced bioprocessing business, which has annual sales of about $100 million and added cell culture media to Thermo Fisher’s portfolio. The firm also bought IntegenX, a provider of DNA technology for human identification used in forensics and law enforcement. Much of the emphasis at Thermo Fisher was on enhancing its position in the life sciences. The company also sought to augment its instrument portfolio with a deal to purchase the electron microscopy supply firm Gatan. When completed, the $925 million purchase will add $150 million in annual sales and about 320 employees. Gatan complements Thermo Fisher’s 2016 purchase of the electron microscope maker FEI for $4.2 billion and the late-2017 acquisition of Phenom-World, a small Dutch producer of desktop scanning electron microscopes. Like other instrument makers, Thermo Fisher is affected by ongoing trade disputes. In a recent call with analysts, CEO Marc Casper acknowledged that new tariffs on trade with China had a negative impact on 2018 earnings. “We have plans in place to address [our] supply chain if the tariffs really remain permanent,” he said.

2. Shimadzu

▸ 2018 instrument sales: $2.18 billion

Shimadzu’s instrument sales rose more than 5% in 2018. Conditions in North America remained strong, the firm said, while the European economy showed a moderate recovery despite concerns over Britain’s pending exit from the European Union. China’s economy seemed to slow toward the end of the year, the firm said, because of lower infrastructure spending and trade friction with the US. In Shimadzu’s analytical and measuring-instrument unit, sales of liquid chromatographs and mass spectrometers to European academic and research institutions were strong, the firm said. Sales of chromatographs and spectrometers to health-care customers in North America were also buoyant. In China, sales of environmental measurement tools increased because of government policies. Japan, however, experienced a decrease in sales because pharmaceutical and chemical customers cut back on equipment investments. Shimadzu said it will continue investing in health care and will apply artificial intelligence and internet-of-things technology to expand its consumables business.

Top 20

Most scientific instrument makers increased sales in 2018.

Note: Results are for the calendar year unless otherwise stated. Some figures were converted at relevant average exchange rates for 2018. a Company estimates for fiscal year ending March 31, 2019. b Results for instrumentation sales in this division alone. c Fiscal year ended Oct. 31, 2018. d Fiscal year ended Sept. 30, 2018. e Estimate based on company outlook.

3. Roche Diagnostics

▸ 2018 instrument sales: $2.06 billion

Sales of molecular diagnostic instruments and tests by the Swiss drug giant grew more than 5% last year. Sales in the sequencing part of the business increased 4%. Most of the growth came from viral-disease testing and the Cobas Liat polymerase chain reaction blood-screening system—a “lab in a tube” used to rapidly detect influenza and strep infection. On a regional basis, Roche said, it posted its strongest molecular diagnostic sales in the Europe, Middle East, and Africa region. Sales in North America were also strong.

4. Agilent Technologies

▸ 2018 instrument sales: $2.02 billion

Agilent Technologies regained the number 4 spot in C&EN’s ranking with 2018 instrument sales of more than $2 billion, up nearly 4%. Instruments accounted for about 41% of the firm’s $4.9 billion in sales. During the year, the company spent more than $500 million on acquisitions. Among them was the November purchase of ACEA Biosciences, a provider of cell analysis tools, for $250 million. The deal complemented the January 2018 acquisition of Luxcel Biosciences, a developer of fluorescence plate reader–based in vitro cell assay kits. Other acquisitions meant to buck up the firm’s bioscience offerings included ProZyme, a provider of glycan reagents, kits, and standards; and Ultra Scientific, a supplier of chemical standards and certified reference materials for environmental, food, and pharmaceutical markets. Another notable 2018 acquisition was the $250 million purchase of Advanced Analytical Technologies, a provider of capillary electrophoresis–based analytical tools. Despite trade tensions, China was a hot spot for Agilent. CEO Mike McMullen told analysts in November that the firm’s sales in China exceeded $1 billion last year for the first time. “So despite the noise in the environment, the environment remains very solid,” he said.

By the numbers

The top 5 companies account for

53%

of the sales of the top 20.

The top 10 companies account for

78%

of the sales of the top 20.

Of the top 20 firms, 8 are US based, 7 are from Europe, and 5 are based in Japan.

24%

of total sales are from instruments, The rest is from consumables, software, and services.

5. Danaher

▸ 2018 instrument sales: $1.94 billion

Scientific instruments make up less than 10% of Danaher’s nearly $20 billion in sales. Besides this business, the firm has operations in diagnostics, dentistry, and environmental and applied solutions. The firm enhanced its portfolio last year with the purchase of Integrated DNA Technologies, a player in the genomic consumables market. At the time of the acquisition in March, analysts estimated that Danaher paid $1.9 billion for the firm, a maker of custom oligonucleotides for academic and pharmaceutical genomic research. Reviewing the fourth quarter for analysts, CEO Thomas P. Joyce Jr. reported strong results for its Beckman Coulter Life Sciences instrument business. In 2019, Beckman will benefit from the January acquisition of Labcyte, which brings acoustic technology for handling liquids. The Leica Microsystems microscope business saw revenue rise in the midsingle digits, Joyce said, led by life sciences research in North America. For Danaher’s mass spectrometry subsidiary Sciex, revenue was up in the high single digits. In February 2019, Danaher agreed to pay $21 billion for General Electric’s biopharma business, a maker of equipment for biotech drug production (see page 10). The new unit will add annual sales of $3.2 billion.

6. Zeiss Group

▸ 2018 instrument sales: $1.83 billion

Germany’s Zeiss Group had nearly $7 billion in sales of equipment used in the medical, semiconductor, and vision care sectors. C&EN reports the sales in Zeiss’s industrial quality and research segment, which manufactures microscopes as well as industrial measurement systems and accounts for about 27% of the firm’s sales. Within the segment, sales rose less than 1% in 2018—a weak year, the firm said. Acknowledging increased competition in the microscopy space, Zeiss said it intends to build up the business by emphasizing “innovation leadership.”

7. Bruker

▸ 2018 instrument sales: $1.52 billion

Bruker had a good year in 2018. Overall revenue increased about 7.3% to nearly $1.9 billion. The firm’s customers work in areas such as the life sciences, drug discovery, chemicals, metals, and materials science. Its instruments include mass spectrometers, nuclear magnetic resonance spectrometers, fluorescence microscopes, and molecular diagnostic tools. In the fourth quarter, Bruker completed the purchase of 80% of Hain Lifescience, a maker of molecular diagnostic instruments and consumables used to detect infectious diseases. It also agreed to buy Alicona Imaging, an optical-based metrology specialist. And it took a majority stake in the chemistry software firm Mestrelab Research as part of a deal to develop software to manage chemical information from analytical instruments. Overall, Bruker completed eight acquisitions in 2018 at a cost of $180 million. CEO Frank Laukien predicted in a call with investors that sales of existing products and services will rise between 4 and 5% this year, versus 4.3% in 2018.

8. Mettler-Toledo International

▸ 2018 instrument sales: $1.50 billion

Laboratory instruments accounted for a little more than half of Mettler-Toledo’s sales in 2018. The firm’s instrument portfolio includes balances, pipetting systems, titrators, and physical and thermal analyzers used for sample preparation, benchtop work, and materials characterization. Mettler-Toledo also offers lab software, process analytical instruments, and automated chemical synthesis systems. In a recent call with analysts, CEO Olivier Filliol acknowledged a 5% “headwind” affecting earnings in the fourth quarter because of adverse currency translations and high tariffs. Despite tariffs, sales in China were up 12%, and Filliol said he sees no sign of a slowdown in China. While his outlook for 2019 remains positive, “macro data and rhetoric surrounding international trade disputes make us cautious,” he said.

9. Waters Corp.

▸ 2018 instrument sales: $1.21 billion

Waters Corp. had a solid year in 2018. Overall sales for the chromatography and mass spectrometry expert rose 5%. Sales of instruments, which make up half the firm’s revenue, rose 2%, while service and consumables sales both increased 8%. Sales to pharmaceutical customers grew 5% in 2018, compared with 7% in 2017. Demand in China “continues to be robust and in Q4 was led by strong growth in pharma,” noted CEO Chris O’Connell in a recent call with analysts. To strengthen its mass spectrometry portfolio, Waters recently launched a screening system, called RenataDX, for high-throughput clinical diagnostics.

10. PerkinElmer

▸ 2018 instrument sales: $889 million

Advertisement

PerkinElmer had a very good year in 2018. Overall sales rose 23%, and instrument sales soared by 27%. The performance helped the firm move two steps up C&EN’s ranking. PerkinElmer, whose instruments can be used in environmental, food, and metal analysis, continues to emphasize diagnostics and drug discovery. In May, PerkinElmer strengthened its environmental, industrial, and food-testing presence with the acquisition of China’s Shanghai Spectrum Instruments. The purchase brought with it a portfolio of photoelectric colorimeters, ultraviolet–visible and atomic absorption spectrophotometers, and accessories. The firm also bought Italy’s Dani Analitica for $52 million. Dani brought with it “critical software and essential technology” to revitalize PerkinElmer’s gas chromatography business, according to CEO Robert Friel. But the firm benefited most from larger changes made over the last few years, including the sale of its medical imaging business, the acquisition of Euroimmun Medical Laboratory Diagnostics, and the purchase of Tulip Diagnostics, an Indian maker of reagents and instruments to diagnose disease.

11.Bio-Rad Laboratories

▸ 2018 instrument sales: $871 million

Bio-Rad Laboratories provides a range of life sciences research and clinical diagnostic products. At press time, the company had not yet reported full-year results, so C&EN estimated annual data using its third-quarter report. Bio-Rad’s life sciences research products include reagents, instruments, and software. Customers include university and medical school laboratories, pharmaceutical firms, food-testing labs, and government and industrial research facilities. In November, Bio-Rad anticipated that sales would rise about 4.5% in 2018. It also said business continued to be strong in most of the regions in which it operates.

12. Eppendorf

▸ 2018 instrument sales: $857 million

Eppendorf is a private German company that develops and sells instruments, consumables, and services for handling liquids, cells, and samples in the lab. Its products include automated pipetting systems, centrifuges, mixers, spectrometers, DNA-amplification equipment, fermenters, bioreactors, and cell-manipulation systems. However, Eppendorf does not break out its instrument sales, so C&EN bases its ranking on total sales. And those sales are estimates based on company projections from mid-2018, when it said 2018 sales would grow “in the midsingle digits.”

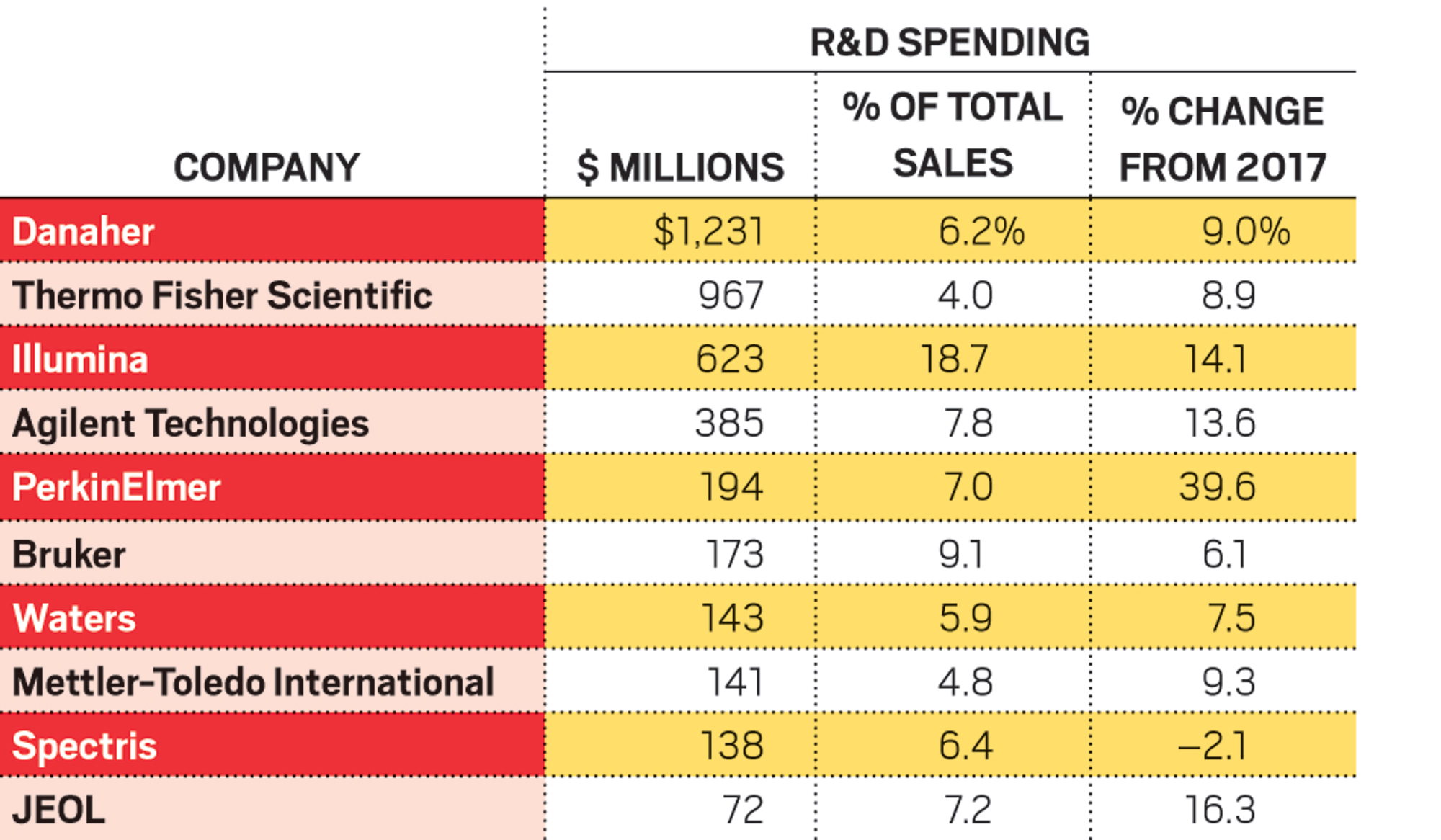

R&D spending

Many instrument makers boosted their investment in 2018

13. Spectris

▸ 2018 instrument sales: $723 million

Sales increased more than 16% for the materials analysis instrument segment of England-based Spectris in 2018. The segment includes Malvern Panalytical, Particle Measuring Systems, and Concept Life Sciences. Spectris acquired Concept, a contract research organization serving pharmaceutical, agrochemical, and environmental customers, in January 2018 for more than $200 million. However, Concept’s performance has “been below expectations,” Spectris reported in its year-end results. Problems include a reduction in work from two major clients, delays in obtaining new lab and manufacturing accreditations, and “a period of suboptimal performance.” Sales for the materials analysis segment as a whole benefited from higher sales to academic customers in North America and Asia. In China and Japan, Spectris said, it benefited from government initiatives to increase spending on science and technology.

14. JEOL

▸ 2018 instrument sales: $648 million

JEOL’s offerings include semiconductor, industrial, and medical equipment. But 65% of its sales are of the scientific and metrology equipment that C&EN tracks. The firm makes electron optic, measuring, and analytical instruments. Electron optic instruments include transmission electron microscopes, energy-filtered electron microscopes, and photoelectron spectrometers. JEOL’s measuring-instrument portfolio includes scanning electron microscopes, focused ion beam systems, and X-ray fluorescence spectrometers. Among its analytical instruments are nuclear magnetic resonance systems, electron spin resonance systems, and mass spectrometers. The firm has been one of only two makers of large NMR instruments since Agilent Technologies withdrew from the business in 2014. The other major maker of the instruments, used to elucidate chemical structures and analyze biological samples, is Bruker.

15. Hitachi High-Technologies

▸ 2018 instrument sales: $613 million

Hitachi High-Technologies has four businesses. Three focus on industrial and electronic equipment. The fourth, which C&EN tracks, is a science and medical systems business that accounts for 9% of the firm’s annual sales. The business’s portfolio includes liquid chromatographs, mass spectrometers, and spectrophotometers. It also makes electron, focused beam, and atomic force microscopes. The electron microscope business stands to benefit from Hitachi’s January 2019 acquisition of Applied Physics Technologies, a US-based maker of electron sources used in electron microscopes and other instruments. For the fiscal year ending in March 2019, competition in the scientific systems business is fierce, but overall demand is strong, Hitachi said.

16. Nikon

▸ 2018 instrument sales: $571 million

C&EN tracks Nikon’s health-care business, a unit that includes biological microscopes, cell culture observation systems, and ultra-wide-field retinal imaging devices. In its financial report for the nine months ending in December 2018, the firm said market conditions for the business, whose sales are largely outside Japan, were solid. In February 2018, the firm invested $30 million in Berkeley Lights, the US-based maker of a cell-staining system. Nikon said Berkeley’s system complements its live-cell-imaging technology and helps further research in antibody drugs and regenerative medicines.

17. Illumina

▸ 2018 instrument sales: $569 million

Illumina’s instrument sales, which make up nearly 17% of its revenue, rose more than 10% in 2018. Most of the instruments the firm sold were for next-generation sequencing, but about 7% were microarrays. The firm’s customers include genomic research centers, academic institutions, government laboratories, pharmaceutical and biotech firms, and ancestry research companies such as 23andMe. The leader in the gene-sequencing market, Illumina consolidated its position with a $1.2 billion agreement in November 2018 to acquire its smaller rival, Pacific Biosciences. The deal will add PacBio’s long-read sequencing technologies to Illumina’s short-read capabilities. Earlier in the year, Illumina acquired Edico Genome, a provider of data analysis tools for next-generation sequencing. Among the instrument makers C&EN follows, Illumina spends the highest percentage of its sales, nearly 19%, on research and development.

18. Sartorius

▸ 2018 instrument sales: $500 million

Sartorius, a maker of bioprocessing and lab equipment, had a good, but not a great, year in 2018. Overall sales grew more than 11%. Sales for the lab product and service division that C&EN tracks grew more than 7%, down from the 21% increase posted in 2017. The division accounted for 27% of the firm’s sales. Sartorius reported that softer demand from European customers in the second half hurt results. Some of the division’s sales growth can be attributed to the acquisition of Essen BioScience, a maker of cell-based assays and instruments used for drug discovery and basic research. The $320 million deal closed in March 2018. For 2019, Sartorius projects sales increases for the division of between 5 and 9%.

19. Olympus

▸ 2018 instrument sales: $357 million

In addition to the cameras for which it is best known, Olympus sells a variety of equipment for industrial and health-related markets. Products include handheld X-ray fluorescence analyzers, nondestructive test equipment, industrial videoscopes and microscopes, and biological microscopes. The Olympus business that C&EN tracks is biological microscopes, used in drug discovery and clinical pathology. For the nine months ending in December 2018, Olympus said, its biological microscopes enjoyed solid sales, mostly in North America and China.

20. Tecan

▸ 2018 instrument sales: $341 million

Tecan classifies 58% of its sales as instruments. Its portfolio of products includes microplate readers, immunoassay equipment, and clinical automation systems. In September 2018, Tecan bought NuGEN, a supplier of reagents for next-generation sequencing. The $55 million acquisition broadens its services for customers in science research and applied markets, Tecan says. The NuGEN acquisition follows the 2017 purchase of Pulssar Technologies, a maker of pipetting piston pumps, and Sias, a supplier of lab automation systems.

Join the conversation

Contact the reporter

Submit a Letter to the Editor for publication

Engage with us on Twitter